Yoni Assia co-founded eToro, which he describes as the world’s leading social investing network, in 2007 with his brother Ronen. Yoni was just 26 years old.

Their idea was to win over young and tech-savvy investors with cheaper and simpler ways to buy into equites, commodities, currencies and, later, cryptoassets than an account with a traditional brokerage firm.

Most new users are aged in their early 30s when they join eToro, with an average account size of around $1,000.

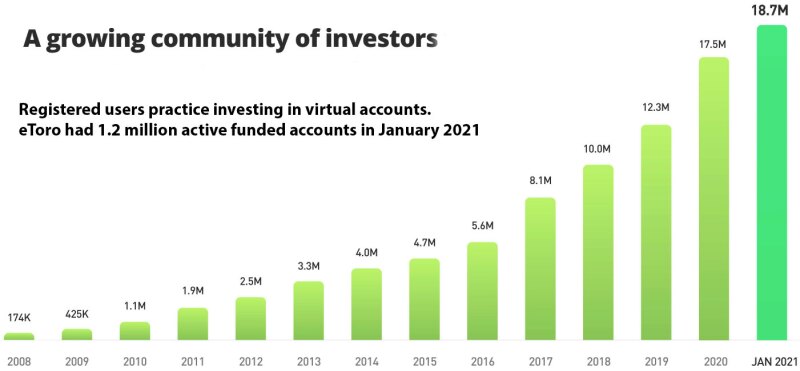

While eToro does offer commission-free direct stock dealing to individuals – and earns most of its revenue from the spread on executing these trades rather than in payment for order flow from the biggest market makers – few new users start on eToro with a funded brokerage account.

Most learn through virtual trading. They first follow the discussions of more experienced traders, identify successful ones and copy them. The eToro platform automates this.

“Copy trading is a form of the sharing economy, like Airbnb or Uber,” Yoni Assia, chief executive of eToro, tells Euromoney.

“Only