As any emerging-market borrower – historically exposed to FX mismatches and abrupt shifts in monetary regimes – will tell you, large corporates can absorb gradual, linear currency appreciation and depreciation. But abrupt currency moves – both levels and regimes – are a game-changer for earnings and, potentially, business models.

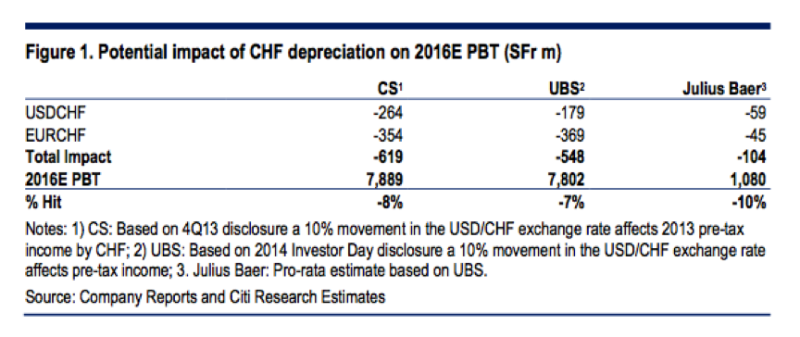

As a result, although investment banks are likely to take advantage of hedging and trading opportunities given the uptick in FX volatility, in the short-term, the SNB move is likely to cut forward earnings of Swiss banks by 7% to 10%, according to Citi, while negative rates will further pressurize margins.

The market certainly agrees, with the equivalent of $25 billion wiped off the shares of the big three Swiss banks – Credit Suisse, UBS and Julius Baer – since the SNB’s decision last week.

In a statement released on Monday, Credit Suisse did little to dispel market doubts: “Actual sensitivities to moves in the US dollar/Swiss franc and euro/franc in 2015 will depend on the average dollar/franc and euro/franc exchange rates experienced in 2015 against the averages in 2014, as well as any offsetting management actions."

Morgan Stanley estimates Credit Suisse could face a 21% to 24% reported earnings per share fall, on the basis of the CHF’s 15% appreciation against leading currencies, citing headwinds from the impact of negative front-end rates on net interest margins and bad debts, given rising refinancing costs for SMEs, and any leveraged cross-currency positions.

Analysts isolate one benefit of CHF appreciation: a marginal boost to leverage ratios, given the strengthening of a Swiss-denominated equity base over foreign-currency denominated debt.

Scope Ratings, a fledgling European ratings agency, is more bearish on the structural impact of the SNB’s moves on Swiss banks’ prospects. In a research note published on January 19, it said:

Taking a bit of perspective from the immediacy of the numbers, we would question the longer-term viability of a Private Banking business model that is so ultimately geared to the fluctuation of the CHF. In the aftermath of the crisis years the public communication of the two large Swiss banks was aimed at explaining the somewhat disappointing profitability metrics of the Private Bank by the combination of low interest rates and a strong CHF. This particular communication subsided somewhat in 2011 and 2012, before re-emerging in more detail in 2013 and 2014, up to a point when both UBS and Credit Suisse engaged in communicating detailed sensitivity analysis (on which most of the conclusions of this report are based) as to what would happen to their financial metrics in case of specific movements in interest rates and currency fluctuation. It is relevant to note that as late as Q3 2014 both banks were focusing their analysis on the strengthening of the USD against the CHF.

Based on the current developments, we believe that in order to avoid decreasing their profitability targets in private banking both Credit Suisse and UBS will probably have to further cut costs or relocate some activities outside Switzerland. At the same time, we note that the strength of the CHF reflects the “safe haven” status of Switzerland, and that the Private Banking business at both banks strongly benefits from this status (in terms of money inflows) even if this has a frustrating impact on profitability. The apparent dichotomy between a growing franchise and a profitability not developing in the same proportion is a question worth asking, even if ultimate answers are yet to be formulated by both banks.