The most recent projections published by The International Air Transport Association (IATA) suggests the global airline industry net profit will rise from the $34.5 billion expected in 2017 to a forecast figure of $38.4 billion in 2018. The boost in net profit is being fuelled by robust demand, reduced finance costs and operational efficiencies, and will translate to the fourth consecutive year of sustainable profits for the airline industry.

The positive macro fundamentals underpinning the airline industry growth have also benefitted the aviation finance industry. Lessors have experienced strong demand for narrow body jets by both airlines and investors, and new-order delivery lags suggest that there is no sign of such demand abating in the near-term.

That said, lessor optimism emanating from the forecast profit projections and strong macro demographics has been tempered by the challenges which the industry faces.

The profitability outlined above has improved the airline industry’s credit profile, which, together with increased liquidity and investor appetite, has contributed to lease rate compression in recent periods, impacting lessor margins.

The recent airline struggles of Air Berlin, Alitalia, Monarch, and VIM have provided a timely reminder of industry fragilities. International and US tax reform, cost pressures from infrastructure, labour and potentially fuel, and competitive pressures provide further headaches.

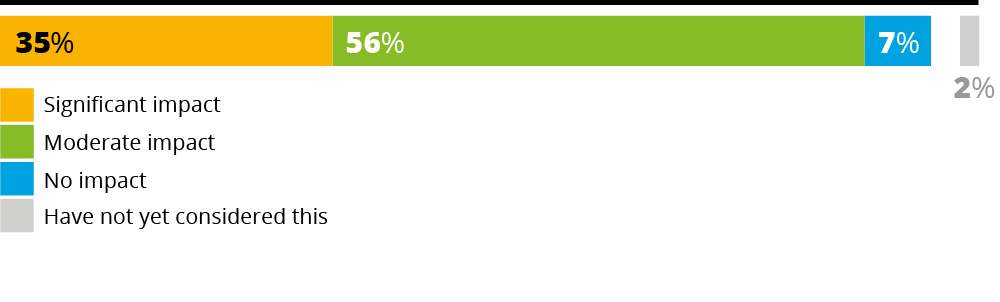

And finally, IFRS 16 Leases is just around the corner (effective for annual periods beginning on or after 1 January 2019), which the industry consensus suggests will have a notable impact from both an operational, reporting, and implementation perspective.

The path to issuance of IFRS 16 has been long and winding, initially being added to the IASB’s agenda in July 2006.

But what does IFRS 16 hold in store for the aviation finance industry? It is clear that the impact on airlines is far more pronounced than their financing partners. Substantial new assets and liabilities will appear on airline balance sheets, while reported profit and performance measures will be impacted.

Perhaps most significantly, the impact on individual airlines will depend on their particular financing and leasing structures, and may be very different from the impact on their peers.

It is less clear how the market will approach the key judgement areas in the standard such as the discount rate assumption which may have the largest quantitative impact on the lease asset and liability valuations, and how the market will perceive, and respond to, the anticipated impacts.

To provide perspective on the market sentiment, Deloitte and Euromoney Institutional Investor Thought Leadership have teamed up to prepare this report on the impact of IFRS 16 on the aviation finance industry.

The report contains perspectives gleaned from 381 senior executives surveyed from the aviation finance industry as well as in-depth interviews conducted with senior industry executives and independent experts. It provides fascinating insight on the operational, financial and implementation challenges which the standard presents.

