Darren Coote, who spent 17 years at UBS, will report to Anders Henrikson, global head of FX trading, and will have the additional responsibilities of integrating the bank’s e-FX algorithmic trading tools within the overall spot trading function. In October, Lloyds launched its single-dealer platform, Arena. “Darren brings tremendous experience and is highly respected amongst clients and peers across the industry,” says Henrikson. “Developing enhanced e-FX capabilities and powerful, yet easy-to-use, trading applications such as Arena is essential to Lloyds’ investment in its FX business.”

Coote will fill the position of Kelvin Jouhar, who left the bank this month after taking voluntary redundancy, according to sources who spoke to EuromoneyFXNews.

Coote is the latest in a series of senior hires the bank has made during the past three months, as it boosts its presence in the foreign exchange markets. Other key hires include Bruno Widmer, the former global head of FX bank sales at Citi, as head of bank and e-sales.

In July, Lloyds hired Richard Chatterton as its e-commerce product manager. In August, it hired Keith Underwood as head of FX trading for the Americas, and Michael Walsh, from Royal Bank of Scotland, to set up a macro advisory group to service alpha-seeking FX clients. In September, Lloyds then hired Graham Harris, from UBS, to head up its financial institutions’ non-banks team.

The same month, it also joined CLS, the cash-settlement system for FX markets, as a full settlement member – after becoming a shareholder earlier this year – to benefit from streamlined and standardized FX settlement processes.

In this year’s Euromoney FX survey, Lloyds improved nine places to 38th position in the global rankings, with a market share of 0.16%.

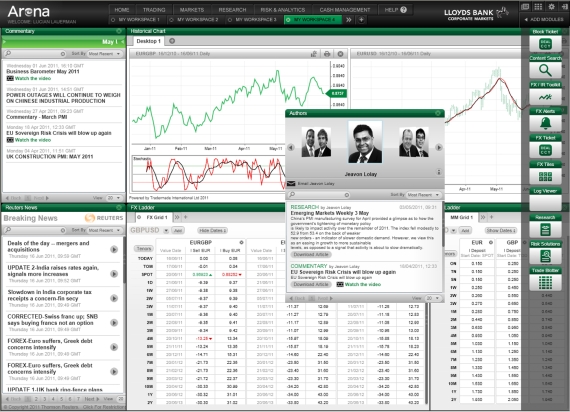

| Lloyds FX trading platform, Arena |

|