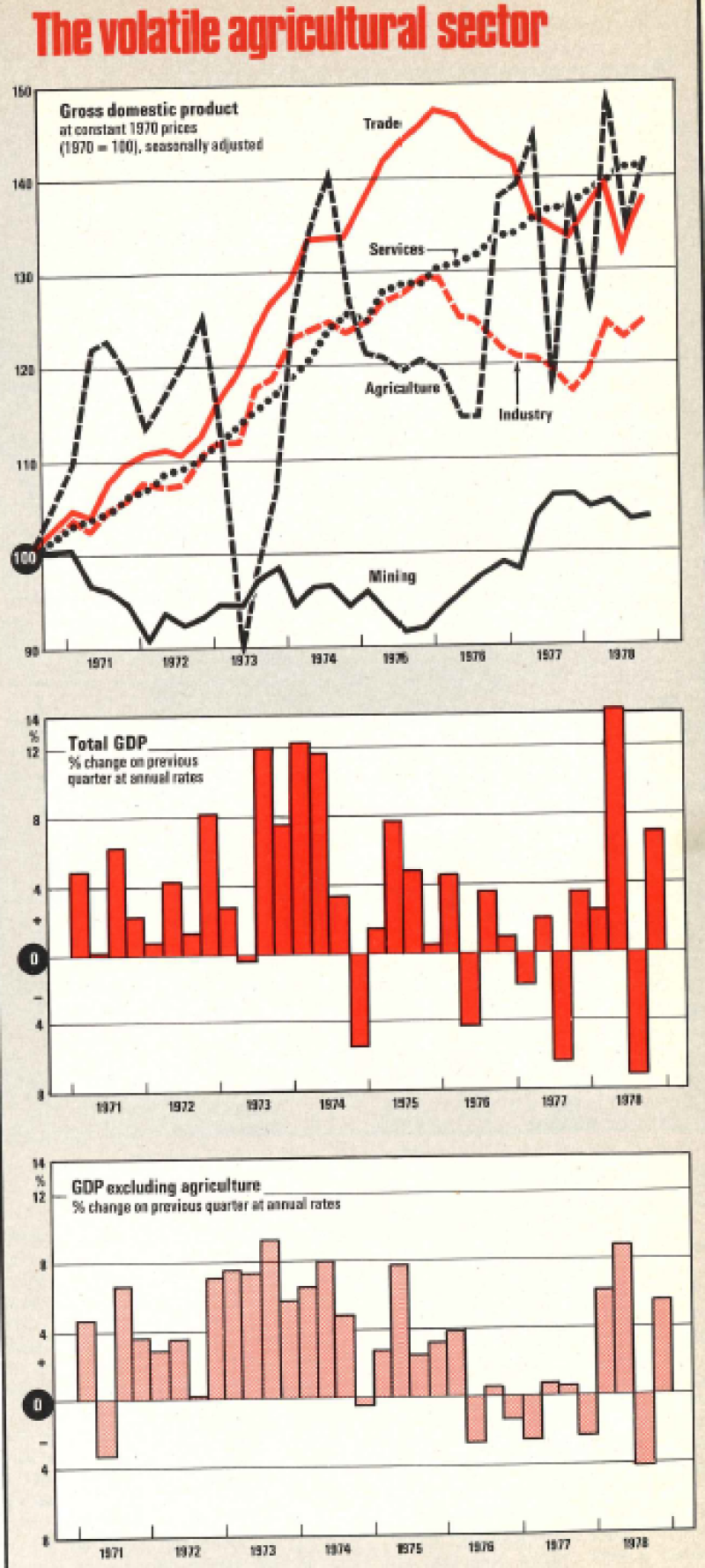

Agriculture accounts for 8.7% of the Gross Domestic Product and mining accounts for another 8%. Manufacturing represents 21.5% of GDP. Its share declined from 22.8% in 1968. Growth in the economy is subject to the volatility of the agricultural sector and to the rise in the gold price.

According to Dagut, South Africa has all the characteristics of a dualist economy. He explained: "Looking out of this window, one sees a modern city that could be anywhere in the developed world. But outside this city there is the rural poverty of an underdeveloped country. Throughout the country there are areas with very different levels of technology. In some of the industrial centres, one can find high technology but with backward labour and backward accounting practices, etc. Finally, there is the dualism which shows up in income distribution and earnings. Studies of income distribution show enormous imbalances."

