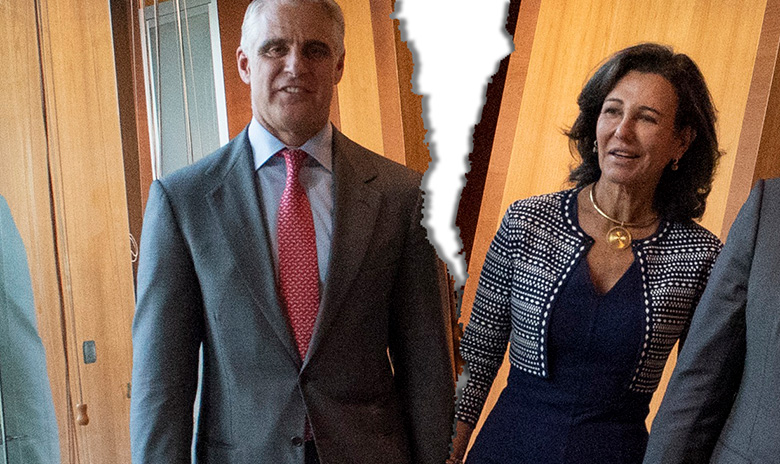

Andrea Orcel and Ana Botín

Andrea Orcel’s eventual non-appointment as chief executive of Santander will, in time, rank high on the list of dysfunctional succession plans in an industry known for some spectacular failures.

Jaws hit the floor in September when Orcel, the epitome of the investment banker, was named as the putative CEO of commercial- and retail-banking focused Santander.

It seemed an unlikely fit, despite the close professional relationship Orcel had developed with executive chairman Ana Botín across decades of advising and doing deals together.

Thanks for your interest in Euromoney!

To unlock this article: