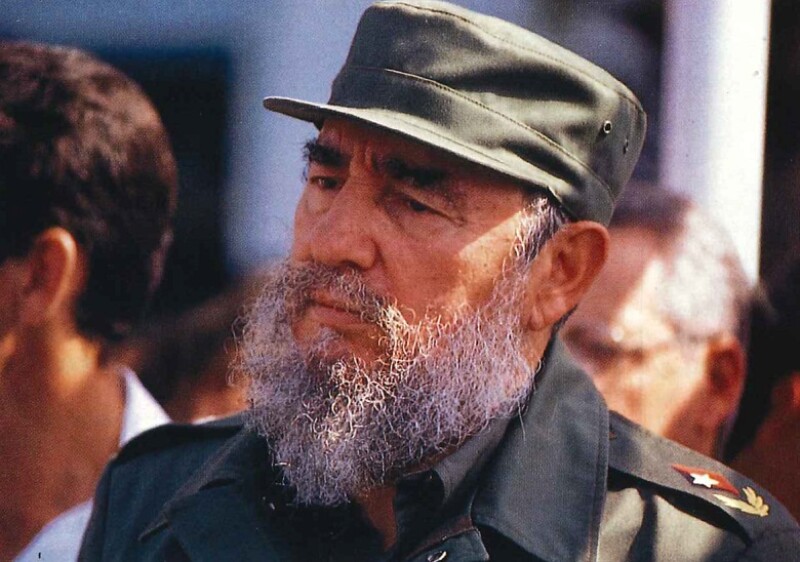

For an ageing dictator, Fidel Castro is not at all what you would expect. He is friendly and softly spoken. He talks with no hint of the wild, ranting tone he uses at mass rallies. At 65, he appears in good shape and is clearly still intellectually vigorous. Although his beard is grey and straggly, his eyes still burn with energy as he talks.

He is surprisingly well-informed: he is well aware of who Ross Perot is, for example. Only his statement that it is extraordinary Americans "do not even know who the president of the US might be [in December]" betrays a lack of understanding.

Castro is facing the greatest challenge of his long career. The Cuban economy is in a mess. Imports have fallen from $8 billion to $4 billion in two years, during which time the economy has shrunk by 35%. Imports of oil, in particular, will have dropped from 13 million tons in 1989 to probably only 6 million this year. The causes of this slump are the fall in trade with the Soviet Union (which represented 70% of Cuba's trade in 1989) and the insistence by the Russians that they pay (low) world prices for Cuba's sugar and charge world prices for their exports of oil.

As a result, the economy is on the brink of disaster. Food is rationed – each person is reportedly entitled to only 80 grams of bread a day. The visitor driving from Havana Airport into town passes parking lots where hundreds of taxis have been lifted up onto blocks – they have no petrol to run on, and the tyres have been taken off for use elsewhere. Castro's response to the fuel crisis has been to agree a deal with China for the mass-importation of bicycles.

On the surface at least, there is little sign of discontent. In Havana, the population looks healthy and well-dressed. Even critics admit that Cuba's health and education systems are among the best in Latin America – although they may begin to deteriorate without Soviet subsidies. Havana, despite the prevalence of half-finished buildings typical of Communist economies, looks far more well-to-do than neighbouring countries such as Jamaica.

But foreign residents of Havana report a growing willingness among the population to criticise the government openly. There are rumours, too, that the army is increasingly disgruntled with Castro's economic policies and may step in.

Castro has responded by putting all hopes for resuscitating the economy on the encouragement of foreign investment. He has reactivated a joint venture law, first passed in 1982, which guarantees repatriation of profits and even allows majority foreign ownership in certain cases. And, as Castro rightly points out, Cuba does have considerable attraction for companies specialising in tourism, oil and some high-tech industries such as bio-technology. At a conference held in Havana on June 10, arranged by Euromoney, 125 potential foreign investors heard that further reforms – such as the establishment of a free-trade zone – are on the cards.

But Castro faces an uphill task. Some investors with experience of Cuba complain of inefficient bureaucracy, and a handful of the joint ventures have already ended in tears. And, with no sign of an exsing of Communist controls in the country and the American trade embargo tightening, the US market remains closed.

