The report Restoring trust in global FX markets will be presented to regulators – by David Mercer, chief executive of LMAX, Ed Warner, chairman of LMAX and stockbroker Panmure Gordon, and Ed Wray, entrepreneur and director of LMAX – in a bid to speed up reform.

Some 450 institutional market participants – banks, broker, funds, asset managers, financial institutions and proprietary traders – were surveyed about fairness and transparency of FX markets, following on from the Fair and Effective Markets Review (FEMR).

Exchange model

The idea of one public rulebook was popular – nine out of 10 respondents agreed it would bring greater transparency.

|

Efficient currency trading relies on quality liquidity so we’ve got to be careful to preserve that liquidity David Mercer, |

Traditionally, FX has been traded bilaterally over-the-counter (OTC) as opposed to on organized venues such as exchanges, but rules-based trading venues are growing in popularity.

Multilateral trading facilities, such as Thomson Reuters Matching, have introduced exchange-style trading to spot FX with benefits including a public rulebook and no last look.

Currency derivatives are being pushed onto organized trading facilities and swap execution facilities, which also resemble exchange-style venues with centralized clearing and trade reporting.

The growth of exchange-style trading will continue, but it will not overtake OTC trading, predicted the report.

Sang Lee, managing partner of Aite Group, wrote: “The goal should be having both thriving exchange-traded and OTC markets.”

Last-look confusion

Last look came under fire – 85% felt the practice is most open to abuse and, as such, 87% felt abolishing it would boost transparency.

However, more than a fifth (22%) were clueless as to what last look even means.

Market makers, namely banks, have the power to pull a price from a platform, even after a customer has clicked on it, ie they have the last look. This uneven balance of power has come under criticism – almost nine out 10 non-banks felt that abolishing the practice would boost transparency.

|

|

Source: LMAX Exchange |

The practice is banned on some platforms such as LMAX, but is available elsewhere – there is no industry-wide agreement: 93% of banks agreed that the practice is open to abuse, but only seven out of 10 actually wanted to ban it altogether.

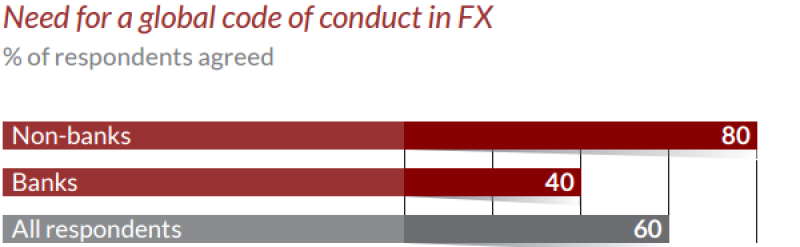

The FEMR report called for the industry to assess the suitability of last look, as part of its new global code of conduct which is being hashed out, but the industry can’t even agree on whether it needs a code of conduct in the first place – 80% of non-banks are in favour, but only four out of 10 banks agree.

Inconsistent time stamping of trades, bilateral trading and relationship pricing, whereby the banks adjust the price for its services depending on the customer, were also identified by most respondents as practices that are ripe for abuse. Time stamping should be mandatory, argued the LMAX report.

“There is no good reason why time stamping of orders, which is inconsistently applied at present, could not be mandated across the industry: establishing a consistent for time stamping would be an important step towards improving the availability of trading information and assuring customers of fair, or at least timely execution,” it stated.

Black swans

A lack of common trading standards was also highlighted in the report. 2015 has been a choppy year for FX, starting with the Swiss National Bank’s decision to remove the Swiss franc’s long-standing cap against the euro. EUR/CHF price quotes immediately dropped from 1.20 to as low as 0.5696.

|

Source: LMAX Exchange |

Platforms exercised their own discretion at to what price to execute their client’s trades – to the fury of many – because there is no industry-wide protocol on how to handle trades when a ‘black swan’ hits. Javier Paz, senior analyst at Aite Group, wrote: “Regulators would do well to motivate the industry to introduce a protocol for executing trades in a fair and transparent manner, possible capping or delaying trade executions, while giving the client viable and fair options of how such trade executions would be handled if/when extreme conditions arise.”

However, it is important to balance the need to add transparency to FX markets, with maintaining the growing volume of trade and healthy liquidity. Market makers need an incentive to make prices, otherwise they won’t bother and the choice of providers will diminish.

LMAX’s Mercer says: “Global capital markets rely on currencies and currency trading. Efficient currency trading relies on quality liquidity so we’ve got to be careful – regulators and the industry – to preserve that liquidity.”