Latin America’s banking system has had what can easily be called a colourful history. It has lured some banks in and unceremoniously spat them out. Some have imploded and vanished without a trace. Others stand tall among the ruins of past crises and dominate their local markets today. Yet what was once one of the world’s weakest banking markets is now one of the strongest and most profitable. What has changed?

“The banking system in Latin America as a whole has tremendous experience of managing volatility,” says Nuno Matos, chief executive of HSBC Mexico since 2015. “If there is one place in the world where you learn to manage volatility, it’s Latin America. Many of the bankers that today are leading Latin American financial institutions learned how to manage in the bad times.

“The financial system here is very robust and that’s not a coincidence, that’s a result of many years of learning and a consensus in society that it is important not to push banks into non-rational lending.”

Brazil’s leading private banks consistently produce some of the most impressive earnings of any leading global banks. Itaú hasn’t dipped below a return on equity of 20% in the last 20 years, most recently recording a 22.7% ratio in the fourth quarter of 2018.

Bradesco’s results weren’t as strong, at 19.7% for the fourth quarter of 2018, and the second-largest private bank was pushed into third place by Santander Brasil notching a RoE of 21.1% at the end of 2018. These results come despite the economy barely returning to growth following a severe, two-year recession.

Throughout the region, institutions are more independent, capital levels are much higher and risk management has become more sophisticated. But it is the memories of past crises that have done most to entrench a sense of prudence that still persists throughout much of Latin America’s banking system today.

“I can’t believe it was 25 years ago since the Tequila crisis. For me it was like yesterday,” says Hector Grisi, chief executive of Santander Mexico. “Whenever I sit on the credit committee and review transactions, it’s always on my mind, you never forget.”

At the time of Mexico’s crisis in 1994, Grisi lost his job at Banco Mexicano (which would later be bought by Santander), and that experience has shaped much of his outlook on banking today.

“It was pretty tough; the whole financial system collapsed,” he recalls. “There was a moment when 50% of the loans outstanding below Ps500,000 ($26,000) were not performing, so it was huge.”

After about six months out of work, Grisi was hired by First Boston, which later became Credit Suisse and where Grisi would go on to become chief executive of the Mexican unit before joining Santander in December 2015. For him it was a chance for redemption.

“It’s like a second opportunity not to make the same mistakes, because we made a lot of mistakes at that time,” he says. “There was too much concentration, we grew really fast and we thought it was a completely different environment. We also lacked the capital structure that we have now, so capital and liquidity are the two things that are my mantras today.”

Fear

That fear of not making the same mistakes again has so far served the region well. When the global financial system crashed after the subprime crisis in the US and the collapse of Lehman Brothers, Latin America’s banks emerged relatively unscathed.

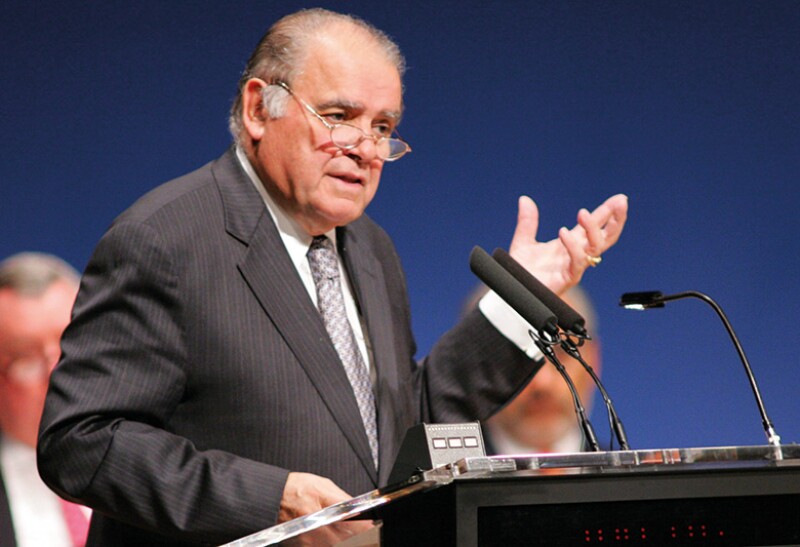

For Guillermo Ortiz, partner and member of the board at BTG Pactual, and who became Mexico’s finance minister at the height of the Tequila crisis, the reason Latin American banks were able to shrug off the impact of the 2008 crisis was because they had just finished readjusting from their own domestic woes a decade or so earlier.

“Emerging markets that experienced a crisis in the 1990s and the early part of this century took similar measures as we did in 1994 in terms of strengthening their banking systems,” says Ortiz. “So, when the great crisis came, the banking systems in Latin America had not been affected by buying subprime mortgages or any assets of this nature. Despite the negative shocks and the capital outflows experienced in 2008 and 2009 that led to a contraction of the Latin American economies, their banking systems proved to be resilient.”

Another important step banks had taken was to better manage their foreign exchange risk.

“Dollar lending on the part of the domestic banking systems was done to companies that had earnings in foreign currency, basically exporting companies, therefore avoiding currency mismatches,” says Ortiz. “This is one of the main reasons for the resilience of Latin America’s banking system during the financial crisis.”