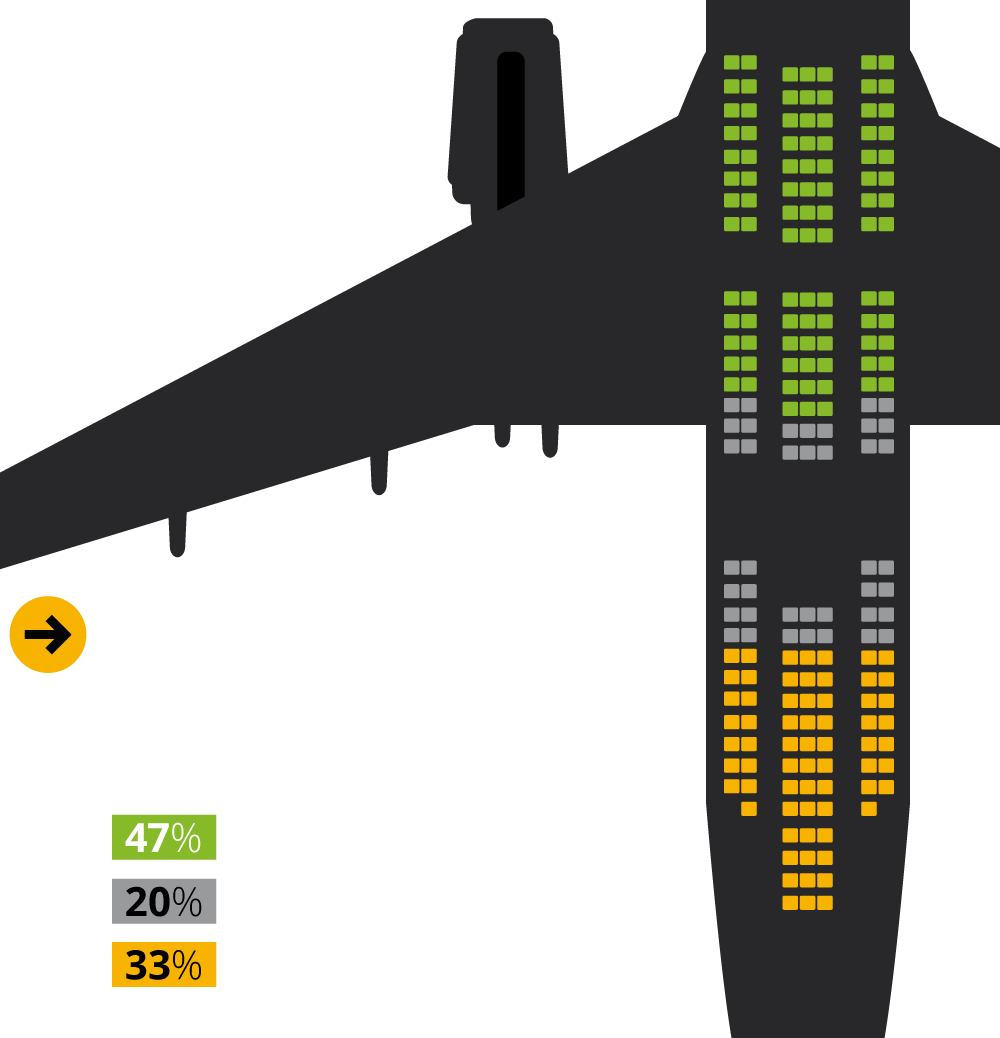

Respondents suggest that the influence of IFRS 16 will extend far beyond financial reporting concerns, with 59% of airlines believing the standard will have a significant impact on their business.

I expect that professionals and stakeholders in the aviation finance industry will find this work insightful at a time when the industry is charting its course through the adoption of this new reporting framework.

The introduction of the new accounting standard IFRS 16 will reshape the balance sheets of most companies that rent valuable equipment. Airlines will be particularly affected once the international standard takes effect from January 2019, and preparations are well underway for the new reporting challenges.

However, the impact of IFRS 16 could extend beyond accounting and into the commercial decisions of airlines, lessors and financiers. By forcing airlines to recognise lease payments as liabilities, IFRS 16 threatens to change their approach to fleet planning, or to how they structure their leases.

Euromoney Institutional Investor Thought Leadership has worked with Deloitte to examine the impact and likelihood of these changes, and what they mean for different stakeholders, with particular attention paid to the often contrasting views of airlines and lessors.

Drawing on a worldwide survey of 381 senior executives involved in the sector, as well as in-depth interviews with nine experts at leading airlines, lessors and financiers, its key findings are:

Most airlines (59%) believe IFRS 16 will have a significant impact on their business. Understandably, airlines that rely heavily on leased aircraft are more likely to predict this.

