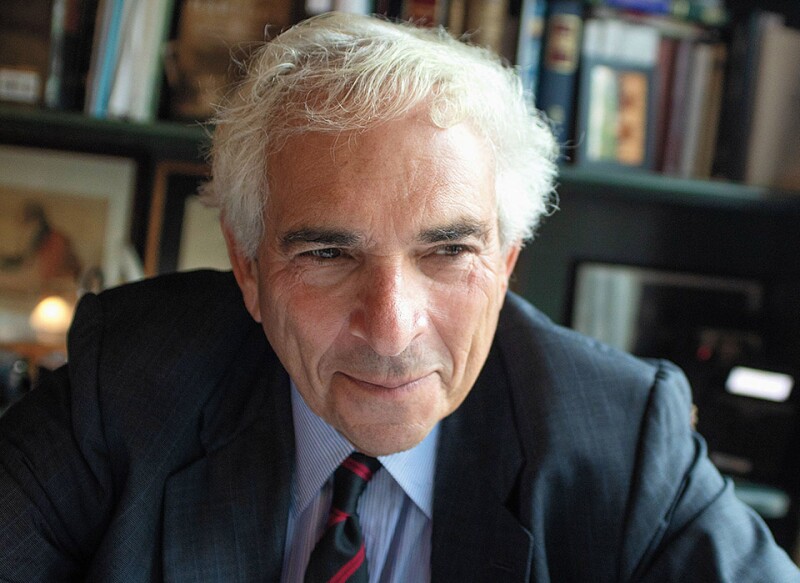

Gary Gensler had a bad summer of US legal conflict. On August 29, a federal appeals court overturned a rejection by the Securities and Exchange Commission (SEC) of an application by Grayscale to turn its bitcoin trust into an exchange-traded fund.

“It is a fundamental principle of administrative law that agencies must treat like cases alike,” the judges hearing the case wrote, pointing out that the SEC has approved trading of bitcoin futures funds, but not Grayscale’s attempt to launch a fund based on spot bitcoin.

“The denial of Grayscale’s approval was arbitrary and capricious because the commission failed to explain its different treatment of similar products,” the judges said.

In July, the SEC had suffered a reverse in a court ruling relating to the status of the XRP crypto token produced by Ripple, though that legal decision itself seemed arbitrary and capricious – if not downright confused – in trying to apply different treatment to sales of the token to institutional and retail investors when defining whether they were in breach of securities laws or not.

Gensler has also been taking blows in the court of US public opinion.

Crypto evangelists have come to loathe the SEC chair and saw no need for restraint when celebrating his recent legal problems. A New York corporate lawyer and law school professor compared Gensler to Russian president Vladimir Putin for his uncompromising attitude towards crypto products, while creators of memes and online parody accounts with fewer formal qualifications enjoyed jokes at the expense of the SEC head.

The industry opposition has been so vociferous, and the SEC’s plans are so complex, that implementing change will be extremely challenging

A broadside from a more mainstream opponent came with the release on August 31 of a report condemning “the unprecedented volume and complexity of rule-making activity” by the SEC during Gensler’s tenure.

The report was compiled by the Committee on Capital Markets Regulation, a lobbying group of academics and financial industry veterans opposed to greater regulation that features former Goldman Sachs co-president John Thornton as a co-chairman.

Gensler and Thornton both rose through the ranks at Goldman in the 1980s, with Gensler making partner at the unusually young age of 30 before leaving to join the administration of then-president Bill Clinton in 1997.

Thornton edged ahead of Gensler in the mid 1990s in seniority at Goldman and would become heir apparent to chief executive Hank Paulson before departing in 2003 when he failed to get the top job.

The two men have contrasting backgrounds and personal styles.

Thornton is the son of a vice-chairman of Consolidated Edison who attended an elite preparatory school in Connecticut, followed by stints at Harvard, Oxford and Yale.

Gensler is the son of a vending machine salesman who went to a regular high school outside Baltimore before breaking into the financial elite by attending the Wharton School at the University of Pennsylvania, as a prelude to joining Goldman.

Setting the agenda

The Thornton-endorsed committee is now supplying data points that Wall Street can use to oppose Gensler’s attempts at financial industry reform.

The committee’s August 31 report noted that the SEC proposed 47 substantial rules in the period between Gensler’s arrival in office on April 17, 2021, and August 15 this year.

The report said that 39 of these rules – or 83% – were not required by congressional statute, to back its contention that Gensler is effectively setting his own agenda for the financial markets.

“The SEC has embarked on a rule-making agenda whose scope, scale, and speed are wholly unwarranted by any congressional mandate or financial crisis,” said Hal Scott, an emeritus professor at Harvard Law School who is president of the lobbying group. "These actions threaten to transform the US capital markets in fundamental ways, to the detriment of our competitiveness in the global market. Given the complex inter-relationship between these various rulemakings, there is considerable risk that neither the SEC nor the market can fully understand their combined effect before they are adopted and implemented."

The SEC declined to comment on the charges made by Scott and the Committee on Capital Markets Regulation.

The points in the report are being deployed by other representatives of the establishment on Wall Street as they seek to slow down the implementation of some of Gensler’s proposed reforms of existing market practices.

Hedge-fund and private-equity lobbyists had already persuaded the SEC to soften the impact of planned changes for their businesses before the agency announced on August 23 new requirements surrounding disclosure of fees and expenses.

On September 1, a coalition of six trade groups took their opposition a stage further by suing the SEC for over-stepping its statutory authority and legislative mandate in adopting the new private fund adviser rule.

This will encourage an overlapping pool of senior industry executives and lobbyists to try to stay on the front foot as they try to thwart an attempt by Gensler to reform US equity trading market practices.

That represents the biggest of the many fights that Gensler has picked with industry incumbents. He has touted potential savings of $1.5 billion for end investors just from changing the way wholesale brokers pay for retail equity order flow, which helped to encourage feedback from individual investors applauding his planned changes.

But the industry opposition has been so vociferous, and the SEC’s plans are so complex – a draft proposal released at the end of 2022 was over 1,600 pages long – that implementing change will be extremely challenging.

Tactical retreat

So how can Gensler ensure that representatives of vested interests in the financial industry do not combine to prevent meaningful reform across different markets?

One approach might be to execute a tactical retreat in a sector where he has arguably effectively prevailed – crypto trading.

Gensler was right to warn about the speculative bubble in cryptocurrency dealing, while many of his fellow supervisors around the world looked naive for their willingness to entertain proposals by digital currency promoters for minimal regulation.

The trial of FTX founder Sam Bankman-Fried, which is due to start in October, will serve as a reminder that Gensler was correct on the core problems with crypto trading, even if he does not succeed in all his assertions about whether particular digital tokens are technically securities.

That could mark a good time for the SEC to relent on approving spot bitcoin ETFs. Industry stalwarts including BlackRock – the biggest asset manager in the world – and Fidelity have already applied to launch spot bitcoin funds, which indicates that they are making an informed guess that approval will come eventually.

If crypto fund investment in the US moves towards competition based on fees, then large closely regulated asset managers will probably establish dominance, and crowd out early movers with weak governance structures or uncertain funding.

Gensler could plausibly make a claim for ‘crypto mission accomplished’ in that event and expect praise from some financial industry beneficiaries, even if the online zealots never forgive him.

He would still face a war of attrition on other fronts, but could potentially divide his enemies among established financial services players. That in turn could help him to secure a qualified victory in his multi-pronged campaign for reform of long-standing market practices.

And then Gensler could turn his attention to a final mission in an illustrious career: saving US investors from the threat posed by artificial intelligence.