The Financial Conduct Authority just can't quite seem to be the nasty cop, even when it has every justification. It’s always fun to return to the topic of Suspicious Transaction and Order Reports, or Stors. And sure enough, the FCA has just published an update that lets us peer into its most recent thinking.

As usual it pulls its punches – at least in the language of its public comments – despite clearly finding aggravating examples of incompetence.

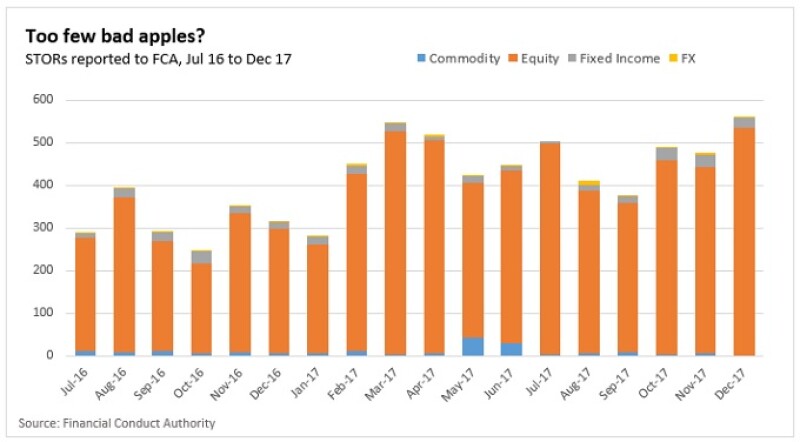

A quick reminder: Stors, which come under the UK's Market Abuse Regulation (MAR), cover the areas of commodities, fixed income, equity and FX, and fall into two buckets: market manipulation and insider dealing. Since the system was introduced in the middle of 2016, almost all Stors have related to equity transactions.

The FCA has said in the past that firms could get much better at reporting Stors in areas other than equity, and particularly fixed income. It's a point that FCA director of market oversight Julia Hoggett has made on more than one occasion.