The economy is at the crossroads. The high growth years of the 1960s and 1970s are over. From 1960-1970, real GDP grew at 5.7% per year. The economy managed an 8.3% rate in 1974. Estimated growth was 2.5% in 1978 compared to zero growth in 1977. When the economies of the developed countries went into the worst recession since the 1930s, the South African economy was still booming. Government spending soared and the money supply was at record levels. Total money rose at 22.3% in 1974. The South African Government failed to see the looming recession in an economy that is heavily dependent on world trade. Exports, including gold, accounted for 29.4% of GDP in 1978, imports 21.2%. Total trade represented 50.6%. Changes in the South African economy have tended to lag changes in the major OECD countries between 1-1½years. When OECD countries began the slow and stuttering upturn, led by the US economy in the fourth-quarter 1975, the South African economy had only just started its decline. It was a recession that lasted for 42 months.

The post-war years have been good ones for the South African economy. Living standards were higher than in many developed countries. But the growth in the early 1970s highlighted the most important weakness in the economy, a lack of skilled labour. The statistics speak for themselves. Out of a total population of 25 million, there are only 4.5 million whites and not all of them are skilled. South Africa had attracted many immigrants, many of whom were unskilled. It became clear, as the economy overheated in the high growth period, that South Africa would run out of skilled labour. It also became very clear that continued unrest inside the country and the increasing hostility from outside would be a restraining factor on future growth. After the Sharpeville riots in 1961 and the Soweto riots in 1976, foreign capital fled the country. Net immigration also declined.

How can South Africa pull itself onto another high growth path? The threat of economic sanctions against the country and another downturn in the OECD countries, which is now forecast, could have a significant effect on economic growth. The problem of skilled labour has to be solved quickly. The population is quickly expanding: about 2½% per year. But for Whites the rate is only 1.5%. Blacks are increasing at 3%, Asians 2½% and Coloureds 3%.

Aubrey Dickman, economic consultant of Anglo American Corporation and a member of the Prime Minister's Economic Advisory Council, explained the problem. "What I am looking for is something that is more important than just a stimulatory budget. I am looking for confidence. It is no good just injecting cash and cutting taxes. These are just short-term measures. We have to reassure business and foreign investors that the next move will be one that everybody participates on a completely new basis, otherwise we just hit the ceiling. The economy is already suffering from labour shortages in some industries. As we have had emigration we have lost workers. The unemployment of Whites, Asians and Coloureds is relatively no higher than it was in 1962, so this shows the shortages. Even at a low growth rate we cannot provide sufficient manpower. The budget is only just one part of the circle. The key to future growth can only be the acceptance of the elimination of race discrimination in the labour field and, hopefully, in the social field," he said.

That view is shared by Ray Parsons, executive director of the Association of Chambers and Commerce (Assocom). He believed, like many South African economists, that increased Black purchasing power was the only real answer to growth. "The Whites can no longer carry the economy," he said. "In terms of decisions, we do not have too much time, there is no question of that. Business and commerce are hammering for changes now. We cannot look to the White man to provide all the managerial skill and demand. This is simply a fact of life." Assocom in September 1978, had circulated its 3,000 members with its proposals, urging sweeping changes in labour legislation. The Urban Foundation and the South African Employers' Consultative Committee on Labour Affairs (Saccola) have also announced that it wants to eliminate discrimination in employment practice. In a statement at end 1977, it said: "The Chamber unequivocally advocates job advancement on merit irrespective of skin pigmentation. Business must be colour blind."

South Africa has the resources and potential for substantial growth. All it needs to do is to unlock that potential. It has the Western world's largest reserves of precious minerals. It has an infrastructure that is developed as some of the smallest developed countries. It also has a non-White labour force that is probably the best educated and trained in Africa. In the past, the economy has been supported by its export performance in gold and in other minerals. Although gold is at record levels, this has not happened in the present cycle. There is a need to increase the purchasing power of the non-Whites to have multiplying effects in the domestic economy.

