Just after Jean-Pierre Mustier rejoined UniCredit as its CEO in July, he attended an event organized by a leading Italian entrepreneur. He told Mustier that he did business with UniCredit not only because it was an Italian bank but because it had a large international network and was therefore able to support his development outside the country.

On another occasion, Mustier heard a slightly different story, although no less positive. A client spent time telling him forcefully that his firm had done business with UniCredit for 50 years and was planning to do so for another 50 years. The client was a Mittelstand firm in Germany.

|

Jean-Pierre Mustier, |

It was with these two anecdotes that Mustier opened UniCredit’s marathon capital markets day on Tuesday, which kicked off at 10am in London. For him, the two stories illustrate a key point about the nature of UniCredit. In Italy the bank is welcomed for the international reach it can provide domestic clients, but on the other side of the Alps, it is seen as a local bank that is firmly integrated into the German economy.

This – and a suite of strategic actions that UniCredit announced on Tuesday – is the key message that Mustier is hoping to communicate to investors. The bank is calling its 2016-2019 strategic plan ‘Transform 2019’, and it builds on the approach that the bank announced in July after Mustier’s appointment.

It hammers home the picture of a “simple pan-European bank” that delivers a network the bank describes as unique, covering Western, Central and Eastern Europe.

Mustier is building the plan around five strategic pillars. First, strengthening and optimizing its capital. Here he pointed to “bold” actions already taken, such as selling asset manager Pioneer Investments to Amundi – completed earlier this week – and disposing of a 40% stake in Polish bank Pekao to PZU through a sale of a 32.8% stake to PZU earlier this month and a 7.3% disposal through an equity-linked deal.

He has also already sold down 30% of the bank’s stake in online broker Fineco, through sales in July and October.

The key capital action still to be taken is a €13 billion fully underwritten rights issue, which the bank confirmed on Tuesday and hopes to launch early next year. Mustier says the deal would help the bank reach a fully loaded CET1 of above 12.5% by 2019. At the end of September, this stood at 10.8%.

The second pillar is improving asset quality. Here there was an important development overnight, with the bank signing agreements with Fortress Investment Group and Pimco to transfer two portfolios of Sofferenze (non-performing loans) to new organizations in which UniCredit will retain a minority position. The transfers represent gross book value of €17.7 billion.

The bank is also taking about €12.2 billion of one-off charges in the fourth quarter of this year.

Transforming the bank’s operating model, maximizing the value of the commercial bank (which accounts for 75% of UniCredit’s revenues) and adopting a leaner group corporate centre – something that shareholders have grumbled about in the past – make up the three remaining pillars of the strategy.

Costs will be dramatically cut by the planned headcount reductions, which now total 14,000 by 2019 after the addition of 6,500 within Tuesday’s announcements. Maximizing the commercial bank will include a greater effort on leveraging it through the corporate and investment bank, which will see internal joint ventures created to enable CIB products to be more effectively offered to corporate and retail customers.

Mustier also announced a raft of financial targets in addition to the CET1 ratio. He wants compound annual growth of revenues from 2015-2019 to be 0.6%. The cost/income ratio should fall to below 52% in 2019 – it was 59.2% in the bank’s third quarter 2016 results. Net income should be €4.7 billion and return on tangible equity should be above 9% – it was 5.7% for the first nine months of 2016.

Massive rights issue

A key part of the UniCredit’s strategic plan is the €13 billion rights issue that it confirmed on Tuesday morning, which will take place after an extraordinary general meeting (EGM) that has been called for January 12. The deal represents a chunky 75% of the current market cap of about €17 billion, but bankers working on it were quick to express confidence that the market was well positioned for a deal of this size and that it had been well anticipated.

That confidence seemed justified by the positive reaction of equity investors on Tuesday. Some initial softness quickly changing to buying, and the stock was up about 7% by 10am London time. At €2.59, it is still some way off its year’s high of €5.06 in April, but it has risen 14% during the past month.

“The first reaction when these things are announced is always from the sellers, but that evaporated pretty quickly,” says one ECM banker. “Now investors will want to see how today’s capital markets day goes, but it’s clear the market is pleased to see the deal out there.”

|

The benign response is also an indication that the market is drawing a distinction between UniCredit and Italian banks more broadly – doubtless a key aim of Mustier’s efforts to change perceptions of the firm since he joined. It is also a function of how well flagged the deal had been, but the fact this is just a part of a much bigger strategic plan – which itself comes on the heels of plenty of actions already taken – is another key reason for its reception, according to the ECM banker.

“The key point is that while you often step into these rights issues finding yourself having to explain the story and convince the market of what can be done, the benefit in the case of UniCredit is that a lot of the work has already been done.