There is a peculiarity in Colombia that international banks have not been as successful as they have been in other Latin American countries - Jorge Londoño Saldarriaga

It is tempting to lump Latin America’s banking system into one homogenous mass, but the banking landscape has evolved unevenly across the region. Take Colombia. Its domestic banks dominate the market, with the only international bank in the top five being BBVA, with a 9% market share.

When BBVA first entered Colombia in 1996 it acquired Banco Ganadero, at the time the biggest bank in the country, remembers Jorge Londoño Saldarriaga, who was chief executive of Bancolombia for 15 years between 1996 and 2011. Despite buying two more banks, BBVA Colombia today is only the fourth-biggest bank in the country.

“There is a peculiarity in Colombia that international banks have not been as successful as they have been in other Latin American countries,” says Londoño from his apartment in Bogota.

Nobody really has a firm answer for why that is. One possible reason is that the banks were overconfident. But another is the challenge incoming banks face when competing with domestic lenders, given that the latter tend to have a better understanding of the local market. And few bankers have a better understanding of Colombia than Londoño, who took Bancolombia – then a small, relatively obscure bank from Medellin, which at the time had just a 3.5% market share – and turned it into what is now the biggest bank in the country.

The story of that transformation starts in the mid 1990s, when Londoño was chairman of Banco Industrial de Colombia. Londoño had been appointed chairman to oversee the bank’s listing on the New York Stock Exchange, the first Colombian firm to do so. That admittance to the international capital markets proved to be decisive.

A year later Londoño became chief executive and shortly afterwards the bank acquired Banco de Colombia, which at the time was the third-biggest bank in the country, catapulting the newly merged bank (renamed Bancolombia) into the top spot, where it has remained ever since.

Part of Londoño’s success was his strategic decision to turn Bancolombia into a universal bank, something that had not been tried before in the country. But for others it was the bank’s ability to finance itself outside Colombia that made the real difference.

“The big change in Colombia over the past 50 years is the availability of capital markets at the international level,” says Juan José Echavarría, the governor of Colombia’s central bank, the Banco de la República. “How did a very small bank in Medellin become this large bank? Because we had access to the international capital markets, and we used the capital markets in order to finance large expansion.”

Consolidation

Another country where local players dominate is Brazil. As in Colombia, the banking system is highly concentrated (six banks own 80% of deposits), however there is one big difference: the biggest bank is state-owned (Banco de Brasil). Just one of the country’s top six lenders is an international bank (Banco Santander), although that is not for want of trying. HSBC, for instance, sold its Brazilian unit to Banco Bradesco in 2015 after failing to build sufficient market share.

Such consolidation has been a recurring theme in Brazil; there was a high rate of bank failures in the country throughout the 1980s and 1990s. But the pace of consolidation has continued, even though the country has not experienced a banking collapse in recent years.

Candido Bracher, chief executive at Itaú Unibanco, thinks he knows why.

“That was due mainly to the increase in regulation after the 2008 crisis and the demand for higher capital commitments, which practically doubled,” he says. “That really forced this consolidation of the sector and it is under this light that mergers such as Itaú Unibanco or Bradesco acquiring HSBC should be seen.”

That inexorable march to consolidation in Brazil has now stopped. The central bank and the anti-trust regulator have signalled an end to the trend when it prevented Itaú buying a majority stake in XP Investimentos.

The central bank has also created a regulatory-friendly environment for fintechs and startups, offering less onerous regulatory reporting and other requirements to enable them to increase their competitive position against the large, incumbent banks. It is also possible that the publicly held banks – Banco do Brasil and Caixa Economica – will either be privatized or, more likely, make disposals of certain assets that could change the competitive dynamics of the Brazilian banking industry.

But that is unlikely to harm the profitability of Brazil’s leading private banks.

There are many reasons for the high level of profitability. The main one has been traditionally high interest rates – and therefore high net interest margins. Another is the high level of concentration, with a handful of banks dominating a huge market, aided by a round of mergers.

However, Bracher also points to the high cost of capital for Brazilian banks as creating a misleading impression about profitability. He argues that, with a cost of capital of around 14% , the “real cost of capital” isn’t as elevated as it may appear.

Lending, he says, creates very little value and it is non-credit activities that create most of the bank’s profitability. The bank is focusing on products and services including insurance, although Bracher does admit that it is increasing its risk appetite in credit and looking to increase its exposure to high-return segments.

Bradesco is also looking to grow in these areas. Its insurance business now accounts for one third of its profitability; its chief executive, Octavio de Lazari, believes it is more important that the bank grows nominal revenues and profits in the coming years than become obsessed with return on equity.

“RoE is the most important measure, but we must look at the whole structure,” he says, although he admits he is aiming for a minimum of 20% RoE for 2019 and ideally a couple of percentage points north of that threshold.

Lazari says the acquisition of HSBC has now been fully integrated and, as the bank is more active in more Brazilian states (particularly the north and the northeast), he thinks a broad-based economic recovery will drive outperformance for Bradesco relative to his main competitors.