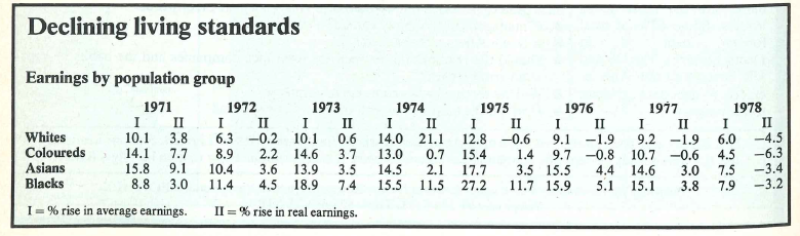

In recent years, the wage gap between Whites and non-Whites has been narrowing. Although, in absolute terms, there is still a considerable gap. In percentage terms, the non-Whites have done much better. Since 1975, real standards for the Whites have been falling. That is also the case for the Coloured. But real earnings for the Asians and Blacks have risen considerably (see table). But 1978 was a poor year for all races with substantial declines in purchasing power. Another problem the government has to face is the falling rate of productivity which is one of the lowest compared to the OECD countries.

The key that could unlock some of that potential was contained in the first report of the Wiehahn Commission into labour legislation in South Africa published in May this year. Professor Nic Wiehahn's report had taken two years to complete, and its conclusions were radical. He recommended in his report that many of the country's laws and practices maintained apartheid in the labour field should be scrapped. The major points were as follows:

• Statutory work reservation should be phased out as fast as possible.

• Workers of all races should be granted full trade union rights.

• Legislation regarding separate facilities for different races in factories, offices and shops should be repealed.

• Trade unions should be eligible for registration irrespective of the colour, race or sex of their members.

• The Unemployment Insurance Act should be amended to eliminate differentiation between races.

• An industrial court should be constituted to replace the present industrial tribunal.

• Any person whatever should be eligible for apprenticeships.

• A national manpower commission should be established.

The government accepted the recommendations of the Wiehahn Commission in principle but has not committed itself to a time scale to implement many of the proposed changes. But the migrant Black African worker will still not be any better off. Fanie Botha the Labour Minister, has said that migrant workers will not be given the right to join a union. Much of the labour force in the mining industry comes from outside South Africa. Botha also indicated that multi-racial unions are not at present acceptable.

But, at least, the government's acceptance of the proposals is a step in the right direction. Blacks now account for 80% of the labour force but are excluded from negotiating rights (excluding agriculture the figure is 57%). In the past, they have formed Black unions but they are not legally recognized. Striking by Blacks is a criminal offence. It is still too soon to judge the opposition from the Whites. White miners struck in March this year opposing any introductions of Blacks into jobs normally held by Whites. The strike only lasted days. It was the White miners strike in 1922 that brought in the present legislation for the preservation of White only jobs.

The following is a report on the major sectors of the economy:

Growth

One of the important variables to growth this year will be the performance of the agricultural sector. This sector used to be the major contributor to growth with a growth rate higher than in the mining sector. In 1968, agriculture was 10% of GDP; in 1978 it was 8.7%. This year it will fall further. But agriculture still plays an important part in the economy. It is still the largest employer of non-White labour in South Africa. The recession severely hurt the agricultural sector. When the recession struck, farmers were asked to continue to employ labourers and to spend less on mechanization. Farming is becoming more capital intensive in South Africa.

Expansion of the agricultural sector is crucial, especially as the population is rising at 2.5% per year. Food prices in South Africa are still amongst the cheapest in the world, and in the past, South Africa exported about one-third of its total food output. That is declining. Maize is the main agricultural crop which, in a good year can be as high as 25% of total agricultural production. Drought in many maize growing areas will mean a 30% drop in production this year. The maize crop is forecast at 7 million tonnes compared to 10 million tonnes in a good year. The amount available for export this year will be only 2 million tonnes.

The drought in the growing areas for sun-flowers, soya beans and sorghums will also mean a 30% reduction. The outlook for sugar is poor as prices on the world markets continue to fall. No improvement is expected for the next two years. The level of investment is falling dramatically in the agricultural sector as the return on capital declines. As a result, the number of farmers has dwindled. There were 120,000 farmers in 1950, compared to 75,000 in 1978. Many farms are now uneconomic. The total labour force peaked in 1971 at 1.6 million and the wage bill was R200 million per annum. In 1978, the labour force totalled 1.25 million with a wage bill of R500 million. Wages remain very low compared to wages in the mines.

Mining

From the first quarter of 1974, the price of gold on the London market rose by 85.6%. Over the same period the volume of gold production declined by 16.8%. Last year was a golden harvest for the gold mining industry. From 1975 to 1978, the working revenue of the primary gold producers rose from R2,347 million to R2,663 million in 1977 and to R3,674 million in 1978. The average gold price received by the industry has risen from $119.34 a fine ounce in 1976 to $194.24 per ounce in 1978.

