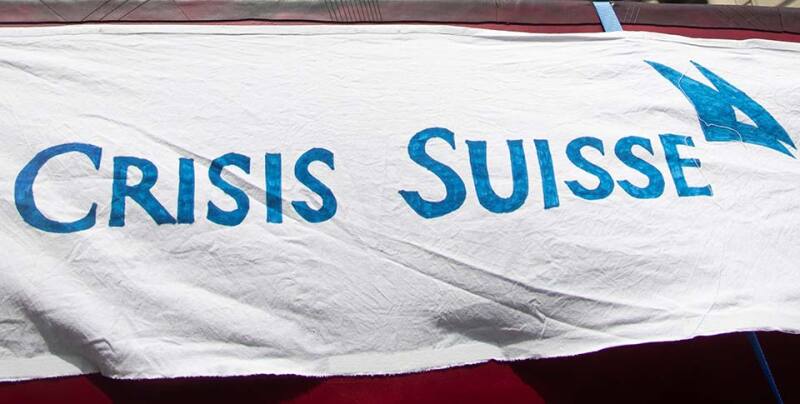

There’s panic in the air at Credit Suisse.

In the light of a SFr900 million ($936 million) loss in the investment bank for the second quarter of 2022, new chairman Axel Lehmann has decided to tear up his predecessor’s strategic review of the group and undertake a new one that will shrink the investment bank even further.

He has also “accepted the resignation” of group chief executive Thomas Gottstein and promoted Ulrich Körner, who only arrived from UBS in 2021 to head asset management, the smallest of the bank’s four business divisions, to replace him.

Körner will now lead a group dominated by its private bankers and investment bankers through yet more change as its highly experienced chief financial officer, David Mathers, heads for the exit, eventually to be followed – according to the Financial Times, which broke news of Gottstein’s replacement – by the new head of the investment bank, Christian Meissner.

Meissner has handed over day-to-day running of the investment bank to David Miller and Michael Ebert, and will concentrate for now on this latest restructuring.