Intelligence that drives action

For over 50 years, Euromoney has been trusted to set the benchmark for excellence in global banking and finance. Today, we harness our unmatched industry access to deliver research that empowers institutions to assess their market position, uncover opportunities, and stand out in a competitive landscape.

Get unparalleled access

Our deep industry connections give us unmatched reach across banking and finance at a global, regional and national level.

Gain unique insight

Our proprietary data and research enable organisations to benchmark their performance and identify market gaps.

Validate strategic decisions

Senior leaders and decision-makers rely on our intelligence to understand their market position and inform their strategy.

Differentiate and lead

Through our awards programmes, we help institutions stand out and lead in a competitive marketplace.

What we cover

Corporate Banking

Covering 200+ corporate banks and drawing on insights from 45,000+ corporate and institutional clients, our corporate banking research analyses market positioning, revenue performance and digital integration across cash management, payments and trade finance – helping you understand your competition, anticipate client priorities and make confident strategic decisions.

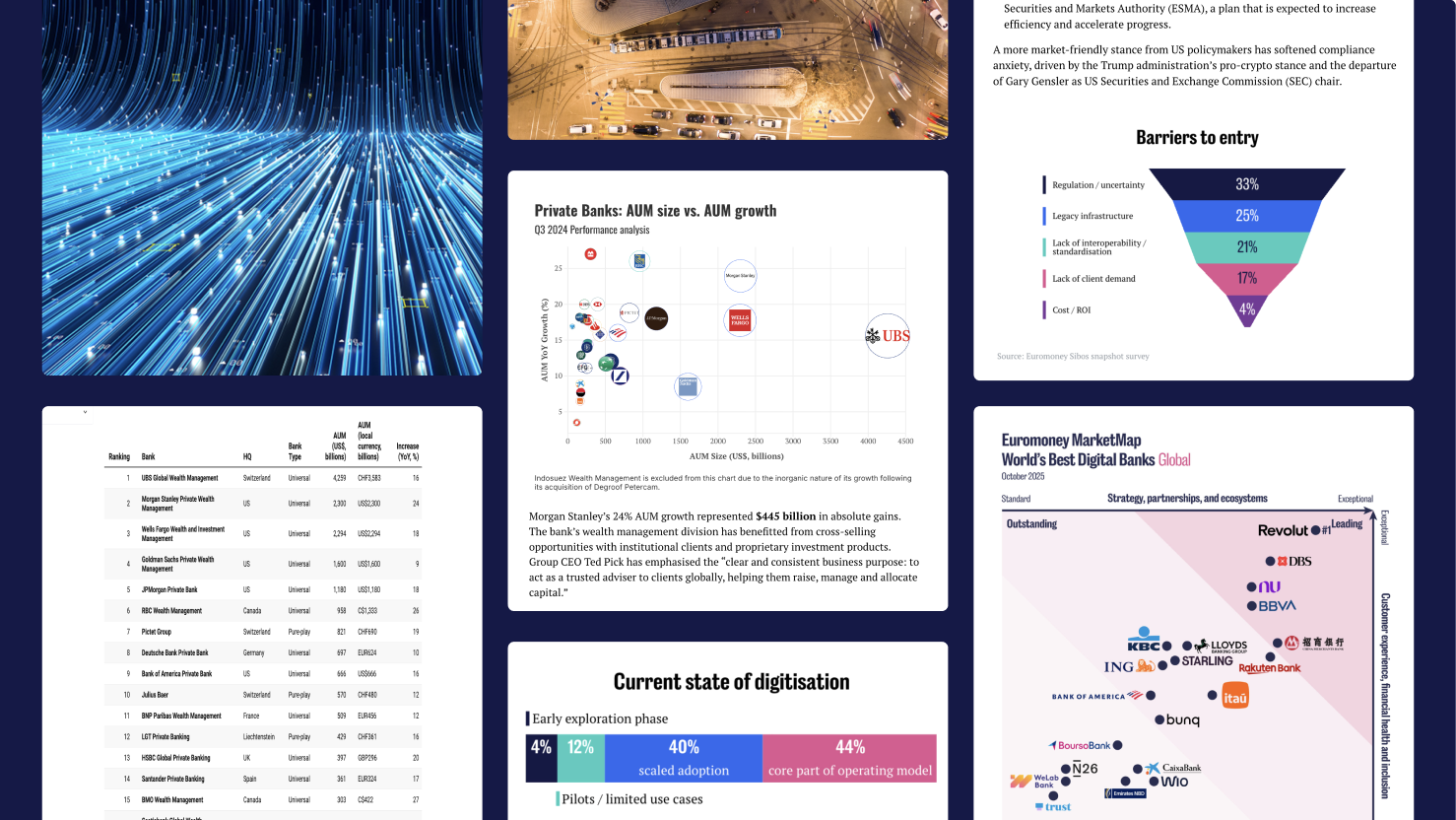

Private Banking

Connecting directly with private banks, wealth managers, and ultra/high-net-worth clients worldwide, our private banking research analyses Assets under Management (AUM) growth, regional market dynamics, sustainable investment, digital innovation, and servicing capabilities – giving you the insight to benchmark performance, understand client satisfaction, and shape strategies for growth.

Retail banking

Our research reveals the strategies shaping success in consumer banking. We benchmark growth, efficiency, and customer value, and assess digital innovation and experience – helping you track performance, uncover what drives best-in-class results, and prioritise actions that enhance customer experience and operational effectiveness.

Investment Banking

Analysing more than 250 investment banks worldwide, our investment banking research evaluates the capabilities and strategies shaping success across ECM, DCM, M&A and risk solutions. We benchmark execution quality, client franchise strength and product depth – helping you understand where your platform leads or lags, uncover opportunities for growth, and make confident decisions on resource allocation and client engagement.

Markets

Our research analyses the capabilities and competitive dynamics shaping global trading and foreign exchange. We benchmark execution quality, client coverage and platform strength across leading franchises – giving you the insight to understand market positioning, defend wallet share, and prioritise investments that deliver impact.

Globally trusted

Being recognised as the best bank speaks to us – and our stakeholders, our clients, our employees, and of course our community and the societies in which we operate.

Access intelligence that drives action

Benchmark your performance and make smarter strategic decisions with full access to Euromoney’s research.