The increased revenue for the industry has come from the gold price and not from increased production. Gold output has fallen from nearly 760 tonnes in 1974 to 705 tonnes in 1978.

The industry reacted in the traditional fashion to a higher gold price by moving towards mining lower grade ores which become economically viable at higher prices. In 1978, the average grade of ore mined was 8.89 grammes per tonne which represented a fall of 4% on the average grade mined in 1977.

Physical output rose by 1% in 1978 mainly as a result of increased capacity and new mines being opened. There has been considerable new expenditure in the mining sector in recent years. Fixed investment in 1978 totalled R396 million compared to R317 million the previous year. Investment peaked in 1976. The level fell in 1977 by 3% but rose again by 24.9% in 1978. New investment has already shown up in the tonnes milled. Tonnes milled by the industry (the amount of gold bearing ore treated) increased from 74.5 million tonnes to 78.2 million tonnes in 1978. New capacity will be coming on stream this year when three new mines will start producing: Deelkraal, Unisel and Elandsrand.

Gold output in South Africa peaked in 1970 at 1,000 tonnes a year. It has since been declining steadily. The Chamber of Mines expect output of 725 tonnes in 1979. Investment and availability of new resources has been no problem. But in recent years the problem has been finding the Black labour for the mines. The Blacks in Soweto, which has a population of 1.6 million, have never been keen to work down the mines. They prefer the factories of Johannesburg. There was a mine labour crisis in 1974, when labour was withdrawn from Angola and Mozambique. An air crash the same year involving mine workers from Malawi worsened the problem. In 1974, Malawi provided 94,000 workers. That number fell to 8,500 the following year.

Following the shortage of 1974, the Chamber of Mines tried to reduce the dependance from South Africa's neighbouring countries. In 1974, only 25% of the labour came from within South Africa. In 1978, it was in excess of 50%. The major sources of labour are now Lesotho and Botswana. Mozambique still supplies 34,000 workers after South Africa signed an agreement with Frelimo. Workers' remittances to the neighbouring countries are substantial. In the case of the Mozambique workers, the South African Government would convert these remittances into the equivalent of gold converted at the then official gold price of $42.22 an ounce. The gold was then given to the Mozambique Government, who in turn sold it on the market at the free market price, paid out the workers' remittances and kept the substantial difference.

At one time, South Africa took 180,000 workers from Malawi and Mozambique. Now the figure is 54,000. There has been no labour shortage in the mines for the past three years.

Uranium

Uranium production has been revived following the oil crisis in 1974, when production was virtually zero. There was a uranium boom in the 1950s when it was looked upon as another source of energy. Production of uranium is a 95% by-product of gold mining. The price has rocketed. In 1974, uranium cost $7.70 per pound, in 1978 it was $43. Production has increased mainly as a result of the supply problems in Australia and Canada. South Africa signed contracts with many of these countries' customers. Production since 1974 has doubled and· the Chamber of Mines estimates that production will rise by another 50% in the early 1980s. Uranium is forecast to be the third largest export in 1979, after gold and diamonds.

Namibia is very important in total uranium production. There are four major uranium mines in South West Africa, of which the Rio Tinto Zinc mine at Rossing is the largest. Rossing can produce 5,000 tonnes at full capacity. Its production in 1978 was 3,000 tonnes, but production has been hampered by harrassment from Swapo, causing labour problems. Rossing's main contract is with the United Kingdom Atomic Energy Authority (UKAEA).

Extra resources are being spent on increased uranium production. There are two main areas of exploration: the Karoo and the Northern Cape. Anglo American Corporation, Esso and Union Carbide are exploring in the Karoo. The first discoveries were made in the Karoo seven years ago, but nobody has found a viable deposit. Approximately R3.5 million is being spent on exploration. Discoveries to date have not warranted production as the areas are too far apart and the grade too low to warrant economically viable production. At best, the Karoo could have reserves of 2.5 million tonnes. Possible production is 250,000 tonnes a year – equivalent to a 10-year life. Anglo American is also the major company exploring the Northern Cape near Springbok. Expenditure is estimated at R750,000 in 1979. New exploration is also taking place in Namibia where Anglo American is looking at secondary deposits around the Rossing area. Rossing itself has reserves of 150,000 tonnes. General Mining has discovered deposits of 25,000 tonnes near Rossing, but the company is dragging its feet on production until the political situation in Namibia becomes clearer.

