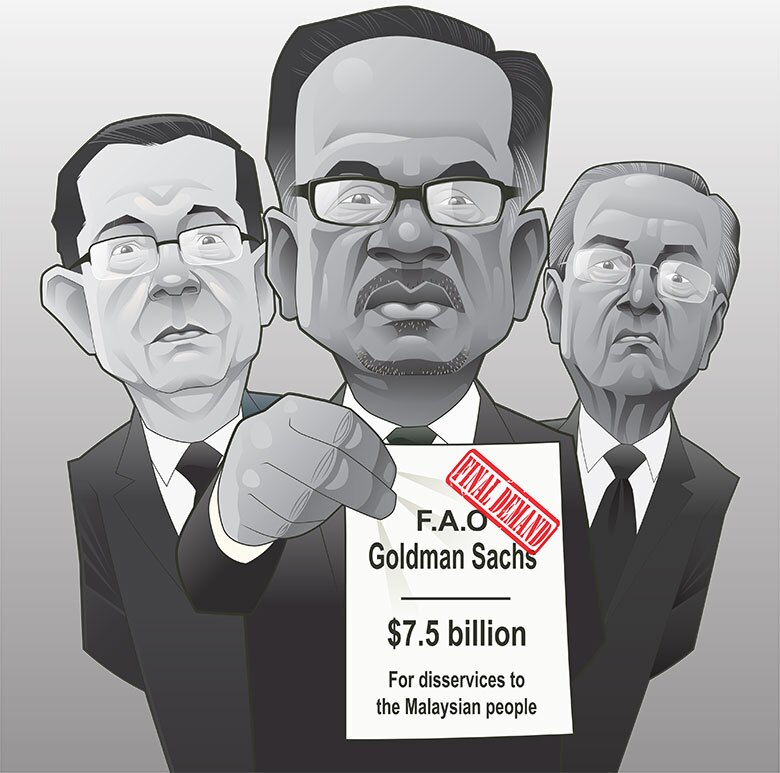

Anwar Ibrahim, Malaysia’s charismatic ‘man who would be leader’, is very clear and very insistent. And Goldman Sachs’ chief executive David Solomon, among others in international banking and finance, would be well advised to take heed.

“Goldman Sachs has to pay,” Anwar declares, during an expansive interview with Euromoney in Kuala Lumpur in mid November. “It’s just not what was taken but also what we lost.”

Anwar is talking, of course, about the deep, still-weeping wound that has infected Malaysia’s economy and politics for much of the last decade, the systemic official pillaging of as much as $10 billion from one of the country’s state-owned investment companies, One Malaysia Development Berhad, better known by its now notorious initials, 1MDB.

Anwar is not the only powerful Malaysian with an axe to grind with Goldman. Finance minister Lim Guan Eng is similarly aggrieved.

“Goldman Sachs should give us back our gold,” he tells Euromoney bluntly.

Why should Solomon and Goldman care what these men say? There are three principal reasons.

Goldman has a $7.5 billion hangover headache in Malaysia that only seems to be getting worse. The US investment bank trousered as much as $600 million in fees in the 1MDB free-for-all that partied through 2012 and 2013, when it raised $6.5