Euromoney: Now that most of the communist countries in the world have gone capitalist, is it possible for Cuba to survive without moving towards a market economy?

Fidel Castro: The failure of socialism in eastern Europe and the USSR has led people to talk about the failure of socialism as a system under any circumstances. I don't share that opinion. What happened in eastern Europe was the result of errors committed by the people who managed those economies and because socialism was destroyed from within as a result of a huge international conspiracy.

"Where investors want to repatriate profit it's automatic and immediate"

Cuba reached socialism as the logical result of the battle for national independence – a fight which was caused by the contradictions and backwardness that capitalism produced in the country. This, to a large extent, explains why Cuba has not succumbed almost three years after the collapse of socialism in eastern Europe.

I want to make one important fact absolutely clear. I believe it is a big error to try to perfect socialism by thinking it can develop on the basis of a market economy. For us, socialism cannot question the preeminence of social property over private property or of the need for planning over the market.

EM: But how far are you prepared to go, within the framework of socialism, to introduce reforms? China, for example, has been very successful in encouraging foreign investment.

FC: Yes, but China is not facing the problems we are. China does not have to face an economic blockade. It is also overwhelmingly a country of peasants. However, we have studied the Chinese experience to look at everything that could be applicable to the conditions of our country, without giving up socialism or the planned development of our economy. We are willing to be pragmatic in order to find solutions to the problem of development.

Any system, capitalist or socialist, needs to develop. But the best chance of doing that is to use resources in an optimum and planned way. That is the advantage which, in my view, socialism has. But we are willing to take any measures which may contribute to the economic and social development of the country. Of course that's a new field to us. Not absolutely new, in the sense that legislation on foreign investment and joint ventures was passed over ten years ago – a long time before all our current problems emerged.

EM: Will you allow more private ownership of property or of enterprises, or is that a fundamental tenet of socialism which you couldn't allow to go?

FC: The right circumstances do not exist for us to approach that issue now. Due to the US trade blockade, we have been forced to run a very strict and rationed economy in order to bring about an even distribution of whatever resources we have. We have been forced to use with very great care every single cent. We are like Britain was in the days of World War Two when it had to manage everything very carefully: raw materials, resources – every penny had to be managed.

Our social and economic development does not depend on [allowing private property] really. Our development, rather, lies in investing in those branches of the economy that would allow us to improve our situation in terms of hard currency and to purchase the equipment and raw materials that the country needs for development. We need capital, technology and markets. Those will not be provided by domestic private initiative. So for the time being. we are not thinking in those terms. We would rather be opening towards the outside and towards foreign investment which could contribute capital, technology or markets.

"We think the country's liquidity crisis is temporary"

EM: So many other countries are trying to encourage foreign investment, why should investors look at Cuba?

FC: Because other countries do not have better conditions than we offer. For instance, we're ahead in areas like tourism. Last year 380,000 tourists came here. By 1995, we will be able to receive one million. We enjoy natural resources which can be exploited in an orderly fashion without polluting the environment, without destroying the beaches as has happened in many other countries. Cuba is offering virgin resources. Other areas such as oil drilling are of interest to investors. There is great competition, you are right, but there is also great competition among investors to invest here in these businesses.

As far as tourism is concerned no other country can offer the advantages we offer: tax exemption for a long period of time; the possibility of recovering capital in two or three years; automatic repatriation of profits without complicated red tape; tax exemption for equipment that has to be brought in and for inputs connected with the maintenance and operation of the hotels; a very skilled labour force; a healthy country, without drugs, with a minimum of delinquency, adequate sanitation – among the best in Third World countries, and very few cases of Aids. In the tourist field we have awakened the interest of many people.

EM: How can you guarantee that foreign investors will be able to repatriate profits when you have shortages of hard currency?

FC: You know why? Because the same funds which are obtained from the operation are used for repatriation. They do not have to go through the complicated mechanism of our banking system. There are no restrictions whatsoever: where investors want to repatriate profits it's automatic and immediate. No other country has that.

EM: Your foreign investment law says foreign majority ownership or joint ventures might be possible "in some circumstances". In what circumstances?

FC: For example, in the ease of a specific technology which isn't available to us, or a product we have to import for hard currency. It could be more economical for the country to have it produced here. Another case might be when a Cuban raw material is being processed abroad, and an investor would like to come and process it here. These are just two examples but we are open to all possibilities. There is no dogma, we are being flexible. Of course, it would always have to be viewed in the light of what is in the national interest.

However, it doesn't mean that all of a sudden we are going to set up capitalism here or that we are going to apply a neopolicy. But we may offer to the foreign investor all the guarantees and all the facilities that the best country to invest in could provide, although this does not necessarily mean that we are going to implement a neo-liberal economy.

EM: But isn't it true that market economies have been more successful than planned ones?

FC: Over a 100 Third World nations have open market economies, but their social and economic situation is awful, it's dreadful. Capitalism has been successful in a number of developed nations, but for the rest of the world, it is no real model. Third World nations need several things: planning to set priorities and for the rational use of resources; efficient management of these resources; and an honest administration. One of the advantages of this country is the honesty of our ministers and our officials; they will not ask for a commission or a pay-off. The Third World needs a dose of this honest management.

In the conditions of neo-liberalism, there is no possibility for these countries to develop, because they are forced to play by the same rules as the big economic powers. The big powers are too powerful, their currencies are strong, their reserves are very great, their resources are enormous. Third World countries have very scarce resources and weak currencies, which means that capital escapes from the country. Here we don't experience any flight of capital. Money goes into private accounts and every penny is invested in meeting the economic and social needs of our people – even in times as hard as the present, when we have lost over 50% of our imports and when we have lost the pillars on which our foreign trade was being conducted: 85% was with the socialist camp. We are receiving less than half the fuel we used to. But the country is still working, and we don't have people jobless and abandoned.

|

| Havana's beauty and tranquility masks a country under siege. Any hope of survival depends largely on enticing back the foreign capital that was kicked out following the revolution in 1959. |

EM: In many successful developing countries, in South-East Asia or South Korea, for example, the state has indeed played a strong role in allocating resources. But these countries also allowed their people to run their own businesses, to own their own land. Could you not liberalise to allow more entrepreneurialism?

FC: I find it very difficult to think that those conditions could be repeated. Countries like South Korea and Taiwan had lots of foreign investment, a very cheap labour force, and very strong social discipline the use of force in other words, repression against strikes. Every day you see police in the streets there. Chile has also made progress with foreign investments and has a very repressive policy. But if you want to have a non-repressive policy, a policy of respect for the interests and the rights of the workers, and at the same time a neo-liberal policy, it doesn't work.

Also, those are countries with certain national traits: people are very industrious, very disciplined and dedicated to their work. For instance, you have to compare South Korea to Puerto Rico. Puerto Rico is a social disaster. All the industries are polluting, the population survives on welfare, on US welfare, unemployment is 30% or 40%. It is really a traumatic situation. With the same policies they do not obtain the same results. Asian countries have a tradition of work which does not exist in the tropics.

EM: Your economy shrunk about 25% last year. When is that decline going to stop?

FC: We are going through the most difficult part now. The blow was very hard. It could have annihilated this country. But, because we are united and organised, it didn't. In this country we have a consensus, we have the majority support of the people. I think we are at the hardest point and some production is already starting to show signs of recovery — oil, nickel, certain food stocks. Transportation has suffered a great deal, but we are replacing traditional transportation with bicycles imported from China.

EM: You are trying to encourage foreign investment, but isn't it difficult for a foreign company to operate efficiently with those shortages?

FC: Oil for all activities related to foreign investors is separated from the rest of the oil we need for our industry and for transportation. As this is not a free market economy, we can avoid the factors that are affecting the national economy from upsetting foreign investment.

EM: How much will the state interfere in the running of joint ventures?

FC: They have a lot of autonomy. We rather prefer the management to be provided by the foreign investors, who are supposed to have more experience than we do in that field. There are certain areas in which we have both experience and capital, for example in managing hospitals, sugar mills, agriculture, fishing production, construction. But a foreign investor would, of course, have more experience managing a hotel or managing foreign trade, or the marketing of a product. In every field in which our partners from abroad have greater experience, we prefer them to manage.

|

Castro's interview with Euromoney editor |

FC: We have very broad workers' legislation which guarantees the efficiency and discipline of the workers in joint ventures. These joint ventures have a special regime of work, with very different standards and stricter discipline. The workers also have advantages: they have better salaries. The investors don't have to deal with the labour force, because the Cuban side takes responsibility for it.

EM: There have been reports of a number of joint ventures which have gone wrong. For example, one construction company pulled out of building a new hotel in Havana.

FC: That wasn't what happened. The construction company was really inefficient. It was not discharging its obligations and construction was falling behind schedule. It was wasting money in the construction. We told them: "We prefer to return your money and we'll do it ourselves", and that's what we're doing. Not every capitalist enterprise is a non plus ultra of efficiency. Every year thousands of those enterprises go broke. And in this case we prevented this enterprise from filing for bankruptcy. They were throwing money away.

EM: Do you plan any changes to currency regulations and to the peso's exchange rate?

FC: Regulations on foreign currency control are already as flexible as possible for joint ventures. Repatriation of profits is allowed in freely-convertible currencies. If the foreign partner decides to close the business it is also liquidated in foreign exchange. Also, as part of our domestic economic policy, we have agreed that some companies should move towards a system of selffinancing in convertible currency. This has already taken place in basic industries and steel engineering, as well as in the biotechnology and fishing industries.

We are also studying the peso's exchange rate vis-a-vis other currencies, in order to adjust it to the new realities that the country has to face.

But we are not contemplating mechanisms that would lead to the Cuban peso being quoted freely on the foreign exchange market. We want to move gradually to an exchange rate that gives us a better measure of what foreign currency costs the country incurs. These changes are a part of the necessary reordering of our foreign trade system. We are contemplating – among other measures – authorising companies, not just joint ventures, to import and export directly.

EM: Will you reform the domestic banking and financial system?

FC: The current Cuban financial and banking system was designed in conditions very different from those today. We began introducing changes in 1980 to eliminate elements that proved to be unworkable in our case, usually because they were copied from other countries' experiences.

But this process was stalled by the new circumstances that led to the emergency economic programme that has been in place since 1990. In our opinion, monetarist austerity programmes will not solve the problems of Third World economies. Basic economic problems are solved in the area of production and the monetary-finance sphere should respond to production's needs, not the other way around.

So you will understand that, although we have not forgotten the need to reform our financial and banking sector, under the present circumstances it does not constitute the number-one priority.

But, once economic circumstances permit, we want to take the necessary measures to solve the country's internal financial imbalance: the excess of cash held by the population and the budget deficit. Among the changes that we might undertake at the right moment is price reform, so that we can understand and control economic activity more efficiently, and also enable better distribution of resources and pay for the workers.

EM: Do you want to attract foreign banks to Cuba?

FC: We are prepared to study whether to let foreign financial institutions set up in Cuba. Logic suggests that the level of activity of joint ventures would make this convenient. We will take any decision in this area with a constructive outlook and once we have got concrete offers – but only as long as it is good for the country.

EM: You owe almost $7 billion in foreign debt, which isn't being serviced. How do you propose to solve this problem?

FC: There is a great degree of ignorance in the rest of the world about our foreign debt policy. In 1985 we reached the conclusion that the debt was unpayable if creditors insisted on traditional servicing methods. We suggested that all debtor countries get together to increase their negotiating strength.

That unity of action was not achieved, but it has since been recognised in various ways that the debt is unpayable. Methods for partial cancellation of debt have been worked out in cases such as Poland and Egypt. Each country was left to its own fate. Cuba has asked for the same, nondiscriminatory treatment in the processes of renegotiation. We have asked for new credits as well as a sensible timeframe to fulfil our commitments. But we won't accept interference in our internal economic policies that we regard as damaging to national sovereignty. It has not been possible to reach agreement with the official creditors in the Paris Club since 1986, and since then we have had to suspend the service payments on our debt.

