It’s not often that a banker invites you, mid interview, to review documents behind a big real estate financing deal his institution has worked on. And Andrew Bester, member of the management board banking and head of wholesale banking at ING, is offering a sight into what just might be the biggest real estate deal in history.

ING is a distinguished brand in retail banking. Bester has been talking Euromoney through progress since his recruitment in 2021 by the Dutch bank’s then still new chief executive Steven van Rijswijk to power up the wholesale banking side.

Bester has spent much of his first couple of years fixing the basics and setting the platform up to do more in transaction services and also to build on its expertise in advising companies on sustainable finance to win more equity and debt capital markets and M&A advisory work.

Bester, who describes himself as a South African Brit, comes with an impressive history. His career took off in the early 1990s at Standard Chartered, where he worked in derivatives structuring and sales. He went on to co-head wholesale banking in Africa, China and Japan and was the first investment banker to become a regional head at the bank.

Global platform

In 2012, Bester was lured away from StanChart to turn around wholesale banking at Lloyds, very much a UK business, before then taking on another UK turnaround job as chief executive of The Co-operative Bank.

Given his career history, the chance to join a bank with a global platform similar in some ways to Standard Chartered’s, that spans the US and Asia as well as much of Europe, was obviously tempting.

Bester and his boss at ING both saw a great deal more potential to unleash. “In the wholesale bank, we have the capital and the relationships to deploy €150 billion of RWA across 4,000 of the largest corporate and financial institution clients in 35 countries,” Bester tells Euromoney. “And it is very important for those large Asian and US multinationals to have a bank that acts as a gateway to 23 European markets.”

As well as a powerful brand, ING also brings a strong credit rating and an abundance of retail deposits. In the era of negative rates, ING had little incentive also to chase deposits on the wholesale side, leaving it underweight against peers even though it has a strong pan-European cash management, trade finance and receivables business.

It is very important for those large Asian and US multinationals to have a bank that acts as a gateway to 23 European markets

Andrew Bester

“Now, with the normalizaton of the euro interest rate corridor, there is a big white space to expand into,” says Bester.

ING is adding some incremental product capability. It has full end-to-end transaction banking capability in its home market of the Netherlands and Belgium as well as Poland and much of central and eastern Europe. “We are a top-three commodity and trade bank, a strong digital bank, we are the leading cash pooling business with Bank Mendes Gans, and we continue to build in receivables and receivables finance which are global businesses,” Bester says.

Bank Mendes Gans is an independently managed subsidiary of ING that grew into a notable specialist in cash pooling inside Dow Chemical before the Dutch bank acquired it. It has many large US corporate clients at a time when many corporates are looking to expand their roster of cash management providers.

Bester continues: “One thing I identified soon after I arrived at ING is that we did not have enough specialist sales capability to leverage our product expertise.”

ING has been hiring such people in the large Western Europe economies, now with a focus this year on Luxembourg, Switzerland, Ireland, Spain and Bulgaria, as well as beyond Europe in Australia, Japan and the Philippines.

ING’s wholesale bank is making moves in other businesses too.

