2015 was an unpredictable rollercoaster ride for foreign-exchange markets; 2016 is set to continue in much the same vein with volatility at the fore, geopolitical risk spiralling upwards and China's economic slowdown weighing heavily on commodity currencies.

Persistent volatility

2015 saw the return of volatility to FX markets, and that is set to "extend into 2016, through the first half if not the whole year", predicts Jane Foley, senior currency strategist at Rabobank.

|

Jane Foley, Rabobank |

Uncertainty is a driving force – uncertainty surrounding China's economic performance and the pace of future interest-rate hikes from the US Federal Reserve are two key factors feeding the engine of volatility, as well as persistent geopolitical risk. Less than a week into 2016, North Korea has already allegedly set off a hydrogen bomb and numerous Arab countries, including Saudi Arabia, have cut diplomatic ties with Iran. Volatility is music to currency traders' ears, so 2016 might well herald positive trading results for banks' FX trading divisions.

Kit Juckes, macro strategist at Société Générale, has published his top three trades for the top 10 most-heavily-traded currencies in the world (G10): short GBP/JPY; short NZD/CAD; and short CHF/SEK.

However, corporates will need to look carefully at their hedging policies, to avoid their profits taking a hit from sudden currency movements.

"It is potentially a difficult year for corporates trying to hedge and potentially policymakers too," says Foley.

Obama dollar rally

The dollar strengthened rapidly last year, and analysts at Brown Brothers Harriman (BBH) believe this is an ongoing trend.

"We expect the Obama dollar rally to continue in 2016," they state. "The premium one earns in US dollars will continue to attract capital flows into the US. Because of the wide, and widening interest-rate differentials, one is paid to be long dollars. This has powerful implications for hedging."

BBH predicts EUR/USD to move from current levels of 1.07 to 0.97 by the final quarter of 2016, as the dollar continues to strengthen.

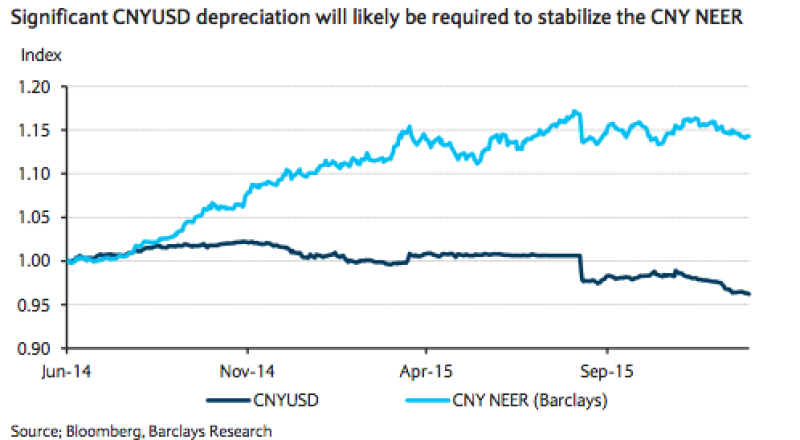

Conversely, China's currency depreciated by 3.87% against the US dollar last year. China remains in a state of flux, as it shifts from a manufacturing to a services economy and seeks to internationalize the renminbi. BBH predicts a similar decline of between 4% to 5% in 2016 would "not be surprising", and anticipates further monetary easing from China's central bank.

|

Source: Barclays Capital |

China is the biggest consumer of commodities, so a weaker RMB in conjunction with falling commodity prices would be another blow for commodity-exporting countries and their respective currencies.

"That story does not appear to be over," says Foley.

Banks + P2P FX

More businesses are exploring peer-to-peer (P2P) FX platforms to cut down on costs when exchanging currencies.

|

Philippe Gelis, Kantox |

Philippe Gelis, co-founder and chief executive at P2P FX provider Kantox, believes banks are starting to show an interest in participating in these platforms as back-up liquidity providers and also potentially as investors.

P2P FX works by matching buyers and sellers of currencies so they trade directly with one another, and save paying a hefty spread to a bank or broker.

However, if a match is unavailable, typically a platform will have banks on standby to complete the transaction. Gelis believes that in 2016 we will see more banks getting involved.

"We are starting to see partnerships between banks and P2P providers," he says. "I see interest from smaller banks that do not have the size or resources to invest in building their own FX offering, to partner with players in the industry.

"We are also seeing real interest from banks to be involved as investors in fintech, including P2P FX. They are starting to understand that it is not so much a matter of providing a service, but also a good user-experience and a customer-orientated solution. Fintech does that much better than them."

Compliance

FX dealers took a reputational hit in 2015, with an onslaught of regulatory fines and pressure to clean up their procedures.

|

Val Jagar, HiFX |

Stronger compliance will be a theme going into 2016, predicts Val Jagar, head of corporate services at money transfer service HiFX.

"We expect FX providers to continue to automate their compliance process with the goals of fighting financial crime, reducing fraud and improving the client journey," he says. "FX specialists who embrace sound compliance regimes and stronger IT security will be the industry leaders."

The FX industry will gravitate towards more intuitive and simplified cloud-based platforms for consumers and SME corporate clients, says Jagar.

"The trend is to offer more transparency, peer-to-peer technology, faster settlement methods and a movement from the traditional Swift network to utilizing more nimble local payment networks."