A merger between DZ Bank and WGZ Bank, the two remaining central institutions among Germany’s cooperative banks, brings some relief to long-suffering advocates of bank consolidation in the federal republic. The two banks say merging will help them deal with the “extensive challenges” in German banking, such as low rates, digitalization, and increasing regulatory and reporting requirements.

|

Andreas Dombret, |

The merger, they say, will add “to the sustainability of our cooperative financial network in times of market-induced and regulatory changes”. That echoes comments from influential figures such as Bundesbank board member Andreas Dombret, who told German newspaper Die Welt in September that lower rates would increase the impetus for bank mergers, given German banks’ reliance on interest income. “There are structural problems at play here which call for structural answers,” said Dombret. Although DZ and WGZ are not listed, credit analysts have welcomed the news. The tie-up brings together the main German central cooperative institution, DZ Bank, and the last regional central institution, WGZ, which runs the franchise in North Rhine-Westphalia, Germany’s biggest state by population.

In a market crowded by middle-market players, the merged entity, to be known as DZ Bank, though retaining some of WGZ’s branding, will be Germany’s third-biggest bank.

Benefits

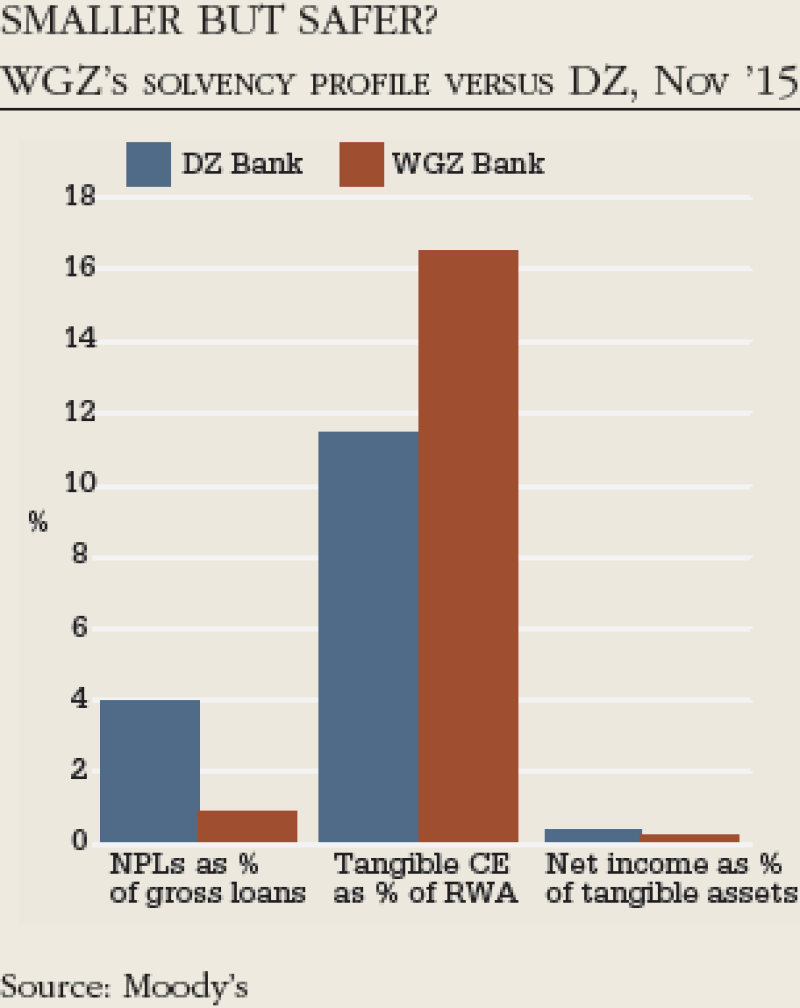

The merger will bring capital benefits in the “mid-triple digit millions” of euros, the banks say. That largely springs from the elimination of charges for minority stakes in jointly-owned product providers in asset management, insurance, private banking and a building society. Although this is of less benefit for DZ, which already owns a majority in two of these, WGZ comes to the merger with a higher capital ratio and a lower proportion of non-performing loans.

|

DZ’s asset quality, which suffered from the early 2000s German recession, had hindered previous merger negotiations, says Michael Dawson-Kropf, senior director at Fitch Ratings. Wolfgang Kirsch, DZ’s CEO since 2006, has also had to rein in an international presence, selling minority stakes in cooperative groups elsewhere in Europe since 2009. As a result, Dawson-Kropf says DZ has only of late been able to demonstrate “the benefits of prior consolidation”, including the 2001 merger of DG Bank and the southwestern cooperative group, GZ Bank, which led to the creation of DZ. But the cooperative sector, under DZ and WGZ, has already proven more cohesive than the public-sector banks: avoiding competition in North Rhine-Westphalia, for example, and advancing partnerships in areas like private banking. Indeed, Katharina Barten at Moody’s says that DZ has been much more profitable than public and private-sector banking groups in recent years. They are efficient, too. In the first half of 2015, DZ’s cost-to-income ratio was 51.5%. WGZ’s ratio was even lower at 45%.

There are more than 1,000 member-owned cooperative banks in Germany, but they have found economies of scale by sharing systems in areas like IT, reporting and marketing. That has happened less among public sector banks, where state governments have defended a middle tier between the nationwide support system and the local savings institutions. Although Dekabank exists as a common asset manager for public-sector banks, many Landesbanken have eroded each other’s margins further by competing outside their regions, while failing to come together in areas like insurance.

After the merger of DZ and WGZ, by contrast, there will only be two tiers of cooperative – DZ Bank, and the 1034 local cooperatives. That makes it similar to the Dutch Rabobank network, and unlike Austria’s Raiffeisen system, which maintains a three-tier structure. The merger will bring around €100 million in annual savings, according to the two banks. But it is not just about cost cutting. The motivation is more explicitly targeting capital charges, and duplication of future investment, such as IT upgrades, needed to meet heavier reporting requirements.

One hub

After the merger, the network will move to one hub, in Frankfurt, for central functions such as strategic planning. However, there will also be headquarters in WGZ’s home town of Dusseldorf, which will become the centre for managing much of the relations with local banks, being a centre for corporate customer services, the back office, and settlement. More than 10 regional support bases for the local banks, as well as corporate banking, will survive: from Hamburg to Munich, and from Dresden to Koblenz.

“They will reduce staff over time, but in a socially acceptable manner, as is usually the case in Germany,” says Barten. She adds that the initially outsized joint board of 12 directors, embracing both banks’ boards, will gradually shrink in number.

Dawson-Kropf at Fitch says DZ’s recent results have been unusually strong, thanks to lower loan impairment charges and healthy asset management revenues, largely the result of benign conditions in the capital markets (the cooperative group’s asset manager, Union Investment, is Germany’s third biggest). But it reflects well on the bank’s management that they are seeking answers now for problems ahead, says Dawson-Kropf.

“They’re doing it from a position of strength; it’s forward-looking,” he says. “They have the time and flexibility to prepare for the future.”

The next question is whether the Landesbanken will follow suit and engage in mergers themselves. However, Dawson-Kropf and others are not holding their breath. “We don’t think it is very likely that the Landesbanken will merge,” says Barten.