Footprint

While in Colombia and Brazil local players have dominated the banking landscape, in Peru the development has been more mixed. Banco de Crédito del Perú (BCP) is the country’s largest lender, accounting for almost 35% of the country’s loan book and 33% of its deposits, according to Moody’s. But BBVA Continental is second, with almost 20% of the loan book and roughly 18% of deposits – a position it has maintained since BBVA merged with Banco Continental in 1995.

Raimundo Morales, chief executive of BCP between 1990 and 2008, and now vice-chairman of the bank, says the way international banks have succeeded in Peru is simply by buying institutions that already had a substantial footprint.

“Anything much less than 10% market share and it’s very difficult to make the bank grow,” he says.

Maintaining BCP’s leading market position, however, is getting tougher.

“The banking system is becoming more sophisticated and more difficult to compete,” he says. “The corporate segment of the market is very competitive and we are all offering the same loans, and it’s just a question of putting a margin on there – if your spread is lower, then you get the business, and if your spread is 1/16th higher, then you lose the business.”

Yet Peru’s banking system today looks very different to when Morales became BCP’s chief executive in 1990. At that time Peru was in financial turmoil as president Alan Garcia meddled with the printing presses and hyperinflation raged through the economy. The Asian crisis in the late 1990s compounded the problem, by the end of which about half of the country’s banks had failed, says Morales.

“The most important thing we did was to be able to maintain liquidity and continue having the confidence of our customers,” he says. “Whenever some of the banks were going under, we were the bank of last resort and those customers would deposit with us.”

I always thought it was a mistake from a national viewpoint – no major country in the world has its banking system dominated by foreign institutions - Guillermo Ortiz, BTG Pactual

That experience had a lasting effect on Morales and it was one of the reasons why he decided to retire early in 2008.

“What I had lived through with Garcia and all the inflation problems, I was probably to a certain extent too prudent in terms of new business,” he says. “I was always thinking: ‘when is this going to end?’ But it really hasn’t ended. The new generation have a more positive view of the future and that has helped us to grow and maintain our dominant position in the market.”

His legacy is not a bad one, however, as anybody who invested in BCP in the early 1990s will attest. BCP was worth around $50 million back then, today the market cap is closer to $15 billion.

“It’s not that the management was exceptional, but a substantial portion of this growth has been the discipline of the economy and the growth of the economy,” Morales says.

He says one of the reasons for the bank’s recent success and sustained profitability is that it has learned to better serve the retail segment of the market, rather than just rely on corporate lending.

That is a model that was really made successful by Interbank – a former state-owned lender that was privatized in 1994. While it is only the fourth-largest bank in Peru by assets, it is second in retail lending (behind BCP), according to Moody’s. Retail lending accounted for 53% of the bank’s loan book in the first nine months of 2018.

“The commercial system has been the core of the banking system in Peru for many years, until Interbank came to the market with its retail strategy around 2003 and really started to grant quick results,” says Luis Felipe Castellanos, Interbank’s chief executive. “We’ve led that growth based on lots of innovation, being creative, partnering with supermarkets, being where the customer is and deploying convenience and agility to everything that we did.”

Tequila crisis

In Mexico, the composition of the banking sector is at the other end of the scale: five of the top six banks in the country are foreign owned, a fate that was sealed during the Tequila crisis.

“When the Mexican banking system went bust in 1994 and 1995 we had to support it,” says BTG’s Pactual Ortiz. “There were two choices: we either renationalized all the banks and wiped out all the shareholders and take over the banks that had been privatized in the early 1990s, or we could try and get some fresh capital into the banking system from the owners of the banks – either current shareholders or new shareholders.

“The banking system crisis cost Mexico 18% of GDP through time, and foreign banks came in and bought some of the major banks.”

It did not happen all at once. Banamex, for example, was not acquired by Citibank until 2001. But after the hangover from the Tequila crisis had finally worn off, the global takeover of Mexico’s banking system was starkly disorientating. BBVA had acquired Bancomer. Santander had acquired Banco Mexicano and Banca Serfin. HSBC had acquired Bital. And Scotiabank had acquired Inverlat. Today the only leading Mexican bank to remain under domestic ownership is Banorte.

“I always thought it was a mistake from a national viewpoint – no major country in the world has its banking system dominated by foreign institutions,” says Ortiz. “I think one mistake that was made during the privatization of the Mexican banking system in the early 1990s was not to allow the presence of foreign banks at the outset. Had foreign banks been allowed to participate, we would have had probably a safer banking system with better risk management.”

One potential problem with having your banking system dominated by subsidiaries of international banks is the possibility of shifts in the parent bank’s risk appetite, particularly in times of stress in their own domestic markets. While Mexico’s banking system proved resilient during the 2008 financial crisis, that dominance of foreign-owned banks meant that lending was curbed, putting a strain on the country’s economy.

“In late 2008, when the financial crisis burst, I was governor of the central bank and Agustin Carstens was finance minister,” Ortiz recalls. “We gathered the major foreign banks to emphasize that the Mexican banking system was essentially sound and a pullback of domestic credit was unnecessary even if parent banks were doing it in their own countries. They didn’t pay attention. These actions, plus some resources transfers from the subsidiaries to the parent banks in Europe and the US, exacerbated the contraction that we suffered in 2009.”

