Last week, on October 19, the Loan Syndications and Trading Association (LSTA) published third-quarter data on trading in the US syndicated loan market.

The good news is that prices were up. The bad news is volumes were down.

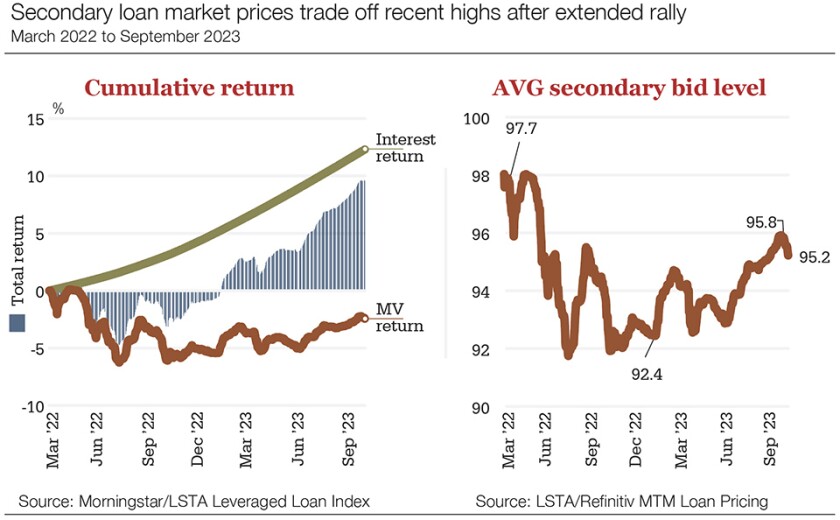

Floating-rate loans have been a sound investment in the first 18 months of rising rates.

Theodore Basta, executive vice-president of market analytics and investor strategy for the LSTA, points out that the Morningstar/LSTA Leveraged Loan Index registered the strongest quarterly total return (3.5%) in three years – which drove the year-to-date return above 10%.

Basta notes that monthly trading levels surged more than 200 basis points in the quarter, to an average trade price of 96.5.

“Even more impressive, the median trade price rallied to a 99-handle, a level not seen since last year’s first quarter,” he says.

But, even though rising default rates are not yet spreading alarm, as October began, loans were just starting to trade off their highs. And secondary loan trading volume fell to the lowest quarterly level in three years.

While the summer holiday quarter is always a little slack, this follows a sharp drop in the second quarter.

Secondary loan trading volume has been in steady decline since the US regional banking mess in March, with 2023 annualized activity (through September) of $735 billion representing a five-year low, or an 13% drop-off year over year.

That