Interest-rate swaps are foundational to the financial markets. Banks are central to originating them and trading them. When a borrower raises floating rate debt from a lender and wants to fix its liability cost, it finds another contracted counterparty, usually a bank, that pays floating and receives fixed while the borrower takes the opposite side, right?

Well, perhaps not for much longer.

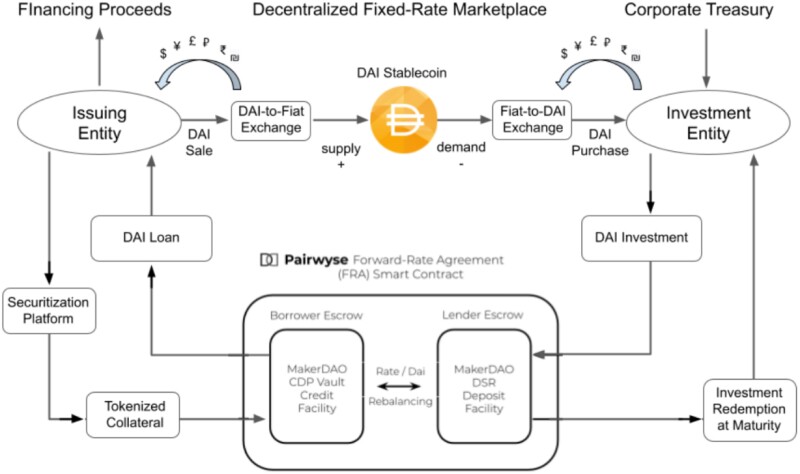

In November, a new decentralized finance (DeFi) protocol, Pairwyse, emerged that enables investors to obtain term fixed rates from overnight DeFi borrowing and lending protocols that have up to now offered only floating rates.

That is because their core building blocks are stablecoins pegged one-to-one to the US dollar. For any money market instrument – in the DeFi world or in centralized traditional finance (TradFi) – that allows free flows of capital in and out, and where an FX rate is pegged, by definition interest rates have to float to maintain that fixed peg.

The developers of Pairwyse have found a way to automate continuous management of cashflows akin to those in forward-rate agreements through a new form of blockchain-based interest-rate swap that turns floating rate DeFi money market protocols into fixed-rate instruments.

Should