Is it all China’s fault? The Fed’s? Febrile sentiment from the likes of Larry Fink? Argentina? Turkey? Or all of the above?

That’s the question on the lips of market players as EM valuations overshoot fundamentals amid a game of which bear can growl the loudest.

Here are two more ways of looking at the emerging-market rout.

The first is from Charles Gave and Louis Gave at Evergreen GaveKal, also picked up by Zerohedge,which touches on the theme of “our currency, your problem“. The analysts note that a prolonged period of dollar weakness is historically correlated with capital misallocation and painful current-account adjustment.

First, a weak dollar leads to a fall in the value of investments made outside of the US. Such investments would have been perfectly profitable but for dollar undervaluation; meanwhile, marginally profitable activities which should have disappeared in the US do not, lowering overall productivity as US “zombie” companies survive. The second effect is a huge “improvement” in the US trade balance, usually with a lag of roughly three years. Since 2006, the US current account deficit has narrowed by nearly 4 percentage points of US GDP—for countries on the other side of this “improvement,” this adjustment can be painful. The third effect is more complex. The dollar is the world’s reserve currency, which means the US is the only country in the world which has no foreign trade constraint. However, as we reviewed in our recent book (see Too Different For Comfort), this also means that the US current account deficit needs to grow if global trade is to expand. Indeed, if the US starts to export fewer dollars, then someone, somewhere will find he is unable to finance his trade. The US current account deficit is the monetary base of world trade and a reduction in the US current account deficit is thus equivalent to a massive monetary tightening for the rest of the world. It is for this last reason that we spend so much time monitoring the growth of central bank reserves held at the Fed; for as long as these are expanding, there are few reasons to fear a hiccup in the global trade architecture. However, as soon as central bank reserves start to shrink, then countries running large current account deficits and/or large budget deficits may find pushing more debt through the system challenging. Excluding China, reserves at the Fed are contracting in real terms.

As the dollar appreciates in value then a big adjustment is on the cards:

In the meantime, we are left to ponder whether the years of the Fed following “euthanasia of the rentier” and “beggar thy neighbor” policies are now coming home to roost? After all, it’s all well and good for the Fed to hope for an increase in US “net exports,” but if the end result is to trigger a collapse in global trade (a distinct risk now that the previously fast growing economies of Latin America, Turkey, Ukraine etc., are hitting the wall while China, Indonesia and India slowing down), then it will look as if the Fed will have sown the seeds for the emerging market growth slowdown. In other words: did the Fed just do to the faster growing, deficit-generating, emerging markets what the Bundesbank did to the rest of euroland.

Most research shops predict the great rotation – from EM to DM – is set to continue, suggesting appreciation pressures on the dollar, historically a harbinger of EM crises.

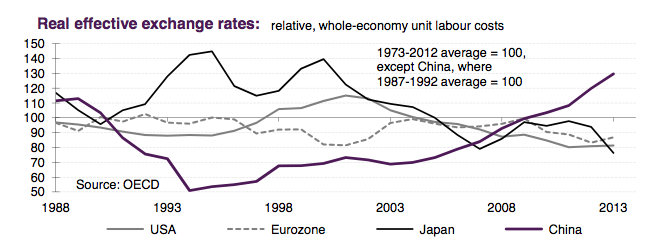

The flip-side, of course, is the apparent strength of the renminbi which Lombard Street Research reckons is, in fact, overvalued by 30% on a trade-weighted basis, citing, in part, rising unit labour costs and disinflationary pressures. The renminbi’s over-valuation, the shop argues, has helped to trigger a looming debt crisis, contributing to the EM rout.

|

| Source: Lombard Street Research |

Lombard analysts argue:

Long-run data for China’s relative unit labour costs (taking account of FX changes as well as relative domestic labour-cost inflation) are not reliable. But basing the index on the first post- Mao stable period, 1987-92, seems right. Its level was 108 in 2011, the year in which China’s producer prices suddenly slumped from 7% inflation into 2% deflation, which has persisted ever since and been more than fully reflected in export prices. Ie, China suddenly had to cut prices to be competitive. 2011 was the first year evidencing an overvalued yuan. Since then China’s relative unit labour costs are up another 20%. Whatever the “right rate” may be in the above chart, it is indisputable that real appreciation of a massive 77% has occurred since China left its fixed, 8.28 yuan/dollar rate in 2005 in favour of a crawling peg. Of this about half is in the trade-weighted exchange rate, the other half being excessive wage-cost inflation.

Overvalued China has squeezed profit margins – ongoing wage-cost inflation versus producer price deflation. And high interest rates, as state-owned bank loans still cost 6%, mean the real interest rate is a formidable 71⁄2-8% allowing for producer price deflation (more for users of the shadow banking system). The 48% investment rate would crash, and with it the economy, without government-mandated lending and investment by entities that should not be borrowing. So China’s ills express themselves in a soaring debt ratio.