“Mustier has already been very active – look at deals like Pekao and Pioneer – and people can see that there has been a lot of good action.”

There’s still plenty for the market and bankers to get their heads around. Tuesday morning’s sales briefing at one of the banks in the underwriting syndicate took an hour: the first briefing on an IPO typically might last about half that time, says a banker. The length didn’t reflect expectations of problems, just the fact it took time to explain the strategic actions UniCredit has already taken.

The positive story and the widespread expectation of a deal won’t make it a breeze, however. Not only is there the sheer size and the lengthy period of market risk, but the bank has also held out the begging bowl to shareholders before. It did a $4.64 billion rights issue in 2010 and raised a further $8.5bn in January 2012 — the latter deal seeing a precipitous fall in its stock price.

Things are different now, though, argues another banker. "Before it was 'we have a hole and we need to fix it'. Now the circumstances are very different. We don't have a sovereign debt crisis, BTPs are not blowing out, and there is a pretty comprehensive restructuring plan that has been announced."

This banker also points to a more stable shareholder base for UniCredit than existed before, with a smaller reliance on foundations, industrialists and other shareholders who might struggle to support a deal.

|

No detailed timetable has yet been announced, but the EGM will take place on January 12 and bankers are expecting the deal to kick off in February. Mustier limited himself on Tuesday to his hope to launch in the first quarter of the year, subject to EGM approval and market conditions. Italian rights issues are among the longest of all ECM processes, and four months from announcement to completion is not unusual.

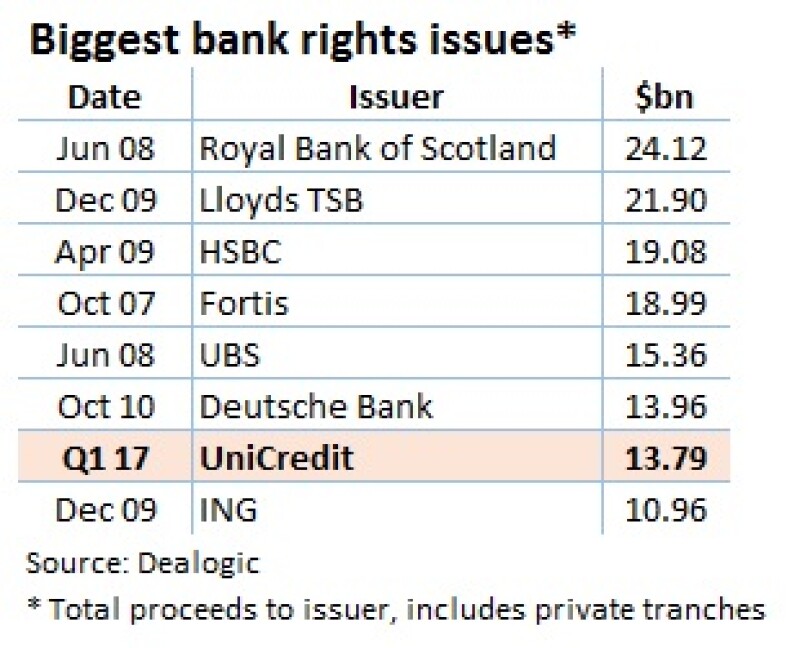

The size puts the deal in the big league. At current exchange rates, the $13.8 billion-equivalent size makes the trade the eighth biggest public ECM deal in Europe ever — ignoring privately placed or guaranteed tranches. It would be the sixth biggest rights issue – the five larger deals have also all been for banks: Royal Bank of Scotland, HSBC, Fortis, UBS and Deutsche Bank.

In terms of actual capital raised through rights issues for banks, including private or ring-fenced tranches, the deal sits seventh. It will also be the biggest in Europe since the $13.96 billion-equivalent rights issue for Deutsche Bank in October 2010.

Unsurprisingly for a deal of this size, the underwriting duties on UniCredit have been well-spread. No fewer than 10 banks are working alongside UniCredit itself on the deal, although the hierarchy is clear in spite of the nebulous titles. The syndicate will get bigger over time, as the leads add more banks at lower levels. The deal has been fully underwritten by the 10 banks, with no sub-underwriting.

Structuring advisers – and effectively running the deal, according to bankers elsewhere in the syndicate – are UniCredit, Morgan Stanley and UBS. The three are joint global coordinators and joint bookrunners alongside Bank of America Merrill Lynch, JPMorgan and Mediobanca.

Finally there is a further layer of banks comprising Citi, Credit Suisse, Deutsche Bank, Goldman Sachs and HSBC. These are joint bookrunners and co-global coordinators – a title that one banker Euromoney spoke to thought he might have heard of once before, but couldn’t remember when.