|

Julius Baer will be the Swiss bank to take the biggest hit on profits as a result of the Swiss National Bank's (SNB) decision to unpeg the Swiss franc from the euro, say analysts.

Nomura analysts estimate the impact on Julius Baer’s pre-tax profit to be a 19% cut, while for UBS and Credit Suisse the decrease will be 8%.

JPMorgan expects a 9% decrease in FY14 profits for Credit Suisse and a 10% decrease for UBS.

“While the [Swiss] banks may be able to mitigate some of the impact with additional cost plans, we expect much to flow to the bottom line, weighing on earnings and relative performance much as in 2011,” says Jon Peace, European bank analyst at Nomura.

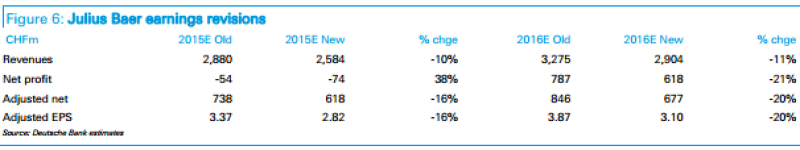

Deutsche Bank analysts also say Julius Baer will suffer more from the exchange-rate move than its larger peers.

“From least to greatest sensitivity, we have downgraded our 2016E forecasts by 12% for UBS, 16% for Credit Suisse, 17% for EFG International and 20% for Julius Baer, with Baer having the greatest mismatch between CHF costs and revenues,” says Matt Spick, research analyst at Deutsche Bank.

Cost/revenue mismatch

For Credit Suisse and UBS, the move by the SNB means they are now facing a costs/revenue mismatch, given their CHF-denominated liabilities while revenues are predominately in US dollars and euros, given their wealth management and investment banking businesses in the US and Europe.

Julius Baer, however, has a much higher cost base in Swiss francs. Spick estimates a cost base of 60% in Swiss francs, leaving a 47% gap between CHF revenues and CHF costs.

“This is better than prior to the [Merrill Lynch] international wealth management (IWM) acquisition, where Baer’s cost base was 80% CHF,” says Spick.

So what now for Julius Baer? Its global expansion, by moving into Asia with the acquisition of Merrill Lynch's IWM business, has been commended by the industry for its integration. Its market cap is seven-times smaller than its Swiss peer UBS and almost four times smaller than that of Credit Suisse.

The bank was said to be interested in buying Coutts’ international business, which is on the chopping block, and, while the diversification of costs to a non-CHF base would be useful in mitigating currency exposure, it would be risky, says Spick.

“We would be negative on Baer planning for further acquisitions, which may be the quickest way to rebalance currencies, but are also in our view the riskiest [execution risk],” he says in his report.

|

|

|

Source: Deutsche Bank Markets Research |