Nonetheless, we think the country's liquidity crisis is temporary and, despite our current difficulties, we are sure that we will be able to find reasonable formulas with those creditors who act in good faith and don't try to impose political conditions on the negotiations.

EM: What repercussions has the debt problem had for your trade relations?

FC: Naturally, the debt has been an obstacle to the normal development of our commercial relations. We recognise that encouraging trade requires finding solutions to the debt contracted by Cuba, especially with certain Latin American countries and with other lenders who have shown a willingness to find solutions that are acceptable to all parties.

EM: Have you considered debt-for-equity swaps?

FC: We have looked at flexible forms of repayment including payment in kind and discounting part of the value of our exports to service debt. And we have analysed the possibility of debt depreciation by combining its payment with the participation of creditors in joint-venture projects. In such a case, the debt-servicing payment would be discounted by giving a stake of equivalent value to the foreign partner in the project – as long as this also included a certain amount of net cash investment by the creditor. Such possibilities are analysed on a case-by-case basis.

This has met with a good reception among our commercial lenders. We have already reached some agreements and others are being studied with a good chance of reaching mutually beneficial agreements.

Given the flexibility that the Cuban government is showing and the level of acceptance that we have found among a group of our main creditors, we are sure we can quickly find solutions to our commercial debt problem. Without doubt this will have a positive influence on the process of renegotiating with the Paris Club.

EM: How much does the US trade embargo affect Cuba?

FC: The economic blockade is an aggressive, illegal and arbitrary measure against Cuba which the US government has been applying for over 30 years. It is calculated that the blockade has cost Cuba a total of $30 billion in all, in other words over four times our convertible currency debt.

But the blockade has not been able, in all this time, to achieve its objective of suffocating Cuba's economy. It is also an anachronism because, after the disappearance of the USSR and the end of the Cold War, this small country can no longer be accused of being the satellite of an enemy power.

It is also damaging for North American businessmen because as Cuba redirects its foreign trade towards the world market and opens up the chance of partnerships with foreign capital, they are excluded and lose business opportunities. North American academics calculate that the US currently loses the chance of selling between $1.3 billion and $2 billion of goods a year because of its exclusion from the Cuban market.

We have often expressed our readiness to establish normal economic relations with the US and make the most out of the mutual advantages derived from being close geographically. But it is up to the American government to decide how long it is going to continue blockading its own companies and businessmen, and also creating friction with the governments of other countries by trying to pressure them into incorporating US subsidiaries into the blockade.

The American government has even tried to block commercial operations between Cuba and firms such as Germany's Siemens and Pharmacia of Sweden, Toshiba and Nikon of Japan, France's COR and Medix of Argentina, despite the fact that these companies are not under the jurisdiction of the US.

EM: Do you see any chance of the embargo being dropped?

FC: In the short-term, I don't think that could happen. It's better to be prepared for it to take a long time and to adopt the necessary measures to meet the difficulties it will cause. But I think it's a matter of time.

EM: How long?

FC: Not even the Americans themselves know. Americans do not know now who is going to win the next election. They have three candidates and the man in first place in the polls has not even registered as a candidate. If they do not even know who the president of the US might be, I cannot know when the blockade will be lifted.

EM: That's called democracy...

FC: Now you see what happened in Los Angeles. Nobody would have thought that anything like that could happen. The American troops that invaded Panama and Grenada had to invade LA to bring the city back to order. So unexpected things happen, strange things happen in this world. The United States today holds a position of hegemony both politically and militarily, but economically it is weak. It is not in a position to compete with the big economic powers which have emerged. It has a $400 billion deficit.

The US is looking for money. It is a competitor with the Third World countries for resources. Before, the situation was very difficult for the Third World. The Soviet Union and the socialist countries had not yet become clients of the international lending institutions. Now the Third World nations looking for money in the market have to compete with the former socialist countries and with the US, so it is not easy to get money.

Instead of all that, there are people who are interested in coming and doing business with us, because here we have peace which you don't find in abundance elsewhere. Where is it better to invest: in LA or in Havana?