The old mine dumps that scatter the Witswatersrand are now being retreated. The Ergo project on the East Rand is being treated to recover gold, uranium and pyrites from which sulphuric acid is made for fertilizer.

Diamonds

Production of diamonds is forecast to rise by 8-10% in 1979. Sales of rough gem and industrial diamonds through De Beer's Central Selling Organization (CSO) during 1978 totalled $2,552 million compared to $2,073 million in 1977 and $1,803 million in 1976. De Beer's total diamond production in 1978 amounted to 12 million carats. It hopes to raise capacity to 19 million carats by 1983. Production from the Namaqualand mines in South Africa now matches the output from De Beer's mines in Namibia. Mining operations in Namibia account for 20% of De Beer's net profits. Approximately 65% of profits go to Namibia. Production in Botswana has been steadily increasing. The two mines in Botswana (Orapa and Letlhakane) both jointly owned De Beers and the Botswana Government, now produce nearly 3 million carats between them. Orapa, the largest, is forecast to raise its production from 2.5 million carats to 4.1 million carats by the end of 1979. The Jwaneng Mine in Botswana will soon be in production. The Botswana Government receives 75% of all diamond profits.

The De Beer's Group, of which Anglo American is indirectly the majority shareholder, has made substantial progress towards the elimination of racial discrimination in its mines. Job evaluation on the mines in South Africa and Namibia has resulted in the introduction of an integral wage scale for all employees.

Krugerrands

Sales of Krugerrands reached an all time record of just over six million coins in 1978, earning South Africa R1,045 million in foreign exchange. Sales since 1970 now total 22.5 million coins which represents 700.5 tonnes of gold, equivalent to South Africa's entire gold output in 1977.

Aggressive marketing, especially in the United States and West Germany, has been responsible for the growth of Krugerrand sales. In 1970, Krugerrands accounted for 0.7% of total gold production and 0.2% of South Africa's total exports. By 1975, those shares had risen to 21% and 9.3% respectively. Sales fell the following year, mainly as a result of Britain's ban on importing Krugerrands. By 1977, the market had partly recovered with Krugerrands accounting for 14.9% of gold production and 4.8% of total exports. Last year Krugerrands took a record 27.1% of production and 9.5% of exports.

Platinum

In 1978, platinum was South Africa's third largest export. Approximately 50% of platinum production now comes from Bophuthatswana, the newly Black independent state, but all production is handled by the South African producers. The South African mines produced 2.6 million ounces in 1978. The market for platinum is increasing. Due to the strict exhaust control regulations in the United States, imports of platinum from South Africa have risen considerably. Platinum is also now being used as a catalyst in oil refining and in fuel cells. The best market is Japan which accounts for 45% of South Africa's total platinum output.

Mineral sales – a forecast

From 1952 to 1977, the value of the country's mineral sales totalled R50 billion in 1977 price terms. Precious metals accounted for 73% of the total revenue with gold alone providing 63%. The Chamber of Mines estimates that annual sales of minerals will total R10 billion a year by 1987. A new area for demand will come from third world countries, who will become important consumers of minerals as they gradually industrialize. But South Africa's ability to raise extra capital will determine its ability to expand future output.

The Chamber forecasts that gold will continue as the major source of revenue but its share declining to 36% of total sales by 1987. Coal exports are expected to increase from 12 to 44 million tonnes a year to 1987 with its share of total mineral revenue rising from the present rate of 17% to 23%. Gold, uranium and diamonds together are forecast to continue providing 70% of total revenue. Processed mineral products, including ferrochrome, ferromanganese, electrolytic manganese, phosphoric acid and titanium slag which accounted for R1,748 million in 1977 representing 24%, are expected to grow rapidly rising to R3,300 million or 30% by 1987.

Balance of payments

There was an outflow of R1,370 million on the capital account in 1978 of which R896 million was short-term. Public corporations, local authorities and the private sector experienced a substantial inflow of capital but this was not sufficient to neutralize the capital outflow. On the short-term account, the outflow in 1978 was four times the outflow in 1975. There has now been an outflow each year since the inflow of R53 million in 1974, reflecting the uncertainties of the economy and the political problems such as the Soweto riots in 1976. Large amounts of capital is leaving the country illegally. The government has set up a Commission to enquire into the illegal outflow. Short-term capital movements in the private sector, including unrecorded transactions totalled R1,175 million in 1978 which followed a similar outflow of R1,017 in 1977 and R584 million in 1976. The positive balance of payments contributed towards a positive change in the gross gold and other foreign reserves of R1,442 million in 1978. Reserves at the year-end stood at $1,658 million.

In 1978, the United States replaced Britain as South Africa's main trading partner. West Germany remains South Africa's main supplier. Combined imports from and exports to Britain, excluding gold, oil and defence imports, totalled R2.26 billion compared to R2.34 billion with the United States. Britain's imports from South Africa fell 8.4% in value to R1.22 billion, whereas US imports grew by more than 70% to R1.35 billion mainly through increased sales of Krugerrands and price increases in diamonds and platinum. Britain's imports of minerals and agricultural products declined.

Imports from West Germany increased by 37% to R1.27 billion to keep it as the largest supplier, a position it has held since 1974. Three countries which have substantially increased their trade with South Africa are Argentina, Switzerland and Israel. Imports from Argentina, although only R9.8 million, have risen 100% in 1978. Tourism has also boomed between the two countries. Sales of Krugerrands resulted in a 113% rise in exports to Switzerland to R463 million. Israel is now South Africa's second fastest growing export market, accounting for exports of R58 million. Trade with Israel will increase further. South Africa will soon be supplying coal.

Investment

New construction prospects look bleak again this year according to the Stellenbosch Bureau for Economic Research who monitors the building industry. In volume terms, Stellenbosch forecasts non-residential public building to rise by 6% but the private sector to decline by 19% after a fall of 18% in 1977. The fourth quarter 1978, did however, suggest the turning point of the building cycle but the industry remains in the process of bottoming out.

The government's only major investment is now the extension of Sasol 2 at an estimated cost of R3,276 million. Escom, however, will be spending R8 billion on expansion in the next five years.

Inflation

Dr. Johann Cloete, chief economist of Barclays National Bank, is critical of government policy. He believed that an official income's policy should be added to its monetary and fiscal policy. "It must combine all three policies," he said. "In Pretoria, the government does not like to admit that it actually has an income's policy. Growth this year and next will be inhibited by inflation. I expect inflation at 12% this year. The gold price will provide the buffer against increasing oil prices, but if the gold buffer falls away then the inflationary effect on the economy would be very adverse," he said. Cloete was also critical of policy when the economy went into recession. "We should not have sat on the economy after it overheated," he explained. "We should have adjusted for 3-4% growth. The government wanted to buckle its belt. It got it wrong. Instead, it should have adjusted to a smaller growth rate. The country is over-controlled at the moment and the government should re-educate itself. It is not possible for us to get back on the 7-8% growth path again but with the right policies we could achieve 3-4% each year.

Unemployment

There are no proper estimates of Black unemployment. Unofficial estimates are as high as two million. The three most important methods currently used to measure total unemployment include the registration method, the continuous population survey and the residual method. Unemployed Whites, Asians and Coloureds register with the Department of Labour and Blacks with the Administration Boards who then pass on the information to the Department of Plural Relations and Development. Over time, the counting of Whites, Asians and Coloureds has proved an accurate indicator. Changes have closely matched changes in the business cycle.

The Department of Statistics started a continuous population survey in the second half 1977 that initially covered Blacks and later Coloureds. It has not yet provided an accurate indication of the trend of unemployment. Unemployment in the Black independent states of the Transkei and Bophuthatswana are excluded. Black school teachers play a major part in the counting. While visiting outlying dorps (villages), teachers record unemployment data.

Using this method, and making estimates for previous years unemployed in South Africa increased from 200,000 in 1970 to 800,000 in 1978 or from 3% of the working population to 9.5%. For various population groups the figures were: Whites 0.3% and 3.6%, Coloureds 1.6% and 11.1 %, Asians 1.4% and 9.2% and 4.1% and 11.1% for Blacks.

Unemployment of Whites, Coloureds and Asians peaked at 34,191 in December, 1977. During 1978, unemployment averaged between 30,000- 31,000 a month. In January 1979, the total was 28,614 the lowest monthly figure since April 1977. The level is still falling and shortages are now occurring in certain industries.