On Thursday, the SEC charged Genesis Global Capital and Gemini Trust Company with violations of the Securities Act of 1933. This is not a criminal charge of fraud but rather a more technical accusation of running an unregistered securities offering by selling an investment scheme to US retail investors without full disclosures.

It could be a big moment, however, as regulators close in on some of the biggest names in the crypto world.

The SEC is demanding a jury trial and seeking disgorgement of ill-gotten gains plus interest, as well as civil penalties. It also says that investigations into other securities law violations and into other entities and persons relating to the alleged misconduct are continuing.

There is a lot more going on behind the scenes here, which may ultimately involve the Grayscale Bitcoin Trust, the biggest collective investment scheme for holding bitcoin.

It is hard to imagine how the reputation of promoters of crypto schemes could sink any lower, so it is not clear what further damage being charged by the SEC might do

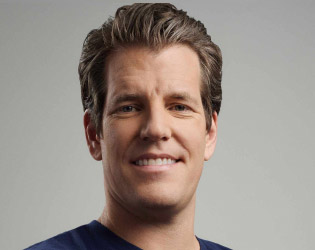

Since the collapse of cryptocurrency exchange FTX and arrest of its founder Sam Bankman-Fried, investors in crypto have increasingly focused on the escalating and bitter row between the Winklevoss twins, Cameron and Tyler, owners of the Gemini cryptocurrency exchange, and another crypto billionaire, Barry Silbert, founder of Digital Currency Group (DCG).

DCG is a holding company for a number of crypto businesses, two of largest being Grayscale, manager of the large bitcoin trust, and Genesis, an early broker in the crypto markets, which subsequently set up a big crypto lending business, Genesis Global Capital.

The two sides used to work together, offering Gemini’s mostly retail customers the chance to earn interest on their crypto holdings by pledging them into the Gemini Earn program, which saw Genesis take in those small packets of crypto assets, pool them, lend them on in turn to big institutional borrowers of crypto, and pass back a juicy rate of interest to retail investors, after taking a margin of course.

Gemini also took a fee before crediting interest to the accounts of customers allocating into Gemini Earn.

Freezing assets

In November 2022, with crypto prices falling again after the bankruptcy of FTX and of other crypto companies, Genesis stopped allowing retail investors to take back cryptos they had pledged into Gemini Earn, freezing $900 million of assets from 340,000 customers of the Gemini exchange.

Those customers are angry with Genesis for freezing their money and fear that it is lost. They are also angry with Gemini for marketing the Earn programme to them when they trusted it to have done proper due diligence on Genesis.

Gary Gensler, chairman of the SEC, states that the charges “build on previous actions to make clear to the marketplace and the investing public that crypto lending platforms and other intermediaries need to comply with our time-tested securities laws. Doing so best protects investors. It promotes trust in markets. It’s not optional. It’s the law.”

Maybe. But it doesn’t resolve the matter at hand.

Separate to the recent SEC charge, the key issue in all this is the degree of recourse those Gemini Earn customers might have to the wider DCG.

Bitter letters

In a series of increasingly bitter open letters published on the favourite propaganda platform of all crypto bros, the Winklevoss twins have tweeted demands for Silbert to make good on the money owed to customers of Gemini Earn.

They have accused him of stalling tactics and, more recently, of misleading statements over a DCG promissory note for $1.1 billion issued to prop up Genesis back in June 2022, after it nearly collapsed thanks to exposure to Three Arrows Capital when it went bankrupt.

Looking further into the murk, they have also raised questions about whether the apparent crypto lending and collateral exchanges between Genesis and 3AC were really bitcoin swaps, designed to boost holdings of Grayscale, which earns fat management fees, even though shares in the trust have come to trade at a wide discount to the price of bitcoin.

Silbert, for his part, points out that Genesis has its own board of directors and management team now engaging with an ad hoc committee of creditors on a restructuring. And while DCG has borrowed from Genesis Capital and used proceeds to buy back DCG shares from an early venture investor and to buy liquid cryptos and public equities, because of the outstanding loans and the promissory note, “DCG executives, including those on the Genesis board, have no decision-making authority related to any restructuring of Genesis Capital.”

Super lame

It seems unlikely that the SEC will bring the two warring sides together by charging both of them with running an unregistered securities offering.

The SEC’s case looks simple enough: Genesis was the issuer and Gemini the distributor for an investment offering from which they both intended to profit, which attracted investors with the promise of a high yield, was described as an investment and clearly was not a bank-like savings account with any insurance protection.

Summoning all of his inner crypto bro and sounding like a teenager whose parents have told him to get off his X-box and do some homework, Tyler Winklevoss took to Twitter to express his disappointment at the SEC’s charge, saying it does nothing to help Earn users get their assets back and summing it up as: “super lame.”

He adds that the Earn program was regulated by the New York State Department of Financial Services (NYSFDS).

But that is not how the SEC sees it. It points out that while Gemini itself is registered as a limited purpose trust with NYSFDS, NYSFDS did not oversee Genesis. Gemini earned fees of up to 4.29% for marketing the programme to its customers. And while it may not have been apparent to those customers that Gemini had sole discretion over its agent fee and thus the net rates of return offered to Gemini Earn investors, Gemini did make it clear that Gemini Earn was not backed by Gemini itself.

Parking ticket

It is hard to imagine how the reputation of promoters of crypto schemes could sink any lower, so it is not clear what further damage being charged by the SEC might do.

Tyler Winklevoss tweets that “we look forward to defending ourselves against this manufactured parking ticket.”

A quick look at the replies to his thread sees Gemini customers offering him their own advice in fairly forthright language.

Meanwhile the nightmare for Silbert would be any shove into a wider restructuring of DGC that might see it forced to sell Grayscale to raise cash to pay off creditors or, worse yet, break up the bitcoin trust, which is such a big earner.

The price of bitcoin has been rising in recent days. Any prospect of a breakup of the trust and dumping of its coins into the open market might bring another bout of volatility.