FX is trading as an independent asset class to a degree that has not been seen since the pre-crisis era, according to RBC Capital Markets.

Of 45 G10 FX pairs monitored by the bank, only four now trade as general risk proxies, it says. The remaining 41 are uncorrelated to equities, the highest count of non-correlated pairs since the onset of the financial crisis.

“This continues the sustained decoupling of FX markets from general risk appetite that began around 2012,” says RBC.

Others observe a similar trend.

|

The yen is currently 30% undervalued based on simple PPP metrics Richard Benson, |

Richard Benson, portfolio manager at Millennium Global, a currency manager, says cross-market correlation between asset classes, including not only equities and forex but other types of credit and commodities, has fallen significantly in recent years due to macro policy and global divergence.

This has had a profound impact on a number of currencies, particularly the Swiss franc and yen, both traditional safe havens that have attracted flows at times of heightened perceived risk.

The Swiss franc’s role as a safe haven was somewhat skewed by its former peg to the euro. However, since that was removed in January, CHF has reverted to its former status, says RBC.

“Despite its status as the most overvalued currency in G10, CHF would now appear likely to be the main beneficiary should markets turn significantly risk averse,” it says.

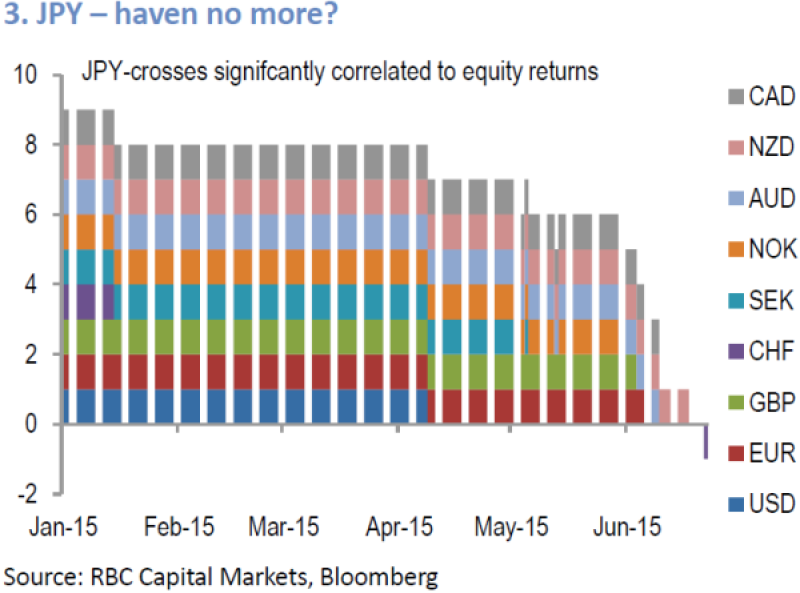

Perhaps more interestingly, in recent months JPY-crosses have traded independently of general risk appetite, says RBC. This bucks a long-established trend.

“Since the financial crisis, all JPY crosses, with the exception of USD/JPY, have traded as proxies for general risk appetite, with the yen serving as a safe haven 85% of the time,” says the bank.

RBC acknowledges that, given it has only been a few months, the trend might not last.

Millennium’s Benson concurs, saying: “Asset market correlations are never stable and always subject to a time window of analysis. FX correlations are no exception to this rule.”

Sentiment shift

Yet RBC believes there are good reasons for Japan to have lost its safe-haven status, explaining: “External flows have undergone a transformation in recent months due to the reallocation of public-sector assets overseas, which at the very least should be neutralizing some of the flow that was at the root of JPY’s safe-haven status.”

The shift in investor sentiment towards yen eases one of the key constraints on positioning for a core negative JPY view, says RBC, adding: “Holding JPY shorts on a range of crosses through periods of risk aversion should be less risky going forward. [It] also makes CHF/JPY options an attractive hedge against tail risk.”

However, while Benson agrees Abenomics has exerted a powerful influence on the Japanese currency that has overwhelmed traditional correlation drivers for a substantial period of time, he does not expect this new relationship to last.

“The issue with the yen is now that it has moved so far that it is up against a significant valuation hurdle,” he says. “When currencies move against such a hurdle it is always likely to influence correlations.

“Certainly at present, the yen is exhibiting quite a high degree of correlation to US money-market levels, more so than the equity market.”

There is very little to support the conclusion that the yen has lost its status as a safe-haven currency Nicholas Ebisch, Caxton |

As yen valuations become stretched, Benson predicts it will redevelop its former safe-haven characteristics, as reflationary impacts can have less of an influence.

“Currencies that diverge from purchasing power parity (PPP) valuation by more than 20% have a habit of snapping back very quickly,” he says. “The yen is currently 30% undervalued based on simple PPP metrics.”

Not everyone agrees the yen has undergone a fundamental shift.

Nicholas Ebisch, FX analyst at Caxton, says the yen remains a safe haven, strengthening when global equity markets fall.

“The last couple of days are a perfect example of this, because when the global equity markets were falling across the board because of concerns about Greece, the Japanese yen saw strong gains against the US dollar, sterling and, of course, the euro,” he says.

“Additionally, equity markets in Asia, Europe and the US have been trading at very high levels all throughout the late spring and early summer, and the yen has weakened overall during that time. There is very little to support the conclusion that the yen has lost its status as a safe-haven currency.”

The Swiss franc and the yen are not the only currencies to see former correlations break down in recent months. Benson notes that the euro has exhibited significantly different safe-haven characteristics to the past.

Typically, the eurozone acts as a safe haven of sorts, given its current-account surplus, leading to euro appreciation, but the existential crisis in the single currency bloc has complicated matters.

Jens Nordvig, global head of currency strategy at Nomura, says recent examples of Greece-related equity market declines have coincided with spikes in EUR/USD. “This was particularly the case on June 18, when EUR/USD tested 1.14,” he says.

With few data points to analyse, Nordvig concedes it is hard to judge the underlying causes of this relationship, but he has a theory: hedge rebalancing. Year to date, he says around €150 billion has been accumulated in European equity markets by foreign investors, of which he estimates around 70% is hedged.

Further reading |

|

This means if Euro Stoxx is down 5%, that would create around €5 billion of demand, a figure that grows if considering the entire stock of foreign holdings. While hedge rebalancing might not occur daily, and some investors might opt to sell the underlying positions instead, this probably at least partially accounts for the relationship, he suggests.

“Sterling would be another example of a correlation change,” says Benson. “During the global financial crisis, the pound was highly correlated to financial equities, which made some sense given the highly leveraged exposure of the UK economy to the financial sector.

“This has changed and now the pound exhibits safe-haven characteristics despite its poor current-account position as a liquid alternative to the euro during periods of intense eurozone stress emanating from Greece.”

Given the fluid nature of currency correlations, Benson says that Millennium does not assume fixed correlations in its investment process.

“At any one moment in time, there may only be one factor relevant to the evolution of an FX cross rate and other factors may ebb and flow over time,” he says.

Other managers prefer to hedge out this FX risk altogether.

Frank Jensen, chief investment officer at Origo Asset Management, a hedge fund, says: “Forex is a zero sum game and periods of not hedging forex risk away are far and few. Events like the strong USD rally from April 2014 to March pop up with three-to-five-year frequencies.”

|

|