Football clubs undergoing a period of transition often talk of needing a transfer window or two to get where they need to be. More often than not, this doesn’t work. Better-run teams continue to make clear-minded decisions that keep them ahead of the pack. Catching up is always hard to do.

When HSBC unveiled plans to pivot to Asia in early 2020 – by redeploying $100 billion in risk-weighted assets to the region to deliver stronger growth and winkle out gains in transaction banking and wealth management – eyebrows were raised.

Asia, as Euromoney argued in February 2021, had to be about more than just greater China, comprising Hong Kong, its financial bedrock, and the mainland, the source of so much of the future growth it needs to generate. Later in the year, chief executive Noel Quinn insisted the point really was to pivot.

“It’s about Hong Kong, China and the rest of Asia,” he told us. “I want growth on all fronts.”

Well, growth is what he got. The plan worked. Of course, HSBC remains the industry’s clear leader in Hong Kong, top-ranked in trade finance and deposits, and the leading international lender in China across wealth and asset management, banking and insurance.

But it is so much more. It posted $900 million in pre-tax profit in India in 2022 and $800 million in Singapore, both records. Another landmark saw it pass the $1 billion pre-tax profit mark in mainland China for the first time.

In Australia – where it posted $450 million in pre-tax income last year, another record – it is the largest international wholesale bank and the last big global retail bank still standing.

And it is investing heavily in India, where it facilitates 9% of the country’s exports, 9% of traded FX and 10% of foreign investment, banks 45% of the country’s tech-heavy unicorns and is on the cusp of reviving its full suite of private-banking services.

HSBC’s acquisition of India’s L&T Investment Management for $425 million tripled its customer base in south Asia’s largest economy to three million.

With Citi exiting several Asian consumer franchises, including Taiwan, mainland China and India, and with DBS less focused on some core markets (Japan and Australia) than others (India and China), the door to HSBC becoming the only true pan-Asian bank remains wide open.

We have made a significant shift in the way we operate

Surendra Rosha

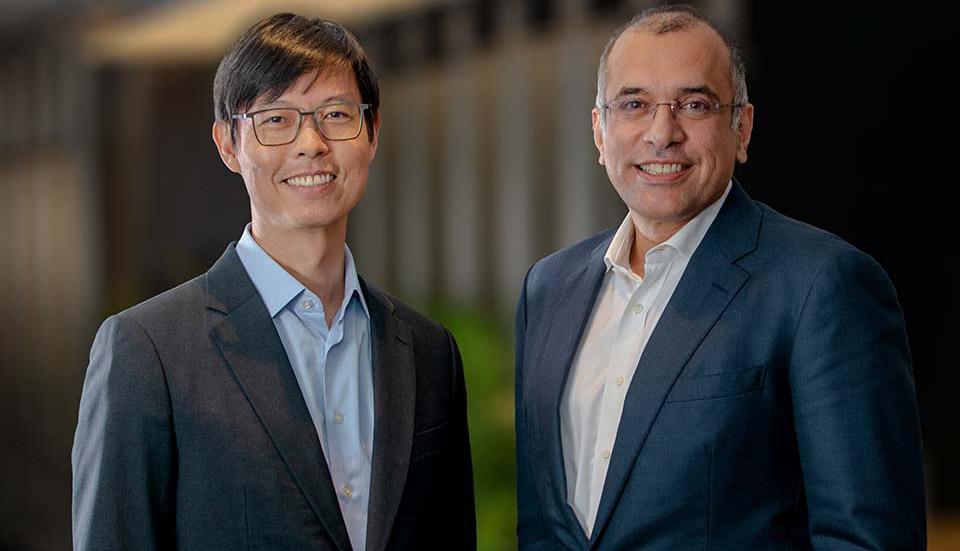

David Liao and Surendra Rosha have been busy since being named co-chief executives of HSBC Asia Pacific in June 2021.

“We have made a significant shift in the way we operate,” says Rosha. “Business heads in Hong Kong and mainland China now report directly into the global business heads; and it’s that sense of empowerment that is energizing the franchise.”

HSBC’s broad and deep presence matters in other ways. Asia is increasingly the epicentre not just of trade but of capital formation. More wealth created in the region is being kept there, in the private-banking hubs of Singapore and Hong Kong: HSBC, of course, is big in both.

This also puts it at the financial heart of growing trade and capital corridors such as the one linking Asia and the Middle East, and to China’s hopes of convincing Gulf states such as Saudi Arabia to be paid for oil in yuan rather than dollars. When Euromoney speaks to Liao in May, he is busy preparing for his third trip of the year to the region.

And it is worth remembering HSBC’s financial strength in greater China is just that. No other global bank can hold a candle to it in Asia’s largest economy. It is the natural bank of choice for tens of millions of citizens in the Greater Bay Area and it banks more than 1,600 Chinese holding companies and their subsidiaries in more than 50 markets.

It is also a key part of China’s outbound story, as mainland firms and global multinationals shift production to India, Indonesia and Vietnam – all markets where HSBC is strong.

Catching up is possible. After so many years of effort, HSBC is finally becoming the bank that truly glues Asia together.