[Read part 1 of our analysis here for coverage of group and CIB results. Part 3 tomorrow will cover FICC and Equities.]

2Q18 table 9DCM

Biggest rise: Morgan Stanley (7%)

Biggest fall: Citi (-20%)

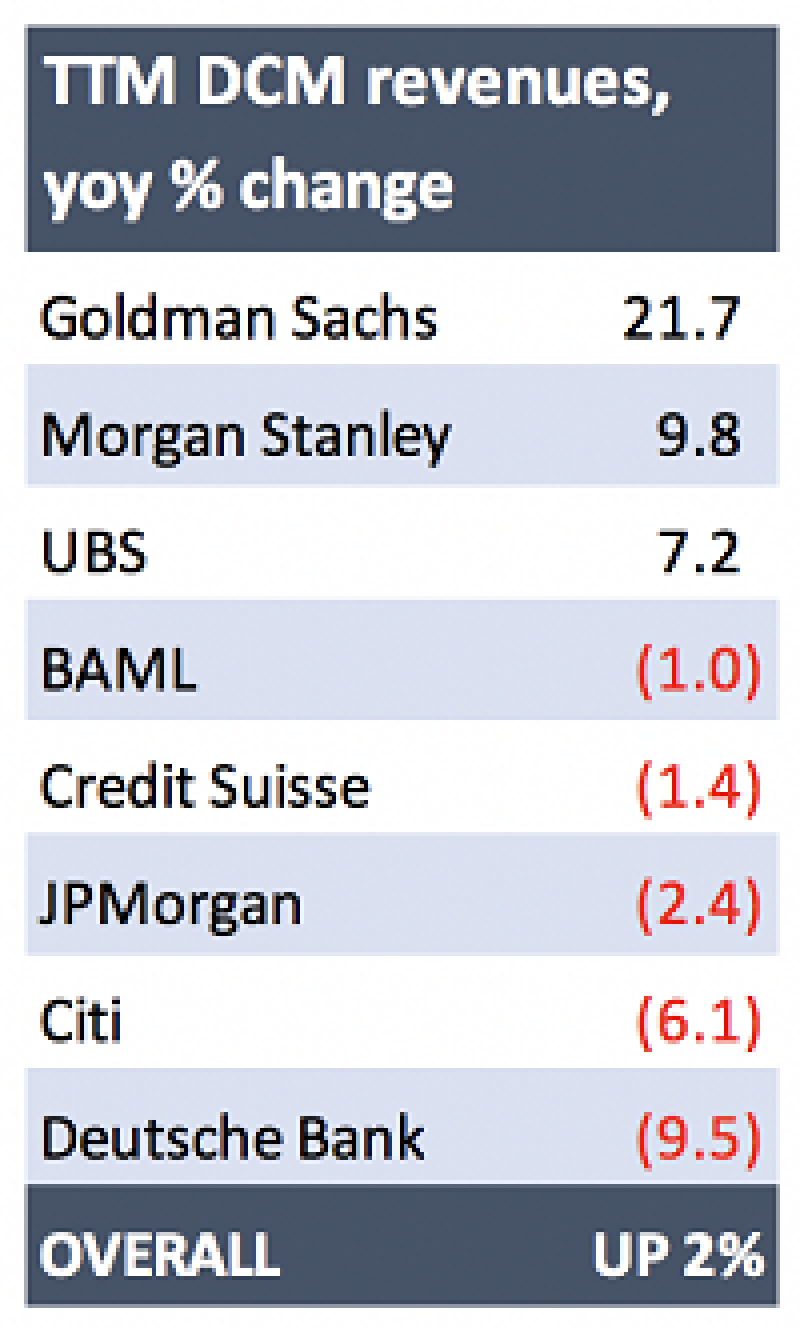

TTM: UP 2%

Biggest rise: Goldman Sachs (22%)

Biggest fall: Deutsche Bank (-10%)

The first of our investment banking business lines, and so the first to be based on a smaller universe. Only the US banks, the two Swiss and Deutsche Bank break out their IB numbers into DCM, ECM and Advisory, so the data here are based on these eight.

The aggregate 2Q18 number is down 4% to $4.9 billion, marking another fairly static quarter for a business that has been at a similar level almost every quarter since 2Q16. For comparison, Dealogic shows global DCM volumes down 1.3% for the quarter compared to the previous year. Most of the firms’ trailing-12-month (TTM) numbers are either at or below their FY17 results, with one exception: Goldman Sachs is building this business energetically and has posted a strong couple of quarters this year.