Echavarría at Colombia’s central bank says the retrenchment of some international banks from Latin America following the 2008 crisis silenced critics of Colombia’s financial sector for being overly reliant on domestic-owned banks.

“About 15 years ago it was the standard view in Latin America that we in Colombia were in trouble because we didn’t have all these big foreign banks,” he says. “Everybody was saying these foreign banks are much more secure, less volatile, that’s what you need. Well, that’s not what happened. After Lehman, many foreign banks disappeared from Latin America, and Colombia did very well. So maybe it’s better to have a mix of both.”

Capable of competing

In Mexico, Ortiz says the success of Banorte – which is the country’s fourth largest bank by assets – proves that domestic players are more than capable of competing with the balance sheets of international banks.

“When Banamex was sold to Citibank, the argument was it could not compete with large foreign banks like HSBC and Santander and BBVA, but that proved to be a false argument,” he says. “And there are a lot of very successful regional banks like Ban Regio and Ban Bajio, which are playing a significant role, and gradually the Mexican banks and Mexican banking system is gaining market share. The dominance of the foreign banks is not going to go away, but it will be reduced in importance.”

Matos at HSBC says Mexico’s banking system is unusual when compared with other countries in Latin America because the number of banks is still increasing.

“In other emerging economies, the number is going down because of consolidation, here we are growing three or four additional banks every year,” he says. “For the most part that is international banks that are coming to support international companies, so Asian banks from China and Korea, but that is more commercial and investment banking organizations, not retail.

“Mexican small banks are doing a great job in the retail arena, so I expect retail competition to continue to grow there, while I see the investment and wholesale pressure to come from the international banks. In 2019, organic moves in retail are very tough unless they are pure digital, which is a model which is still not successful.”

Yet while the likes of BBVA, Santander and Scotiabank have enjoyed success across the region, albeit to varying degrees, few domestic Latin American banks have been successful or even tried replicating their success outside their home country. Apart from Brazil’s Itaú Unibanco – which also owns top-five banks in Uruguay and Chile – there is a dearth of familiar names that cover the region.

The financial system is a huge, huge industry and I think the incumbents will lead the national system for the foreseeable future - Roberto Setubal, Itaú Unibanco

Part of the problem is size. Unless you have the capital to buy an existing name with sufficient market share, growing scale in retail banking is a challenge.

“Putting your brand into a country is very tough,” explains Castellanos. “It’s very hard to build the infrastructure. What usually happens when a big bank comes in and says: ‘We’re going to establish a retail presence,’ they start buying or renting places and they overpay for rent. Then they need to bring in the talent, so they overpay for the talent. Then a downturn comes in one of their markets, they stop growth and then they sell up and leave.”

Another challenge is finding a viable cultural fit. Londoño says that when he was chief executive at Bancolombia, the bank was scouting for opportunities to expand into other Latin American markets, with little success.

Brazil, for them, was another world; Argentina was also too different; Chile was already too developed; and Peru was interesting, but they could not find anything suitable to buy. In the end, they found a bank in El Salvador – Banco Agricola – and it proved a success; Colombian banks now own around half the Central American banking system, says Londoño.

“That was the first successful acquisition by a Colombian bank abroad,” he says, “but there were a lot of doubters – rating agencies put us on review, shareholders didn’t like it at the beginning and our share price went down for about six months. But when they saw that we were making money there, things started to get better, and then our competitors followed us.”

The secret to that success? Ensuring the acquisition caused as little disruption as possible, such as keeping the name the same and keeping Colombian management personnel to a minimum.

“It was 100% Bancolombia, but it was managed as a Salvadorian bank,” says Londoño.

Examples of such success, however, are relatively scarce. Morales at BCP recalls an ill-fated foray into Colombia at the end of the 1990s.

“We bought a smaller size bank in Colombia, but our timing was really bad, just before the crisis there,” he says. “We had to put up a lot money to support the bank, but we sold it three or four years afterwards because our experience had been very bad.”

Political risk

The big test for the region’s banks today is the reemerging risk of populist politics. But even in Argentina, where reform efforts have come unstuck amid an acute economic crisis, raising the spectre of a return to populism when voters go to the polls later this year, the banking system has remained stable.

“If you look at the profitability of the banking system, it is very good, the capital level is very good and liquidity is very good,” says Fabián Kon, chief executive at Argentina’s Banco Galicia. “NPLs [non-performing loans] are higher but remain low, so if you look at the crisis it didn’t affect the financial system, it only affected growth.”

In Mexico, the election of populist president Andres Manuel Lopez Obrador last year created a cloud of uncertainty for the country’s financial system that has yet to fully dissipate. The decision to cancel the development of Mexico City’s new airport, despite it already being partially built, rattled investors. And a proposal from the head of the Mexican senate, Ricardo Monreal, to restrict the fees banks can charge customers, such as for withdrawing cash from ATMs, initially caused bank shares to tumble. Yet both Matos at HSBC and Grisi at Santander believe that Mexico’s banks can reach a deal with the government.