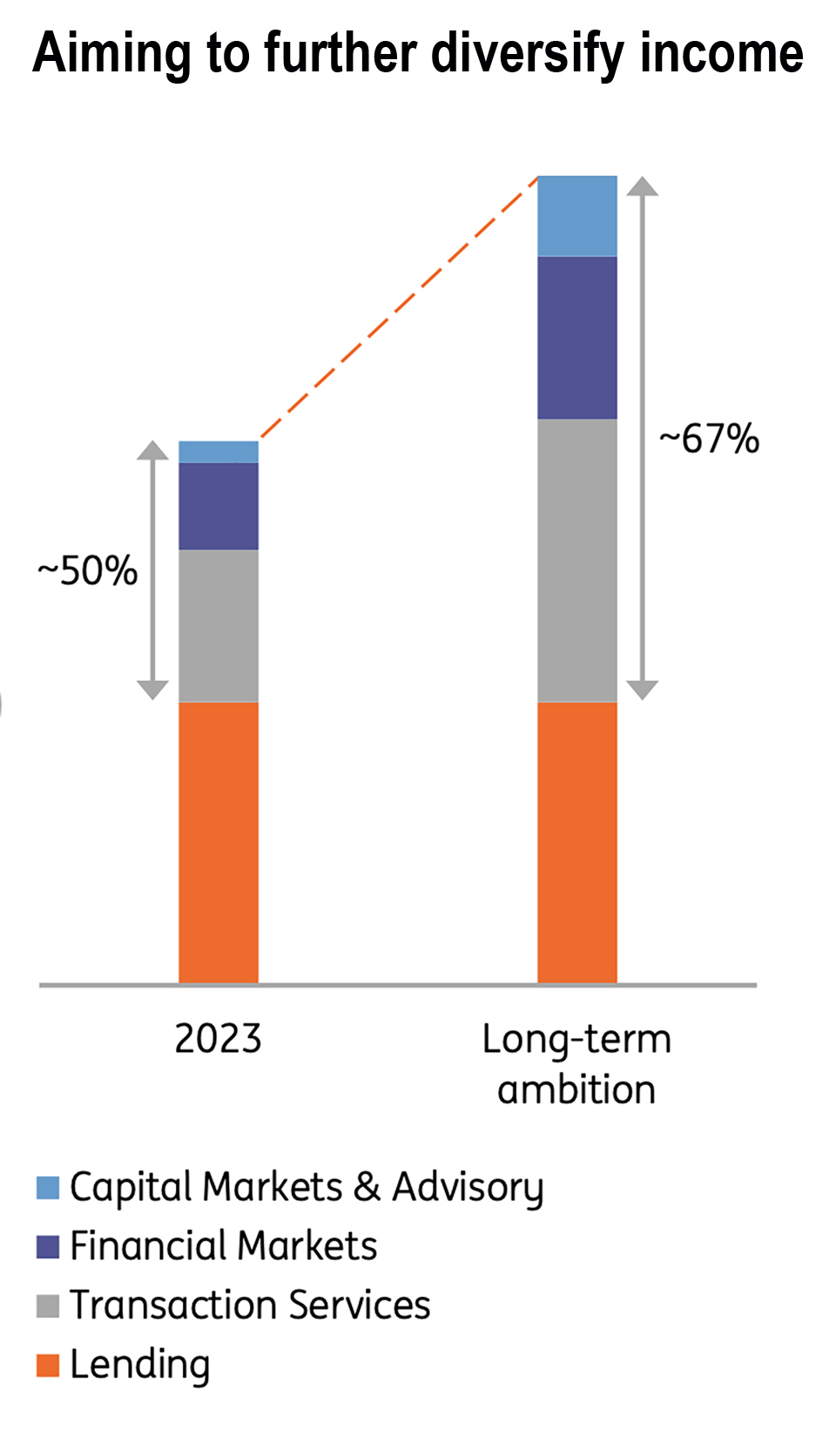

Bester says: “As well as scaling up in transaction services and in financial markets to help clients with hedging, you will also see us bringing in around 100 capital markets and advisory bankers to help the boards of companies that are already our clients with M&A, DCM, ECM and acquisition financing.”

There is no shortage of ambition. Van Rijswijk’s vision for ING is to be the best bank in Europe, also meaning the best wholesale bank in Europe. Shoot for the stars. “Post-Brexit, EU wholesale banks are very interestingly positioned,” states Bester.

Post-Brexit, EU wholesale banks are very interestingly positioned

Andrew Bester

ING has endured none of the agonizing that US and Asian banks have faced over relocating senior staff from London to Europe. Banks such as BNP Paribas, Deutsche, Societe Generale and Santander, which already have head offices in the EU as well as big capital markets teams in London, have benefited from remaining close to the big private equity funds, hedge funds and other institutional money managed in London.

Like them, ING has scale in both the EU and the UK and plenty of history in wholesale financing.

Its London offices at 10 Moorgate are home to the archives of Barings. Back in 1995, the Dutch lender acquired the remnants of the centuries-old UK merchant bank that Nick Leeson’s illicit derivatives trades brought down. Bester asks if we have time to review the deeds to the sale of Louisiana, which the bank financed in 1803.

In fact, Barings acted more as principal than agent. It bought Louisiana from France and then re-sold it to the newly formed United States, doubling its size.

Sorely tempted, Euromoney choses instead to press on with the interview.

