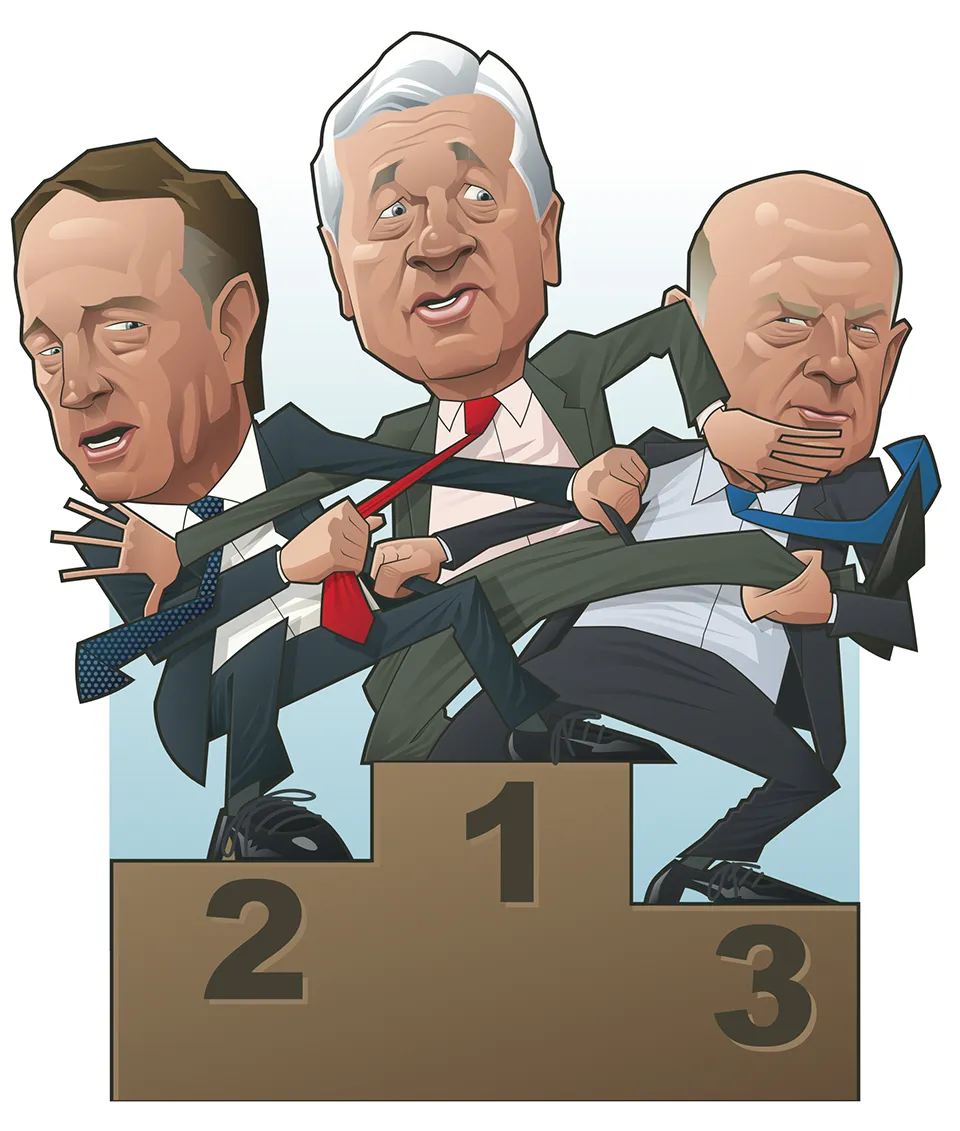

A three-way battle between Goldman Sachs, Morgan Stanley and JPMorgan for top spot in equities revenue in 2024 will come down to derivatives performance. Equity derivatives also offer European banks a chance to win back market share and boost staff morale.

Morgan Stanley chief executive Ted Pick gave his view of the key to investment banking performance on the firm’s second-quarter earnings call with analysts in July.

“It continues to be an equities world,” Pick said, as he talked up Morgan Stanley’s institutional securities group, which is more heavily weighted to equity revenues than its main rivals.

It is certainly turning out to be an equities year for big investment banks, as fixed income revenues for many firms fall or stall and fees from dealmaking recover more slowly than hoped.

Equity derivatives have driven the revenue boost for big banks.

Goldman Sachs noted that “significantly higher net revenues in derivatives” offset a fall in cash equity revenue and equity financing income in the second quarter, compared with the same period in 2023, for example.

This left Goldman as the leader in overall equity revenues in the first half of the year, with a total of $6.48 billion. That was 8% higher than in the first six months of 2023.

Morgan Stanley ranked second with $5.86 billion revenue in the first half, at a slightly higher growth rate of 11% compared with 2023, and JPMorgan was third with $5.65 billion of equities revenue and a rise of 10%.

VIX vapours

Both Morgan Stanley and JPMorgan outperformed Goldman in second quarter equity growth compared with the same period in 2023, with rises of 18% and 21% respectively, while Goldman was up only 7%.

