The role of high-frequency traders in financial markets and their relationships with traditional banks in frequently traded markets became a big talking point in 2015, particularly in foreign exchange.

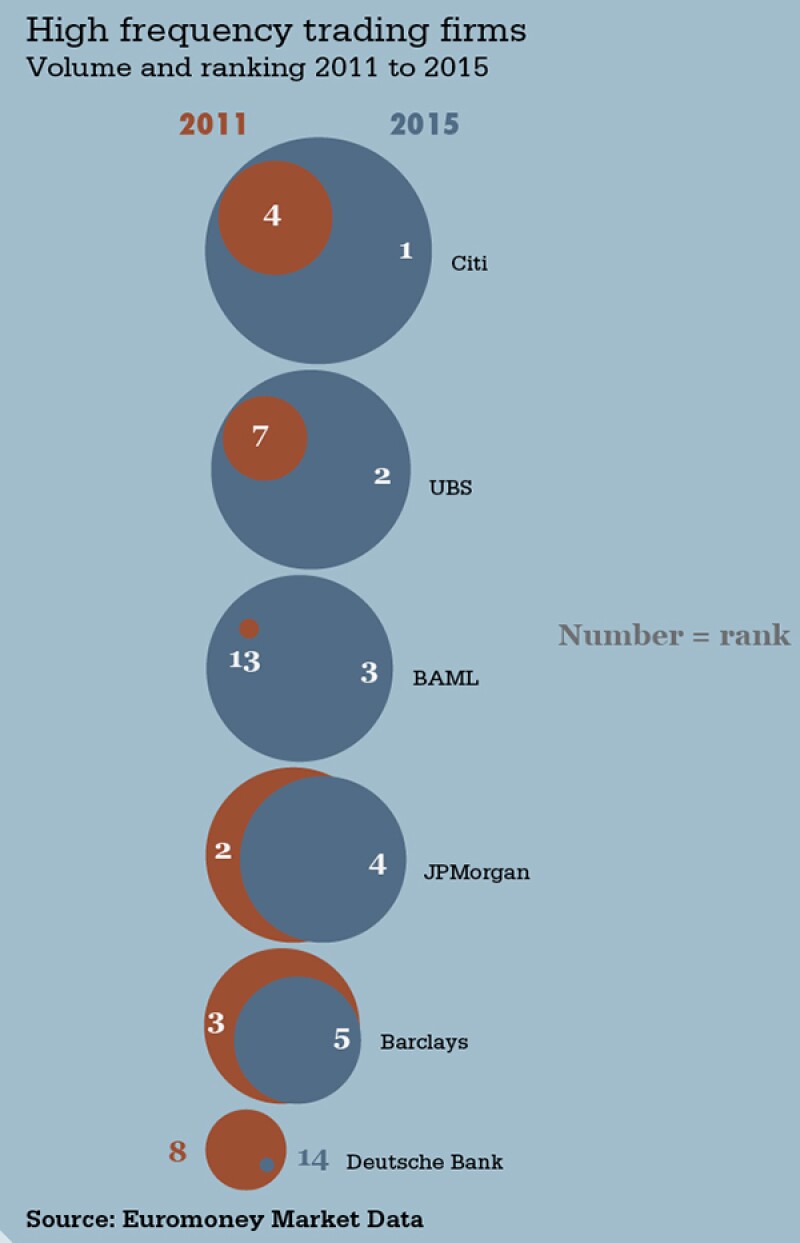

Banks’ uncertain relationships with HFTs could immediately be seen in the chart below, published in the June issue of Euromoney as part of our annual FX survey. This shows the volume and market share rankings of the leading banks among this client group. The HFT sector appeared to be getting more competitive. Leader Citi’s market share fell from a high of 33% in 2014 to 18.7% last year, with UBS hot on its heels. The biggest riser was Bank of America Merrill Lynch, whose share of the HFT market grew from less than 1% in 2012 to more than 15% in 2015.

Dealing with HFTs divides opinions and strategies in FX. It is a client group driven purely by price and therefore provides little in the way of profit. Others see it as simply outsourcing liquidity to other providers – although whether HFTs actually provide liquidity or simply match back-to-back trades, is another contentious issue that Euromoney wrote about in 2015. Deutsche Bank, for one, has largely withdrawn from trading with HFTs, as the data show.

This year’s talking point is likely to be the evolution of some HFTs to become market-makers in their own right. Leading the way in this is XTX Markets, as revealed in the December cover story of Euromoney. As former head of FX at Deutsche, Kevin Rodgers, wrote for us in June as the FX survey results were published: “We should expect non-bank liquidity providers to become more important in spot FX. Electronic provision has become an almost purely technological battleground, and non-bank outfits have the strong advantage of specialization.”