Anyone who was around financial markets, especially in Asia in the late 1990s, will remember the name Andre Lee. As Asian currencies devalued and financial markets collapsed in 1997, ending the astonishing bull run that had lasted for most of that decade, one of the first big casualties was Peregrine Holdings. An Asian-focused investment bank, led by charismatic chairman Philip Tose, Peregrine had grown as a collection of country-based equity brokerages across Asia and then expanded into the new and fast-growing market for Asian high-yield corporate debt.

|

Andre Lee, formerly |

Lee had pioneered that market, first at Lehman Brothers and then, following a big team move, at the entirely Asia-focused Peregrine. Lee was driven by two things: the high-minded belief that Asia needed and deserved a bond market that would finance the region itself by allocating capital to the many unrated companies the international investment banks did not bother to follow and by the youthful determination to prove himself in investment banking in the age old way: by doing more and bigger deals than anyone else. As markets collapsed, Peregrine was stuck holding inventory falling in value that it could not refinance. Creditors lost confidence and pulled their lines. Young, outspoken and brash, Lee was fingered for the blame by irritated rivals and even by some of the old guard at his own firm. Along with many of the senior management at Peregrine, Lee was banned from running a company in Hong Kong for four years.

It must have felt like his career was over. Of course, the collapse of Asian markets in 1998 and of Peregrine, merely foreshadowed the much greater financial system collapse a decade later that swept away much older, bigger and more powerful firms. Come 2008, thousands of bankers must have known what Lee felt like a decade earlier. His re-invention may be a heartening lesson to them.

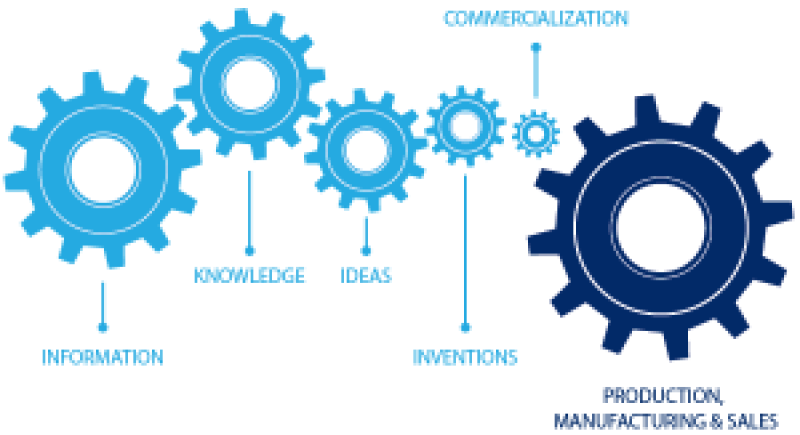

Since Peregrine’s collapse, Lee has immersed himself in the hitherto disparate areas of technology, SME finance and intellectual property. Now he is attempting to bring them together in a new form of finance.

He saw life lessons coming together, from the creation of a new bond market for unrated corporates to the need for some platform to extract, exchange and so put a value on those intangible assets around innovation and intellectual property that are the big drivers of the new knowledge economy.

Heart of the action

Euromoney reports on the tech reserve bank Lee’s company is about to launch for multinationals to deposit intellectual property and SMEs to borrow packages of it that can be used in new product development. He also has innovative ideas for new limited recourse lending for product development, secured against IP rights and future revenue streams. This could be a breakthrough for SMEs that are denied this lending right now by the banks.

Further reading |

|

If his ideas work they may help governments keen to support SMEs that boost creativity and productivity. Nearly 20 years ago it seemed that his career was over, and Lee all but disappeared from public view. Now it looks like he might once again be right at the heart of the action, pioneering a new liquid market in intangible assets and bringing capital to innovation.

Lee has learned something else from that chastening experience in the Asian crash. He had worked in the classic antagonistic, ultra-competitive fashion of investment banking, seeking to grab market share for his own team and crush and humiliate the opposition. Today, he understands the need for all participants to embrace a new market for it to thrive and has spent four years refining his new plans in discussion with national and regional governments, large multinational corporations and SMEs.

If a new market in intangible assets really is to take off and help societies to boost innovation, productivity and job creation in the still uncertain aftermath of the financial crisis, then the banks, investment banks and allocators of institutional capital will need to play their parts too.

Lee remains chastened by his experiences of two decades ago, but unbowed. He would appreciate the irony if someone so closely associated with an individual financial collapse were later to be regarded as the inspiration for a new form of finance.