The Standard Chartered Renminbi Globalization Index fell 1% in March on the back of disappointing FX turnover and CNH (offshore currency) deposits and the eighth straight monthly decline in dim sum bond issuance. Offshore renminbi deposits also struggled to grow, because of the persistent CNH discount against its onshore equivalent.

According to the Bank of America Merrill Lynch 2015 Asia Pacific treasury management barometer survey released on Thursday May 28, 35% of participating companies are using renminbi for cross-border trade (up from 16% in 2013) and 32% hold renminbi cash balances.

Ernie Preeg, senior adviser for international trade and finance at the Manufacturers Alliance for Productivity and Innovation, a membership organization for US-based manufacturing companies, reckons renminbi usage to finance trade outside Asia improved during 2014.

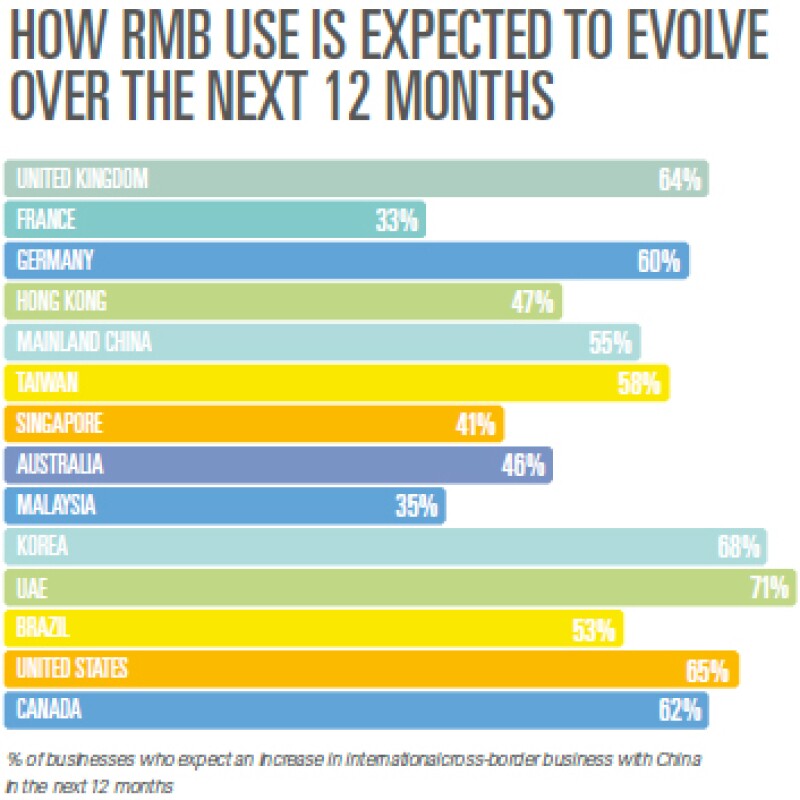

However, HSBC’s latest renminbi internationalization survey finds the currency's use for cross-border business with mainland China remains primarily driven by the Asia Pacific markets and that volumes are little changed from last year. Across non-Asian markets, usage is comparatively low, with the exception of the business banking segment in the UK.

Although over a quarter of non-users surveyed said they intended to start using the renminbi for cross-border business in the future, outside of Asia Pacific there was a slight weakening in intent across all markets apart from Germany.

|

Source: HSBC RMB internationalisation survey 2015 |

There are three main reasons why usage remains low, suggests Yang Du, head of the China desk at Thomson Reuters. “Trade currency drives renminbi usage and bilateral trades with China are not yet settled in renminbi outside Asia.Corporates are also reluctant to hold renminbi positions due to currency risk. Finally, there is the issue of local relationships. Chinese banks have clearing status in Europe but most do not yet have strong links with the buy-side community outside Asia.”

Linan Liu, managing director Greater China rates & FX strategist at Deutsche Bank, adds as reasons the amount of work required to update treasury infrastructure, limited investment opportunities and the uncertain convertibility timeframe.

Liu says: “Firstly, it takes time for corporations to consider switching to another settlement currency and making the necessary changes in their treasury management-related systems and policies. Secondly, the limited renminbi investment product suite available outside Asia and likely higher transaction costs of investing into Asia markets mean it may not be sufficiently attractive for corporates to grow renminbi cash pools. Thirdly, there are questions over renminbi convertibility timeline. Finally, there are concerns over a renminbi weakness against the US dollar.”

In 2014, 22% of Chinese goods trade was settled in renminbi (up from 18% in 2013) and HSBC believes that figure will increase to 30% by the end of this year. Vina Cheung, global head of renminbi internationalization for payments and cash management at HSBC, says this growth will be driven by the desire to reduce FX risk exposure and costs and the simplification of renminbi trade settlement documentation, which now compares favourably to the documentation required for settlement in US dollars.

Cheung accepts that awareness of renminbi trade settlement among non-Asian corporates is still not high enough, but she says this will improve as more multinationals such as Siemens and Samsung start to use the Chinese currency to settle trade directly with their domestic companies.

Around one-third of respondents to the HSBC survey suggested that the renminbi would become an international trading currency used for settling trade deals with no connection to China within the next five years.

“When companies are managing a significant renminbi position in their currency portfolios in offshore markets, it would be a natural progression to use the currency to settle trades that have no connection to China,” adds Cheung.

Liu also believes that when the issues she highlighted are resolved, the renminbi could become a global currency for trading, settling, investments and reserve management for any transaction directly or indirectly linked to China, or indeed with no connection to China at all.

However, Du is not convinced that the renminbi will ever be widely used for settling trade deals with no connection to China since the offshore market does not offer enough liquidity outside of Hong Kong.

“With the Chinese international payment system to be launched by the end of this year, onshore liquidity will be a huge benefit for the corporates who are settling in renminbi,” Du concludes. “The current clearing banks will be allowed direct access to the Chinese interbank market via their headquarters, which will gradually bring CNY and CNH back to one single currency as the renminbi.”