“If the fee restrictions go through as a whole, yes they would hit us,” says Grisi, “but the government understands that if we’re not able to charge any fees at all in ATMs, then who is going to invest in ATMs? It has to be profitable for it to work, so I’m optimistic we’ll come to an understanding on that.”

Ortiz says the government has since taken steps to be more cooperative and look at ways to strengthen the banking system as well as to reduce transaction costs for customers.

“All of this is to put banks on a better footing, even with reduced commissions, but not by decree,” says Ortiz. “The current officials at the Treasury understand this very well and they are following a constructive approach, but legislators are a different thing and you will from time to time hear a lot of noise coming from congress when it comes to banking system regulation. That’s a tension that is not going to stop.”

Similar tensions are also simmering in Colombia, where the profitability of the country’s banks has drawn the ire of popular opinion, prompting congress to approve higher taxes for the sector.

“If you’re a bank, you have to pay more because you’re a bank; you’ve been doing so well that you have to be taxed extra – which is bad,” says Echavarría.

Third-party products

Roberto Setubal, co-chairman of the board of Itaú Unibanco, believes that digitalization will make the bank more competitive. Itaú has opened its architecture to enable clients to buy third-party products.

“It’s interesting because clients like it if you offer other people’s products,” he says. “The evidence is that this is often enough for them to be comfortable and stay with you at the bank. Our clients are necessarily buying third-party products, but it has a very positive psychological effect.”

He says it also increases competition within the bank to offer better products and services.

Ultimately he believes that new competition will emerge that will compete alongside the current incumbents rather than replacing them.

“The financial system is a huge, huge industry and I think the incumbents will lead the national system for the foreseeable future,” Setubal says. “That doesn’t mean that some of the fintechs won’t be very successful – some will, and will grow to be very large companies – but the big banks will also remain.”

Digitalization also enables Bradesco to sell products at a lower cost and in areas without a great physical footprint. Lazari says that 55% of all its personal loans were sold through mobile and online platforms as proof that its investment in digital banking has paid off. Bradesco has launched a purely digital bank called Next and expects to have 1.5 million customers by the end of 2019.

Lazari says that, as well as increasing the efficiency of the bank, the investment in digital platforms allows Bradesco to take on new and existing competitors in specific sectors, such as payments, which has seen a huge focus from fintechs in Brazil in recent years.

Unbanked

Perhaps the biggest opportunity – and challenge – for the region’s banks is how to tackle informality and improve the scope of financial services for the unbanked segment of the market. In Mexico, for example, roughly 60% of the population does not have access to a traditional bank, with cash accounting for around 80% of all transactions. That is one of the reasons credit growth in the country remains so low; credit-to-GDP is around 35%, says Matos at HSBC.

“The new administration is taking bold measures to try and counter that situation and is working side by side with the banking industry to drive bancarization, to drive people into the financial system and to reduce cash usage, which undoubtedly will foster credit expansion,” he says.

One measure the government has taken is to introduce a new QR (quick response code) payment system that will allow the low-income segment of the market to make transactions without cash and without having to pay a fee, says Matos.

Some banks are also looking at ways to expand banking services to low-income customers. Santander, for instance, has set up a financial inclusion unit, Tuiio, to better serve this market.

“At the beginning it was very focused on credit, but we added a fully digital account onto it that we call SuperDigital and that allows customers to use our ATMs without any cost and allows you to get deposits,” says Grisi. “That has not only been a driver of financial inclusion, it has also increased transactionality. We need critical mass to make it profitable, right now we’re losing money, but we’re going to break even in 2021.”

The challenge for banks and regulation is how to use the digital services for more and better financial inclusion without increasing the risks of banking systems - Enrique Iglesias

Peru has also been working hard at improving financial inclusion, particularly among small and medium-sized businesses that operate in the informal sector.

“Before the banks started lending to them, these informal businesses were borrowing from people who would only lend to them at very high rates of interest,” says Morales. “We have been successful in defining a model to be able to understand and access this market where, even though it might be more costly in terms of servicing them, we can still have substantial profit margins.”

Morales also discovered an interesting trait among these borrowers.

“The informal low-income sector is a better paying sector than the formal low-income sector,” he says. “Why? Because they are very concerned about maintaining a good credit standing because the difference between the rates they would have to pay to an informal financial lender is substantially larger than what you can pay to a formal lender.”

Other countries also have more work to do to improve rates of financial inclusion. Former Colombian finance minister, Juan Carlos Echeverry, says the consolidation of the country’s big banks has been at the expense of smaller lenders that were attending to smaller and mid-sized firms.

“Colombian banks are not really paying attention to the small individual,” he says. “They pay lip service to bancarization, but the typical worker of Colombia is not bancarized and they will not be bancarized if they depend on the current financial system. If you are a medium-sized or adolescent firm, between 20 and 200 employees, and $5 million to $50 million of annual sales, you don’t really get the attention from the financial system, because the cost of supplying credit to those people is high. There are a lot of small firms in Colombia, but the banking sector concentrates on the meat, and the bone is left unattended.”

