Sterling enjoyed an uncharacteristically buoyant day of trading on Tuesday, strengthening by 2.5% against the US dollar in its best day of trading since July.

Traders had reacted positively to the details regarding Brexit laid out in a speech by prime minister Theresa May, driving sterling off the three-month low it had sunk to on Monday. Ahead of the speech there was much talk of a further precipitous fall for the currency, once she confirmed the UK would not seek to remain within the single market.

As it turned out, all the bad news had been priced in, leaving only upside for any positive news that had not been leaked in advance.

Craig Erlam, senior market analyst at Oanda, called it “a textbook short squeeze in the pound”, with the pound rallying on news that the ultimate deal would be put in front of Parliament before ratification.

Few surprises

Anyone hoping the day would mark a turning point in sterling’s fortunes was disappointed on Wednesday, however, as the currency appeared to have resumed its former downward trajectory in early trading.

The speech had contained few surprises. May confirmed the UK will leave the single market and the customs union, warning she was prepared to default to World Trade Organization rules if the EU does not offer a palatable, bespoke arrangement.

| HSBC's Brexometer |

|

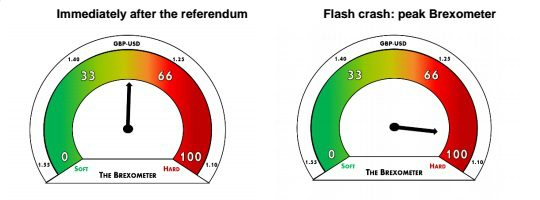

HSBC has argued that currencies in general are increasingly influenced by political developments and that sterling specifically has become a gauge of market expectations of the hardness of Brexit, a phenomenon it measures with its Brexometer.

However, this gauge was of little use on Tuesday, as the Brexit May outlined was undeniably hard, yet sterling surged.

|

Kathleen Brooks, |

Traders seemed to react favourably to confirmation that Parliament will vote on any final Brexit deal between the UK and the EU. The proposal of a new customs deal with the EU that would allow tariff-free trade would also have been seen as positive, says Kathleen Brooks, research director at City Index.

UK businesses will also welcome May’s determination to conclude talks within two years, with a phased transition period after that, she adds.

“The market rushed to buy the fact after selling the rumour of May’s speech,” says Brooks. “It is worth remembering that since the Brexit vote last June, rallies in the pound have been fairly weak, while sell-offs have been harsh and prolonged.”

All eyes are now on where sterling goes from here, as traders grapple with the question of whether Tuesday marked a turning point.

Brian Martin, head of global economics at ANZ, says: “The current risk premium for holding UK assets may be sufficient and this week is the first real suggestion since the Brexit vote that that might be the case.

|

“Based on producer prices, sterling is estimated to be 33% undervalued vs USD, and using the Big Mac index the degree of undervaluation is estimated to be around 25%.”

Sterling is also 25% below its average for the past 25 years, he notes.

Shaun Osborne, chief FX strategist at Scotiabank, concurs, adding: “We do not exclude the risk of additional GBP losses in the near-to-medium term, but we are starting to think that the GBP sell-off may be closer to stabilizing from a longer-term point of view, as valuation metrics are starting to look stretched.”

Osborne notes that the UK’s previous idiosyncratic shocks, such as the 1992 Exchange Rate Mechanism exit and the 2008 banking sector shock also saw GBP starting to stabilize around 150 to 160 business days after the event.

“These are, of course, incomparable events in and of themselves, but the point is perhaps that shock waves, however severe, eventually recede and markets move on,” he says.

To stage a sustained turnaround, sterling will need to develop a greater tolerance to political bad news, but it is too early to know if Tuesday is evidence of that, says Brooks at City Index. If GBP/USD does continue this rally into the end of this week, and moves back towards $1.25, then it could suggest the UK currency is developing a natural resistance to Brexit, she says.

This is not something HSBC is expecting, and it will not be surprised to see early signs that the sterling rally had petered out.

“Hard Brexit rhetoric should keep the downward pressure on sterling, despite [Tuesday’s] modest rally,” says Simon Wells, chief UK economist at HSBC.

It is worth noting that sterling’s Tuesday surge began hours before May started talking. The initial momentum seems to have come from president-elect Donald Trump’s concerns about dollar strength, and hints in an interview with The Times that the UK has grounds to hope for a trade deal.

Mihir Kapadia, CEO and founder of Sun Global Investments, says: “The slump and the subsequent gain had little do with the pound itself but more to do with the broader and anxious dollar sell-off based on investor fears over Trump’s comments.”

Other factors

Of course, currencies can be driven by factors other than Brexit and Trump, despite the UK having posted some positive results in recent weeks, including retail sales and mortgage approvals, without sterling enjoying any benefit, says ANZ’s Martin.

Traders will be digesting more traditional economic data on sterling this week, including unemployment data on Wednesday that was slightly better than expected, as average earnings had been.

There had already been confirmation that headline inflation had risen by 1.6% year on year, and 0.5% month on month, by the time Tuesday’s rally got under way.

Bank of England (BoE) governor Mark Carney had forecast inflation to overshoot the 2% target to close to 3% within the next 18 months, so the rise was no surprise, but if sterling can maintain the gains it made on Tuesday and is no longer trending weaker that could ease inflation pressures.

James Hughes, chief market analyst at GKFX, says: “Brexit is, of course, a huge sticking point for inflation prices, and this number shows that currently the BoE predictions of much faster inflation growth are in line.

“However, such is the uncertainty over Brexit and the reaction of the pound that we could well see the situation change very quickly.”