| Authors | |

|

Mariyam Baig, EMEA Treasury Advisory Group, Treasury and Trade Solutions, Citi |

|

Dr. Duncan Cole, EMEA Head Treasury Advisory Group, Treasury and Trade Solutions, Citi |

|

Erik Johnson, |

The latest findings from the Citi Treasury Diagnostics (CTD) survey [1] highlight key trends among Citi’s global clients in areas such as digitization, including opportunities arising from real-time treasury technology. Approximately 400 participants took part in the study across a wide range of company sizes, geographies and industries.

Positive correlation exists for both revenue and earnings before interest, tax, depreciation and amortization (EBITDA) with the treasury effectiveness scoring from the CTD survey. The chart below shows the compound annual growth rate (CAGR) of both revenue and earnings as the performance of corporate treasuries increases. The top 25% of performers as measured by the diagnostics show an EBITDA CAGR and revenue CAGR of 7.98% and 5.72% respectively. In addition, irrespective of industry, the revenue to EBITDA ratio increases significantly (1.07 to 1.40) between the bottom 25% and the top 25% of treasuries measured.

The benchmark performance of treasury is an effective indicator of its ability to add value to the firm’s bottom line.

We can conclude from this observation that the benchmark performance of treasury is an effective indicator of its ability to add value to the firm’s bottom line.

Evolving ecosystems: are treasury management systems meeting treasury’s needs?

Despite the increasing recognition of technology as an important enabler, approximately half of the survey’s participants reported that their treasury management systems (TMS) do not fully support financial risk management processes.

Many companies need to consider making material changes to optimize their treasury and financial technology core infrastructure.

63% of respondents noted that their TMS was either not integrated or only partially integrated with their enterprise resource planning (ERP).

77% reported that they lack full integration of their ERP and TMS infrastructures with banks.

Respondents are starting to embrace new technologies for efficiency and integration, with 58% leveraging robotic process automation and 54% using application programming interfaces.

Looking ahead, 54% of respondents call for continuous improvement in operational treasury efficiency. Companies are also looking to banks as key partners in their journey to transform treasury, with 79% of respondents highlighting an intent to acquire innovative solutions.

Technology to support treasury continues to be a core priority. With the digital advances taking place, deciding how best to invest resources is now a core challenge.

Sourcing innovation: who is best placed to support with new technology?

As new treasury technology capabilities come to market, corporates will look to their trusted partners to bring them the latest innovations. In many instances, clients want established partners to deliver the latest solutions rather than engaging directly with new players such as fintechs: 79% of respondents identified banking solutions providers (and 58% ERP/TMS providers) as potential drivers of treasury transformation. A coherent roadmap for adopting these new technologies ‒ developed through a dialogue with trusted advisers ‒ will be essential to successfully navigate a rapidly changing landscape.

Treasury policies: are objectives aligned with practices?

While companies are becoming more effective at aligning policies and practices, their key risk management objectives remain similar to those of the recent past. A total of 63% of companies reported that reducing volatility in earnings and cash-flow was a key risk management objective. However, just 12% of respondents directly hedge earnings translation exposures. For some companies, hedging may be unnecessary as they have limited FX exposure but this is not the case for the vast majority of companies.

A board-instigated policy review is a priority this year. An important driver is to ensure FX policy is aligned with the firm’s broader risk management objectives.

Managing cash flow uncertainty: are options the new norm?

Along with the inability to quantify the FX risk in their TMS system cited by 45% of survey respondents, 81% of corporates surveyed follow a rolling, static, layered or opportunistic approach toward hedging forecasted exposures. Moreover, any hedging programmes continue to be short term in nature: most companies focus on a three- to six-month outlook owing to lack of visibility and connectivity. As a result, the number of companies realizing significant economic and risk-reduction benefits is limited. Over half of respondents reported analyzing hedging performance on a monthly basis.

Half of the survey respondents allow option-based strategies despite relatively low FX volatility. One possible driver for this is corporates’ eagerness to retain flexibility. Many experience challenges in cash-flow forecasting and visibility and are consequently concerned about missing targets and taking P&L losses because they may have hedged for the wrong duration or currency. Options offer a way to mitigate such challenges.

Centralization of cash and risk remain key: where are the opportunities?

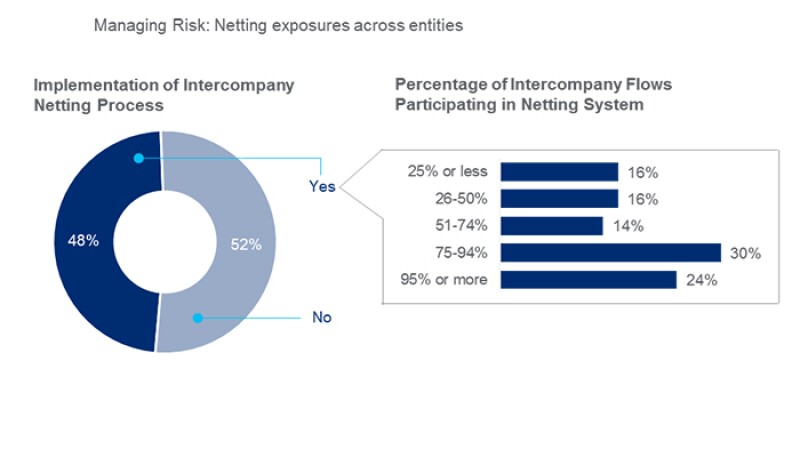

Of the companies surveyed, 80% reported managing risk on a centralized basis using constructs such as netting, in-house banks and shared service centres. However, perhaps surprisingly, more than half of respondents have no intercompany netting process ‒ a system that acts as a natural risk management technique by netting exposures across entities. Even among those firms that do this, only 54% include more than 75% of intercompany flows in their netting system. For many companies, the absence of an intercompany netting process (or its limited use) is a significant missed opportunity.

More importantly, treasury’s role in relation to working capital continues to increase: more than 80% of respondents said that treasury is involved in working capital in some capacity. For some companies (31%), treasury is central to working capital management, with full visibility over commercial activities.

The employment of working capital optimization programmes varies considerably by industry, but overall, 37% of respondents have deployed supplier financing and 32% the sale of receivables. Given the impact that improvements in working capital can have on the overall financial performance of a company, treasury’s increasingly strategic partnership with the business is expected to grow further.

Furthermore, 91% of respondents use cash-flow forecasting. Somewhat surprisingly, however, given the importance placed on effective cash-flow forecasting, 72% of survey respondents reported that inputs are compiled manually, possibly reflecting underlying inadequate or outdated infrastructure.

Managing and reducing forecasting error will be a core key performance indicator for many leading global treasuries in the next three to five years.

Conclusion: getting the basics right is a prerequisite for innovation

Despite continuing hype over emerging technologies such as artificial intelligence, machine learning and blockchain, getting the fundamentals right remains the primary focus for treasury. Some companies have started on the journey to remedy their fragmented technology and data landscape as a prerequisite to embracing predictive and prescriptive analytics in treasury. Others are naturally benefiting from emerging technology opportunity through scheduled upgrade of incumbent technology. Further insights into the responses of treasury technology vendors can be found in our recent collaborative The Future of Corporate Treasury white paper.

[1] Source: Citi Treasury Diagnostics Survey (2014-2018)