Growing wholesale capability

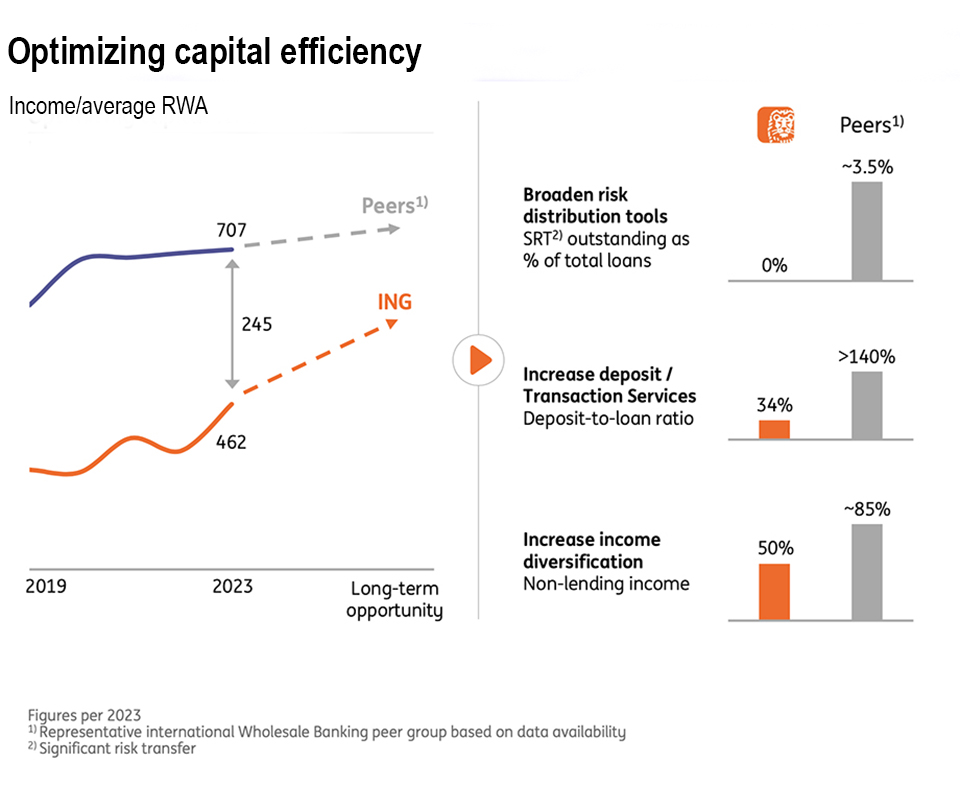

One problem for ING is that it is looking to grow its wholesale banking capability in two main fields – transaction services and capital markets and advisory – that are intensely competitive. And while both have low risk-weighted assets (RWA) density, which is a clear attraction to the equity investors that provide capital to banks and also to ING’s own executive board, which wants to grow the wholesale business while keeping it on a capital diet, many of the products are somewhat commoditized.

Certain of them, most obviously advisory, have poor cost/income ratios.

So, while it now seeks to scale up, building on its position as a pioneer in sustainable finance as well as its global network, ING also intends to focus on certain sectors. And that takes us back to Louisiana and to Barings.

“Our specialist sector expertise grows out of the history of Barings as a leader in structured finance around complex real assets,” Bester says.

Real estate finance is still one of the seven major sectors ING focuses on, though there are fewer mandates these days for land masses covering 52,000 square miles. Other sectors include commodities, food and agriculture; transport and logistics; telecoms, media, technology and healthcare; energy; and infrastructure.

“As we have finite amounts of capital, we need to ration deployment to clients that see value in partnering with us holistically, based on our geographic network, product and sector expertise,” Bester points out. “Treasurers and CFOs don’t tend to look at receivables finance as a single product. They see it as one component of working capital which they are charged to manage from end to end.”

ING disclosed at its capital markets day in June that it now serves 35% fewer wholesale clients than it did at the end of 2019. The good news is that, over the same period, average income per client has more than doubled.

Bester believes the wholesale bank can cut its dependence on income from lending by doing more than diversifying into new income streams. It can also do a better job of RWA management, both by distributing more of the assets that it originates off balance sheet and, even when it retains them, by using synthetic derivatives trades to secure regulatory capital relief. In the growing market for significant risk transfer, ING has been a noticeable absentee. Not for much longer.

ING has benefited from being a pioneer in sustainable finance, having developed transition plans for 2,000 of its largest clients. That has helped in winnowing the client portfolio. “We are too big a bank to simply exclude lending to significant sectors of the real economy,” Bester explains. “But we have had to exit relationships where we cannot reconcile corporate transition strategies with steering our own portfolio to net zero by 2050.”

He points out: “There is a risk that certain sub-sectors will become unfinanceable, leaving banks with stranded assets that are RWA heavy.”

Strength in sustainability

Sustainability is a boardroom topic and ING hopes that having its experts already there working on sustainability frameworks will give it a chance to build up in capital markets and advisory. Bester has no aspiration to turn ING into a bulge bracket investment bank. Yet it is finding that plenty of investment bankers want to join its teams, as it recruits managing directors in its main hubs of New York, London, Amsterdam and Singapore, as well as junior bankers to help execute the deals they bring in, mainly in continental Europe.

ING has recently established a sustainable value chains team, focused on providing financial services and solutions to new value chains that will need to be built and expanded upon to support the sustainable transition.

Made up of a global network of product, sector and finance specialists to help clients achieve their sustainability goals in a structured and coordinated way, the team is zooming in on four specialist areas: battery manufacturing; EV charging and charging services; recycling and bio-based materials; and cleantech components and services.

“It is a great benefit that many of our bankers working on structured finance for complex assets are engineer-trained and so have been able to shift seamlessly from advising oil and gas companies on field development to advising them on renewables,” Bester says. “Our transport bankers can advise auto makers on the sourcing and financing of raw materials for the batteries that power electric vehicles. Artificial intelligence may become a big global business, but it has huge power needs. We have the expertise to advise on sourcing renewable energy.”