That has created a gap in the market that Echeverry is hoping to fill by launching a private debt fund called Grou that will provide credit to Colombia’s neglected mid-sized businesses. And Morales says BCP is also trying to replicate its success in Peru’s informal sector by launching a pilot lending scheme to low-income borrowers in Medellin.

Driving change

For many, this is where the intersection of technology and banking is really going to drive change. Morales says that by using artificial intelligence, the bank can predict far more accurately – and efficiently – the level of credit risk of an individual customer.

Digital banking can also allow banks to expand into new market segments that were previously too costly to tap. Interbank’s digital strategy, for example, has allowed it to target wealthier clients by giving them access to specialist bankers remotely – something the bank was not able to offer within its traditional branches.

While digital banking could help promote greater financial inclusion, some market watchers also worry about the impact that could have on branch networks in remote areas.

Uruguayan economist Enrique Iglesias

“Digitalization will be the main driver of banking evolution in the region,” says Uruguayan economist Enrique Iglesias, who was president of the Inter-American Development Bank between 1988 and 2005.

“Nevertheless, the reduction of branches in rural areas may destroy financial inclusion of micro enterprises in those non-urban areas. The challenge for banks and regulation is how to use the digital services for more and better financial inclusion without increasing the risks of banking systems.”

But Grisi sees no reason why the expansion of digital services will result in fewer physical branches.

“Our clients are omni-channel, they use the branch as well as digital,” he says. “Maybe they use the branch less than before, but when we are growing – we grew by about one million net new clients last year – those new clients need branches, they need the call centres and they need the digital platform.”

And while larger international banks like Santander might have an advantage over regional players when building digital platforms, Kon at Galicia reckons that does not necessarily translate into a better experience for customers.

“It’s true that global banks have the capability to invest more money in technology than local banks, but it’s not true in any country in South America that the deployment of that technology has created a difference,” he says. “It didn’t happen in Brazil or Colombia or Chile or Peru; the local banks have the same quality or better quality of services.”

Not investing in technology, however, is ultimately a sure path to obsolescence, says Londoño.

“The banking industry is being transformed very deeply by technological change,” he says. “The banks that are able to understand that will thrive and the banks that don’t change are going to disappear.”

Candido Bracher, chief executive, Itaú Unibanco: Banking blood in his veins

Late afternoon has given way to early evening as Euromoney waits for Candido Bracher. It has been a long day. Itaú Unibanco has announced its fourth-quarter results and the chief executive has been busy with the hoopla that surrounds earnings releases.

|

The results were more than solid: a 3.1% increase in profits to R$25.7 billion ($6.9 billion) and a return on equity up 10 basis points over the same period in 2017 to 21.9%.

Still, the talk in the meeting room of the already iconic new BBA headquarters on 3500 Faria Lima, São Paulo, is that day’s 4% fall in the bank’s share price.

When he arrives, Bracher appears relaxed; the weight of expectation is neither new nor a surprise to him. He is, after all, following in the daunting footsteps of Roberto Setubal, the man who presided over the growth of Itaú into one of the world’s largest and most profitable banks.

But Bracher has an impressive banking pedigree of his own. His father, Fernão Bracher, was president of Brazil’s central bank before founding BBA Creditanstalt in 1998 with Antônio Beltran (the two had worked together at Bradesco) and financially backed by the Austrian bank.

Candido was also part of the launch, one of a group of 20 executives, with $20 million in capital. Fifteen years later, the bank had a headcount of 600 and a capital base of $600 million and had already paid out $200 million in dividends.

Itaú bought the bank for R$3.3 billion in 2002. Itaú had identified the need to add expertise in its corporate and wholesale business, but Bracher is clear about the benefits that Itaú brought to the BBA operations.

“Before becoming part of Itaú, I had a client conversion rate of about 45%. When we added the Itaú brand – and especially the retail current accounts, cash management and collection – this rate increased to 96%. Basically I had to do something very, very wrong with a company for it not to become a client.”

Bracher says Itaú’s funding base was an even more important part of the deal’s logic for BBA.

“ Having concentrated funding is very dangerous, especially in volatile markets like Brazil,” he says. “We were very conscious of this risk; it was only acceptable as long as the market thought we had a reference shareholder – the second-largest bank in Germany – as a lender of last resort. But that was a hypothesis we didn’t want to test.”

Bracher would work closely with his father, becoming chief executive of BBA when Fernão retired aged 70, before becoming chief executive of Itaú Unibanco in 2018.

Fernão Bracher died on February 11, 2019, after our interview with Candido Bracher and Euromoney would like to extend our condolences to his family.

Fabián Kon, chief executive, Banco Galicia: Growth despite the pain

Fabián Kon is the first to point out that Banco Galicia’s performance is dependent on its volatile operating environment.

|

The bank conducted a $550 million follow-on equity transaction in September 2017 to fund its inorganic expansion programme. Galicia issued the new shares at $50; a couple of months later, they had hit $73. Then came the most recent Argentine crisis.

