A report from Nomura’s equity research team put out today is cautiously optimistic on Barclays’ Q1 earnings ahead of the official presentation on Thursday morning. Nomura reckons that with US earnings beating expectations then the trend could extend to Barclays, particularly in comparison to Barclays’ eurozone-based competitors.

|

"Relative to the EU-17 banks, we continue to prefer Barclays and with recent US IB results showing a better-than-expected trend, we would expect BarCap to be ahead of the Q1 11 run-rate. Nonetheless, we retain our Neutral rating on the name as we think additional upside will require a rerating of BarCap ROEs, which we see as difficult to achieve in an environment of low interest rate and sluggish growth. However, relative to other domestic UK banks we prefer Barclays, as we believe it is at least able to make profits and has arguably lower restructuring needs." |

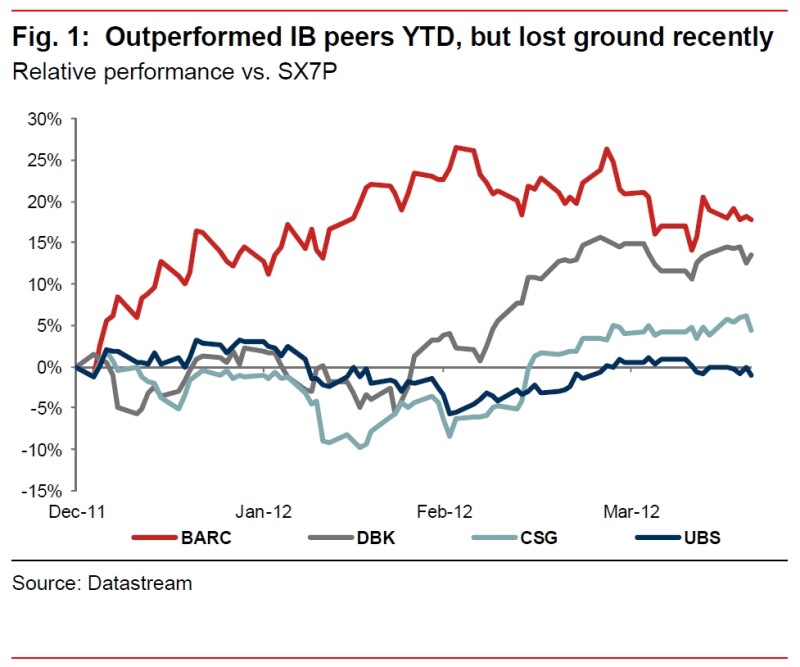

Barclays has certainly managed to outperform its competitors over the last few months – outperforming the sector by 18% YTD – but slipped a little over March.

Nomura think that Barclays can benefit from the even tougher conditions facing investment banks on the continent, and has fewer inherent risks than other UK banks – assuming that the problems in Europe don’t get even worse. Essentially, Barclays looks good if Europe is struggling, but not if its struggling too much.

| "However, we do think that Barclays will outperform the EU-17 banks on a relative basis, given the headwinds faced by continental European economies from austerity in a low growth and deleveraging environment. We see limited asset quality issues at Barclays, particularly relative to Lloyds and RBS, unless the eurozone breaks down." |

Nomura are expecting an improvement on 1Q11, and that this boost can be largely attributed to stronger performance at BarCap. Supporting this, they point out that the areas where US banks saw positive results are also those where BarCap derives a lot of its revenues.

|

“Strength in FICC was driven to a large extent by rates and currencies... The read-across of these results are positive for Barclays given a large portion of revenues come from FICC and within FICC from Rates. The mortgage area has been a strong performer as well according to the US IBs, which should be a positive driver at Barclays. Similarly the read-across on Prime Services and equity derivatives is positive.” |

This is all encouraging stuff for Barclays, but it does all seem rather dependent on the results neatly mirroring those we’ve already seen from the US. Nomura are qualifying their optimism for a reason.