James Malcolm, strategist at Deutsche Bank, warns investors have become dangerously familiar with US underperformance. Indeed, US stocks have lagged their peers for a decade and as interest rates were cut against a backdrop of falling inflation, leveraged carry trades and emerging market-bound investment flows surged.

There were, of course, hiccups, but even through the global financial crisis, the general pattern of a relatively weak US economy held.

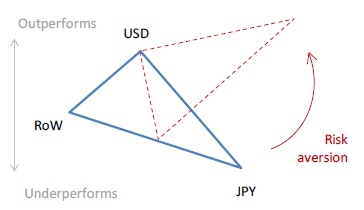

Malcolm strips the FX market down to its bare essentials: the dollar, yen and the rest of the world (RoW) – although he says the euro or the Australian dollar could easily be used as a proxy for the latter.

The dominant trend during the past decade was one of dollar weakness, while the RoW made the biggest gains but also experienced the sharpest sell-offs during spells of heightened risk aversion.

The yen, meanwhile, behaved in a very different manner. In good times, strong current account flows offset selling interest from investors eager to sell the low-yielding and structurally challenged currency to drive it modestly higher. In bad times, there was only the former, creating sharp appreciation pressure.

Malcolm says this was the secret of the yen, and one which caught out many “old-school” traders, who were used to much more volatility in USDJPY.

| Paradigm of the past decade |

|

| Source: Deutsche Bank, Bloomberg |

Developments this year suggest a radically new template for FX has emerged, with investors starting to view the US as the engine of global growth, much as they did between 1995 and 2001 before the dotcom crash, Enron scandal and the terrorist attacks on New York changed international perceptions.

The Australian dollar has underperformed, despite the Federal Reserve’s commitment to keep interest rates low for longer at its January meeting and a broad rally in risky assets.

Meanwhile, the euro has not managed to rally strongly despite the larger short position in the market and the recovery in eurozone peripheral debt. The yen has weakened steadily, helped by the Bank of Japan’s extension of its quantitative easing policy and adoption of a 1% inflation target.

| New paradigm? |

|

| Source: Deutsche Bank, Bloomberg |

“All this suggests that a resurgent US, stagnant Europe and slowing China, combined with stretched valuations and long-term positioning, could now favour dollar gains against the RoW regardless of the risk environment,” says Malcolm.

“The yen should take over as the ultimate high beta play. Parallels to the 1995 to 2001 era abound.”