In August last year, the Argentine peso devalued by more than 30% and those dollar-denominated shares tanked, hitting a low of $20 in a crazy ride that saw the stock bounce back to $37 by the time Kon welcomed Euromoney to Galicia Tower in February this year.

Kon is upbeat. He believes the country’s economy “can grow very fast if the conditions are there” and is eyeing both organic growth and acquisitions.

Inorganic growth is, of course, dependent on the willingness of sellers, and Kon doesn’t want to speculate about specific names. Banco Patagonia and HSBC are both often cited as potential targets. The odds of it being the former are good as the Brazilian government seeks an ambitious disposals programme, while the availability of the latter is less clear.

Regardless, Kon says that while the banking industry waits for its almost inevitable consolidation, Galicia has a lot of potential to outpace the competition.

During Argentina’s difficulties, Galicia has been investing in its digital capacity to enable it to take advantage of anticipated growth. The bank is focusing on developing its Naranja brand, which for now is the country’s second most-widely used credit card after Visa.

Kon says Naranja will be launched as a fully fledged digital bank by the end of this year.

Why create a second banking brand?

“Naranja has five million clients, and the client base is much more spread throughout the country than Galicia, which is more concentrated in the province of Buenos Aires,” says Kon. “The segments are also different. Whereas Galicia has a big participation in agribusiness, corporates, small and medium-sized enterprises and high-end retail, Naranja is a more middle-class brand.

“ They are totally different banks and Naranja is rated as the best brand in the financial system, largely because it wasn’t a bank [before] and so it didn’t suffer from all the criticism that the banks in Argentina have faced.”

Galicia also has insurance and asset management operations and so expects broad-based growth after any resurgence in Argentine GDP. But Kon gives the impression of a man eager to buy to boost Galicia’s market share of roughly 10% to something like the 13% enjoyed by leader Santander Rio.

“We have the capital, the brand and the management to take advantage of the growth of Argentina,” he says. “We just need it to be a normal country.”

Hector Grisi, chief executive, Santander Mexico: Driving for deposits

Santander Mexico’s chief executive, Hector Grisi, is sitting in the back of his black SUV as it slowly inches its way through Mexico City’s notoriously frantic Friday afternoon traffic. He has just finished signing documents at Mexico’s tax office over the street from the Palacio de Bellas Artes and now has to race across the city to attend the birthday party of a bank client. There is no time to sit down to do an interview, so Euromoney is tagging along for the ride.

|

One topic is foremost on his mind: the bank’s new strategy. We come back to it frequently.

Despite being Mexico’s second-largest bank by assets, it has slipped to fourth by deposits. That has called for a strategic rethink to acquire new customers, limit churn and lower the cost of funding. Part of that has involved launching a Mexican version of the 123 current account popularized by Santander in the UK. Another has been offering a revamped mortgage package, both of which are designed to promote customer loyalty in a population that is frequently fickle.

“The problem was in the past we were not the number one bank to our clients,” says Grisi. “The client would come in and get the mortgage, open the checking account to pay the mortgage once a month and, once the mortgage was finished, we would lose the client. Now we say: ‘I’ll give you the best rate, but you have to do your insurance with me, you have to do your payroll with me and you have to have your credit card with me.’ That’s the strategy, and that’s working really well.”

Whether or not that translates into the increase in the market share Grisi covets is yet to be seen, but deposits grew by 7.1% in 2018 and he says the churn rate is improving (down by around 50%).

The bank’s results have been improving too. Net income rose 11% in 2018 as higher domestic interest rates boosted the bank’s net interest margin to a healthy 5.47%. And while the central bank’s hiking cycle has likely come to an end, Grisi is unconcerned.

“Our strategy works either way, because if rates go up, we’ll make more money and if rates go down, we’ll make more money, because the aim is to get more clients and demand deposits,” he says. “In the past, probably the liability side was not a priority for the bank, the priority was to grow the loan portfolio, but now it’s not the case, we want to be a fully blown commercial bank.”

Luis Felipe Castellanos, chief executive, Interbank: The digital transformer

Luis Felipe Castellanos, chief executive of Peru’s fourth-largest lender, Interbank, is sitting with his back to the window. The Crystal Palace-supporting banker doesn’t like to be reminded of his competitors, whose skyscrapers puncture the view from Interbank’s own imposing office tower in Lima’s financial district.

|

The Austrian-designed building is a potent symbol of Interbank’s ambitions, with its slick curves and neon lighting reflecting Castellanos’s vision to modernize the bank’s culture and embrace the digital banking revolution.

Part of that involves building new digital products and services (Castellanos has tripled Interbank’s investment in technology) and part involves simply shaking up the working environment.

“That comes from the culture, the way we dress, the way we talk, the way we communicate, the talent we bring in, who we incentivize, how we work, the physical spaces and how we do stuff with the teams,” explains Castellanos, who has ditched his suit in favour of a blue gingham shirt and casual trousers. “So, breaking down the traditional structures, from dropping the suits to not thinking that growth in deposits needs to be through physical stores.”

One thing that has not changed, however, is Interbank’s flat organizational structure, which he says allows ideas to flow much faster and fosters a culture that will enable the bank’s digital strategy to flourish. Not only will the digital strategy improve efficiency, it will also allow the bank to target new business.

