Merk says the long-standing strength of the yen supported by an intimidating current account surplus is ending, as signs emerged in September that the surplus is finally dwindling. This means the Japanese economy will no longer be able to keep up with a massive public debt burden driven by a debt-to-GDP ratio of more than 200%, says Merk.

Global investors are beginning to take note, he says.

In recent years, the yen would appreciate in value whenever risk-off sentiment would emerge, largely as a result of Japanese companies repatriating foreign earnings.

However, in 2012, with fear rife in the markets on a nearly daily basis, the yen’s value is losing correlation with implied volatility.

“The days of the yen being perceived as a safe haven may soon be over,” says Merk.

| 12-months rolling correlation of the yen with VIX |

|

| Source: Merk Investments, Bloomberg |

“The yen no longer is the go-to place when fear is elevated. As the current account has deteriorated, the yen’s safe-haven status appears to be eroding.”

Many an FX speculator has tried and failed in the past to short the yen, so much so that the currency earned a “widow maker” moniker off the back of a current account surplus that has always quickly rebounded in the face of global or domestic crisis.

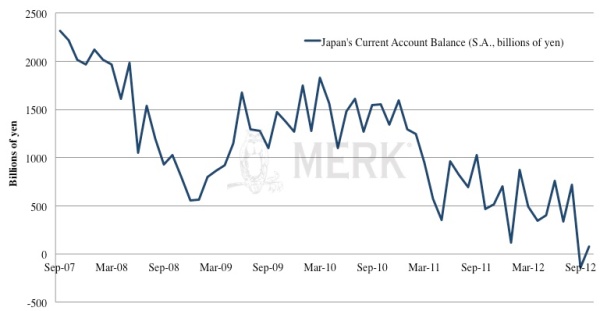

However, in September, that current account surplus briefly became a deficit.

| Japan's current account balance |

|

| Source: Merk Investments, Bloomberg |

Merk says there are three long-term economic fundamentals causing the demise of the Japanese current account surplus.

First, population dynamics: the world is running out of Japanese people as high life expectancy in Japan is mixing with falling birth rates to cripple the country’s earning power.

Couple those factors with almost no net immigration into Japan, and a perfect storm aimed at the current account balance is only buffered by a tendency for Japanese workers to retire later than in other developed countries.

Second, the Japanese government’s main economic achievement after the March 2011 earthquake there was to abandon nuclear energy.

Yet a new reliance on imported energy has married with Japan’s turbulent political system that has seen seven prime ministers take office since 2005, which has failed to do the country’s current account balance any favors, says Merk.

“Usually a government that gets things done is one that spends money, but Japan could not even get an expeditious rebuilding effort under way after the earthquake struck,” he says.

Finally, rising Japanese political tensions with China are bad for trade between the two nations.

Now, with former Japanese premier and Liberal Democratic Party leader Shinzo Abe poised to take office again after elections set for December 16, the yen is weakening.

Abe thinks that deflation and a strong yen are Japan’s biggest economic problems, and he has said he would be willing to undermine the independence of the Bank of Japan by calling on the central bank to undertake “unlimited monetary easing until inflation reaches a target of up to 3%”.

Merk says, though, that Abe’s strategy will be moot if the Japanese current account continues to deteriorate.

“At this stage, we assess the risk of not acting to be high and are putting our money where our mouth is,” he says.