Banks say virtual accounts can improve corporate cash management, giving a much clearer view of company accounts and helping treasury play a more strategic role within organisations. But corporate treasurers themselves may be confused about the benefits they offer, and may also have more important matters on their minds.

Keeping track of a company's money has never been easy. There is one account for the foreign subsidiary denominated in euros, and another for a separate entity in a second jurisdiction in sterling. Then there are the dollar accounts for travel and expenses in one place, separate from the account handling procurement. The treasurer can see all the accounts individually, but how to get a sense of the overall position?

The answer to this question, say banks, is virtual accounts. Virtual accounts allow companies to consolidate thousands of segregated virtual accounts into one physical account. They provide all the benefits of separate accounts, with the transparency, efficiency and convenience of having them aggregated into one.

|

| Stephen Baseby, Association of Corporate Treasurers |

It sounds like a no-brainer. But Stephen Baseby, associate policy and technical director at the Association of Corporate Treasurers, says that in their eagerness to appear innovative, banks have failed to communicate adequately the benefits of virtual accounts.

“[The virtual account] has the potential to be a good idea but it is being poorly communicated. The bank offerings all look quite different and the benefits are not clear. The cost of operating bank accounts has become a huge issue for treasurers and they are certainly keen to cut the number of accounts they use, but in most of the literature banks have put out it is not clear whether each virtual IBAN has an additional cost.”“Banks want to offer a new product, to draw attention to themselves in the age of fintech to remind people they do develop useful products, too,” Baseby says.

Shadow threat

“Open banking means an independent party could identify a gap in the services being offered by banks and enter that space, potentially disintermediating them. Banks can see that risk and so have upped their game,” he says.

Banks argue treasurers want more real-time visibility of their accounts to allow them to make better decisions. They point out there are strong commercial incentives for companies to exert greater control over receivables.

Mark Evans, director of payments advisory at HSBC, says: “Clients are increasingly demanding services that help them manage their cash more efficiently. New virtual account solutions, such as the one HSBC is bringing to market later this year, allow clients to 'virtually' manage multiple account positions from a single operating account, providing greater control and flexibility, and allowing clients to self-fund from the aggregate balance across all virtual accounts.”

|

| Mark Evans, HSBC |

Evans adds: “Regulatory policies such as Basel III have made it more expensive for banks to offer pooling arrangements, a problem that virtual accounts solve with the creation of a single net position. Regulatory, client and technology trends have come together perfectly to reduce the headache of managing payments and receivables for treasurers.”

Technological progress

|

| Ad van der Poel, BAML |

Ad van der Poel, head of core cash management for GTS EMEA at Bank of America Merrill Lynch, says: “Five years ago one of the biggest concerns for treasurers was payments centralisation. They have made a lot of progress in that area, and in the last year or two they have moved on to think more about centralisation on the receivables side, in processing, reconciliation and receivables financing. That used to be seen as too difficult, too local, but digitisation and regulations like SEPA [Single Euro Payments Area] have changed all that. The market has matured.”

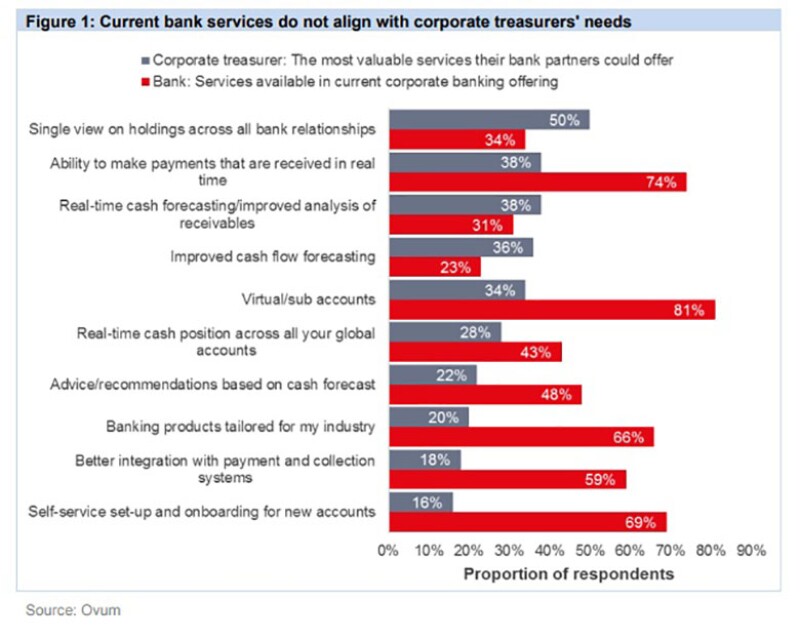

There is evidence to support this assertion. According to a recent study by Ovum and commissioned by Cashfac, half of corporate treasurers want a single view of holdings across all bank relationships, putting it at the top of the corporate wish list. But only a third of banks offer it.

Baseby is not convinced this paints an accurate picture. “I think the expectation that treasurers have been calling for the ability to manage all their accounts through the bank portal, and virtual accounts are evidence of banks responding to that demand, may be overplayed,” he says. “A lot of these companies have invested in sophisticated ERP [enterprise resource planning] systems that may have already solved this problem, in particular where they operate shared service entities to manage group cash flow.”

The bank response to this is that virtual accounts do not compete with ERP solutions. The two do different things, and provide most value to clients when working together, they say.

For example, ERP systems provide client-specific references, while virtual account references can be market recognisable, eliminating the need for reference information. And unlike ERP systems, virtual accounts can seamlessly integrate with other bank products, such as intelligent receivables, trade, card, liquidity and FX services.

Still evolving

|

| Tim Martin, Cashfac |

“If you asked 10 different banks what virtual accounts are you would probably get 10 different answers. Many banks offer some virtual account capabilities, such as offering real-time visibility on incoming payments with IBAN or a self-service account capability, but few offer them all. A lot of corporates are still not getting the service they need,” says Martin.

Baseby believes this is because some banks really see virtual accounts as a way to make customers send more precise data with their payments, by substituting the customer IBAN with a virtual IBAN.

“As one example, when customers make a bulk payment for large number of invoices or supplier accounts, they may not forget to include the payment reference, they leave it out because it no longer applies,” says Baseby. “I don't see how [virtual accounts] would change that behaviour. By default, I expect they will continue to use the generic IBAN.”

Ultimately, Baseby says, treasurers may have too much else on their minds to devote much time to thinking about virtual accounts. “Treasurers have a lot of problems to deal with right now, whether that is complying with new regulations following the financial crisis or preparing for seemingly limitless potential Brexit scenarios. This will not be a high priority to consider until these issues are settled,” he says.

But Meenen sees virtual accounts as part of a bigger picture – one that treasurers are interested in. “At the moment, corporate treasury generally is concerned with evolving its function from being an operational function within the business to becoming a more strategic element of the business,” he says. By having a better view of the company's overall financial position, treasurers can play a more strategic role within their businesses.

For that to happen, however, banks will need to ensure clients fully understand the benefits of virtual accounts, and that they are worth devoting time to, in the face of all the competition from other things vying for treasurers' attention.

Martin believes this is already happening. “Understanding of virtual accounts has come a long way. A year ago, people were asking me what they were, now they are telling me exactly how they want the service configured for their business,” he says.

The next stage of maturity will see the business start to standardise, adds Martin. “As the industry matures we will continue to see differences in bank service in virtual accounts, as they cater to different sizes and sectors of corporates, but there will be an emerging consensus in their understanding of what virtual accounts actually are,” he says.