“Before, it was a little bit hard to build up physical infrastructure to serve all the people; today with analytics and digital it’s much simpler,” he says. “Now we’re serving new segments, like the wealthy or emerging wealthy, through digital. Before, our business model was not efficient for that.”

That digital focus will also allow Interbank to maintain its goal of growing loans at a faster pace than the system average, without having to overstretch into riskier corners of the market. Interbank’s loan book expanded around 17% last year, compared with 11% for Peru overall.

Interbank is also de-dollarizing its loan book more rapidly than other banks, with foreign currency loans accounting for 28% of the total book in the first nine months of 2018, compared with more than 30% for the market as a whole, according to Moody’s.

“For most big banks in Peru, the loan book is usually 65% to 70% commercial and 30% retail, and in commercial you tend to have lots of dollar-denominated loans,” Castellanos says. “We’re split 50/50, so all our retail banking is in soles, and that puts us at an advantage to the system.”

Octavio de Lazari, chief executive, Bradesco: The operational CEO

Bradesco’s new chief executive, Octavio de Lazari, already knew that running a business the size of the Brazilian bank was going to be a challenge, but the resurgence of Santander Brasil has emphasized the scale of the task.

|

Bradesco has been pushed into third place in the local market when measured by return on equity, and the country’s recent record low interest rates and the potential for further cuts mean that retaining private banking and super-affluent clients is a concern.

Lower returns from the traditional staple investment of these clients – sovereign fixed income products – is leading to an increase in interest in riskier credit products, as well as other investments, such as equities and alternative investment classes.

In January, Lazari announced a new, flatter management structure to better fight competitors: traditional banks, emerging threats and other startups.

Since then, Lazari has announced a new rewards plan that breaks from the bank’s traditional bonus system of splitting group profits to link variable rewards with personal performance. He hopes this will both incentivize and retain talent. Meanwhile he has increased his advisory board to enhance his ability to focus on day-to-day operational challenges.

Lazari aims to grow Bradesco more quickly than his competitors. The bank’s profile may let him achieve this goal if the economy takes off: Bradesco has exposure to more regions of the country than its competitors.

It also has more exposure to lower-income retail segments, which can grow faster than the overall economy but carry more risk. The bank’s insurance business, which Lazari was leading before being promoted to overall chief executive, gives the group a competitive advantage and now delivers roughly one third of Bradesco’s profits.

“ Return on equity isn’t something that needs to be considered in the short term,” he says. “We need to think about this in the long run, but it will be a function of the good performance of all of our business – our strength is in our diversified revenue streams.” However, Lazari adds, he would like to see ROE above 20% again by the end of 2019.

Lazari was not the market’s favourite to succeed previous chief executive Luis Trabuco, who is now chairman. Watching the men together at the bank’s sprawling Cidade de Deus campus in Osasco, just outside São Paulo, Lazari’s elevation seems less surprising. The chemistry and humour between the pair, who both joined the bank as 15-year-old “office boys”, is clearly genuine.

Lazari says such a heady appointment was never in his mind in the early days: “I never, ever envisaged such a thing when I started working at my Bradesco branch; I was hoping to save enough money to go to dental school.”

Nuno Matos, chief executive, HSBC Mexico: Grand designs

When Nuno Matos took the top job at HSBC Mexico at the end of 2015, it is fair to say the bank was what house buyers call a ‘fixer upper’.

|

The bank had been embroiled in a money laundering scandal and was haemorrhaging market share. Rumours of an imminent sale abounded. That did nothing to deter Matos, however, who quickly set to work on the repairs, stopping the rot and restoring some of that lost market share.

To do that, Matos has been ramping up the pace of lending, with the bank’s loan book expanding around 27% in the first nine months of 2018. That has helped boost profitability. Return on equity at the end of September last year stood at 11%, up 3.5 percentage points from 2017.

That is all well and good, but many economists reckon Mexico is unlikely to grow much faster than 2% over the next couple of years. How long can he maintain that rate of growth?

“If you want to gain competitive position and market share, you have to grow faster than the others. We are convinced we are able to grow faster, and in a safe way,” says Matos, in his sleek corner office at HSBC Tower in the heart of Mexico City.

“We’re growing faster than the industry on the loan side, but don’t expect us to grow 27% every year, because obviously that’s not sustainable. But if the market is growing at 10%, which is what happened in 2018, you should expect us to outpace the market by up to 5% each year, which will allow us to continue expanding our activities in Mexico towards a market share of around 10%.”

HSBC Mexico’s market share by loans had nudged up to 6.8% at the midway point of 2018, from 6.7% a year earlier, according to Moody’s data. Meanwhile, its share of deposits had grown to 7.3% from 7% over the same period.

That underscores the scale of the task still ahead, but Matos says the bank has “the right to win” because of its global wholesale banking reach, which gives it an edge on the commercial lending and transaction banking side, and because of its 1,000-strong branch network on the ground in Mexico, which gives it sufficient clout to compete for retail deposits.

The bank is no longer a ‘fixer-upper’, but the renovation work is not over yet.