Has Martin Taylor lost his nerve? That's the question asked by those who have seen him recently say one thing then do the opposite.

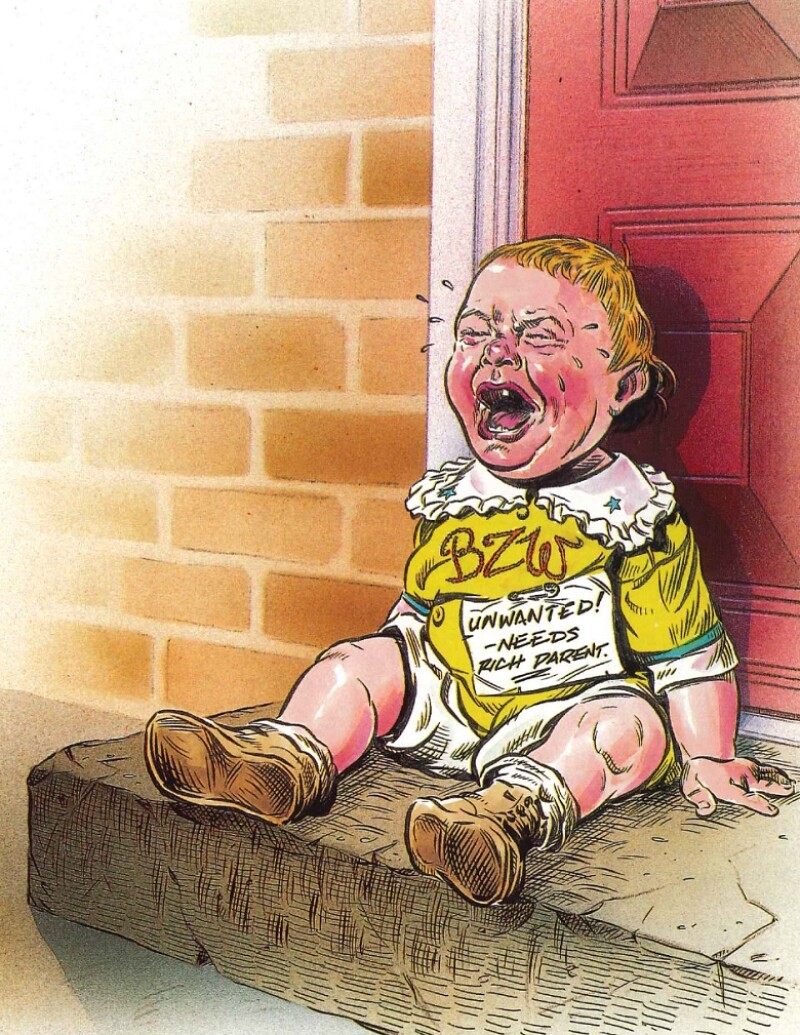

Taylor sailed into banking from the textile industry in 1994 when Barclays' board hired him to run what was fast becoming a full-service universal bank. Taylor kept his foot on the accelerator, apparently prepared to pay what it takes to compete with the likes of JP Morgan and SBC Warburg. But with his foot still on the gas pedal, we now discover, Taylor was talking as early as November 1996 about selling the whole of BZW, including debt securities, which he's now decided to keep.

Was this the reaction of a far-sighted man to an increasingly expensive adventure into investment banking where prices have clearly gone bananas? Or did he fear cultural colonization and the eventual eclipse of Barclays and his own career, by any US entity he chose to merge with? Or, most human of all, did he lose faith in Bill Harrison, the man he'd chosen to revive BZW? The following narrative may provide some clues.