That means that any mistakes – or smart navigation – during recent surges in equity option volatility could determine which bank takes the revenue top spot this year.

Monday, August 5, saw the biggest single-day jump in the VIX index of US equity volatility in its 31-year history. Global markets were suffering as the Nikkei index fell by more than 12% in the hours before US trading began, but a brief spike to 65 for the VIX was nevertheless a surprise.

The rise in the VIX was short-lived and by midday on August 5 trades were seen around 30, reflecting an increase in volatility but not evidence of sustained forced covering of short volatility exposure by investors or banks.

A consensus developed in the weeks after the spike in volatility that most large dealers had been running relatively balanced equity option books and should have been able to dodge losses.

Any mistakes – or smart navigation – during recent surges in equity option volatility could determine which bank takes the revenue top spot this year

Complaints from investors that banks had been offering unreasonably wide bid/offer spreads for equity derivatives trades during the market downturn also suggested that dealers were able to navigate their way through the turbulence by profiting from any forced covering by clients without losing their own money.

An intense burst of buying of VIX calls and S&P index puts before the US open on August 5 could nevertheless have come from a bank market-maker covering its own existing exposure, rather than an investor, and brought related losses.

And equity markets saw renewed volatility in early September when thin summer liquidity could no longer be blamed for price moves.

That will test the risk-management skills of equity derivatives dealers, while also offering the prospect of another period of revenue growth.

There are multiple equity derivatives products that can deliver revenue for banks as long as volatility markets do not become disorderly. Exchange-traded funds with some downside protection for investors are relatively straightforward for dealers to hedge.

Dispersion trades between equity indices and their single-stock components can be more complex for banks to manage, but there was limited evidence of forced unwinds of deals during the summer volatility jump.

Call spread purchases by corporates that issue convertible bonds have boosted bank revenues this year. US convertible issuance was well over $30 billion in the first half of the year and call spread volumes to hedge potential dilution for issuers approached similar levels.

Structured products

Equity structured product issuance to retail investors has also been brisk. This is giving a boost to the European banks that are still trying to compete with the big US dealers for derivatives market share and can improve morale among staff who may feel they now work in a second tier.

BNP Paribas saw a 57.5% increase in its second-quarter equities revenue compared with the same period in 2023, for the biggest percentage increase of any large dealer. The €1.14 billion equity and prime services total was also slightly more than BNPP’s fixed income revenue in the quarter, in an unusual twist for a bank that normally makes the bulk of its markets earnings from rates, FX, credit and other debt instruments.

SocGen, which historically had a reliance on equity derivatives revenues that was the opposite of BNPP’s fixed income bias, has also benefited from this year’s equities boom.

SocGen’s second-quarter equities revenue of €989 million was up by 24.4% compared with the same period in 2023, in an almost identical increase to the 24% rise seen by Barclays, another European bank that relies on derivatives for its equity market share.

The European banks that enjoyed strong percentage equity markets revenue growth in the second quarter are still well behind the big three US dealers for total income from stock and derivatives trading.

Goldman, JPMorgan and Morgan Stanley were all keen to stress that they generated $3 billion or more of equities revenue in the second quarter.

JPMorgan even took the slightly Trumpian, but entirely understandable, step of rounding its actual equity revenue total of $2.971 billion up to $3 billion in its earnings announcement.

Bank of America and Citi are also some way behind the equities big three. BofA had $1.9 billion of second-quarter equities revenue, for an increase of 20% from the year before, while Citi generated $1.5 billion in a 37% rise from the same quarter in 2023 that it said was “primarily driven by equity derivatives, which included a gain related to the Visa B exchange completed in the second quarter”.

The Visa B boost, which was also noted by Barclays in its accounts, was an example of how quirky tailored equity derivatives transactions – in this case hedges of Visa shares held by multiple banks that had been locked up since its 2008 IPO due to litigation exposure – can both boost dealer earnings and serve as a reminder that derivatives revenue sources are opaque.

Derivative promotion

A number of senior managers at banks that are trying to compete with the big three Wall Street dealers have a background in equity derivatives. Yann Gerardin, head of corporate and institutional banking at BNPP, launched an equity derivatives business for BNP and ran the same group after its merger with Paribas. Alexandre Fleury, co-head of global banking and investor solutions at SocGen, is an equity derivatives specialist. Rob Karofsky, president of UBS Americas and co-president of the bank’s global wealth management business, made his name as an equity derivatives trader at Morgan Stanley and Deutsche Bank.

And Fater Belbachir followed over a decade working in equity derivatives at JPMorgan by being appointed global head of equities at first Barclays and more recently Citi, which must be nice, guaranteed bonus work if you can get it.

These managers all understand the upside from equity derivatives trades and, in Karofsky’s case, the enormous potential gains from selling more derivatives-based investments to global wealth management clients.

Their own bosses and bank shareholders will have to hope they also avoid the unexpected pitfalls that intermittently plague derivatives markets.