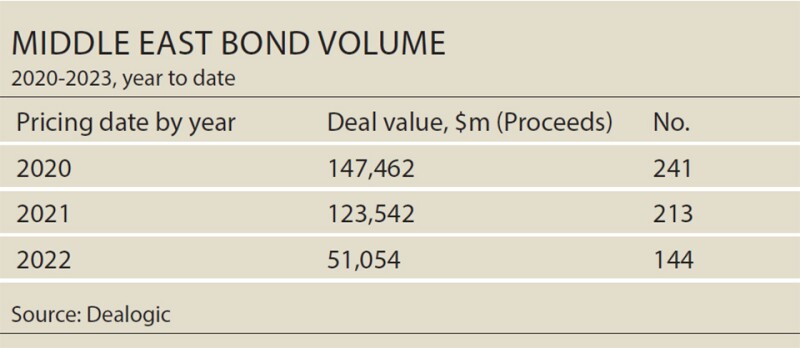

In 2022, Middle East bond issuance dwindled sharply. According to Dealogic, deal volumes shrank 16% between 2020 and 2021, followed by a 59% drop from 2021 to 2022. A combination of lower oil prices, market volatility and high liquidity at banks meant that for regional fundraisers, the easiest and cheapest route was the bank market.

An upshot of this was a rise in regional issuance of sustainability-linked loans (SLLs), and with COP28 around the corner – hosted this year in Dubai – it is no surprise that banks and borrowers alike are taking the opportunity to bolster their environmental, social and governance (ESG) portfolios.

Like sustainability-linked bonds (SLBs), SLL products offer a cost of financing that varies depending on the extent to which the borrower meets pre-set key performance indicators (KPIs) that focus on one or more aspects of sustainability – some structures offer discounts if the KPIs are met, while others provide penalties if they’re not.

Unlike with green loans, the proceeds of an SLL do not have to be put towards a specific green project, and so they provide more options for firms that are looking for a flexible approach to ESG.

“Where