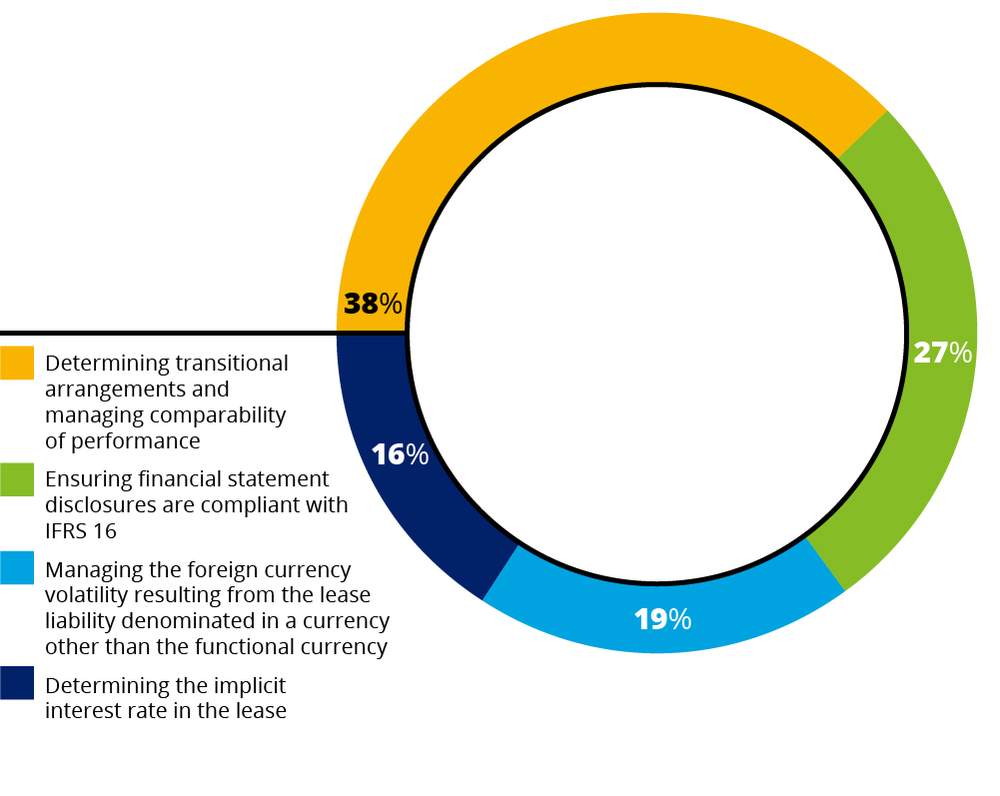

Among airlines’ top concerns are transitional arrangements, the review of existing lease and finance data, and renegotiation of lease contracts.

The bulk of the rest of the industry expects only a moderate impact. This is unsurprising, given that IFRS 16 principally overhauls accounting for lessees, not lessors, only 38% of which think that IFRS 16 will seriously affect their business.

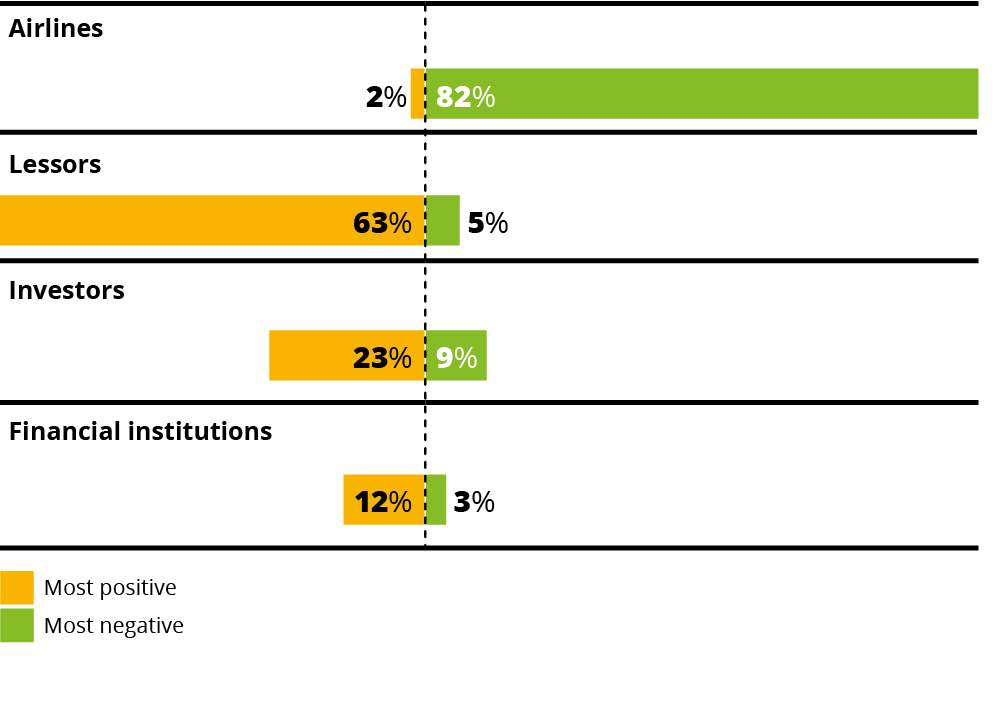

A related finding is that 82% of respondents expect IFRS 16 to be more negative for airlines than for lessors, investors or financial institutions.

Lease contracts are expected to change in the wake of IFRS 16. Airlines (90%) and lessors (74%) say they will need to renegotiate existing leases as well as create new standard terms.

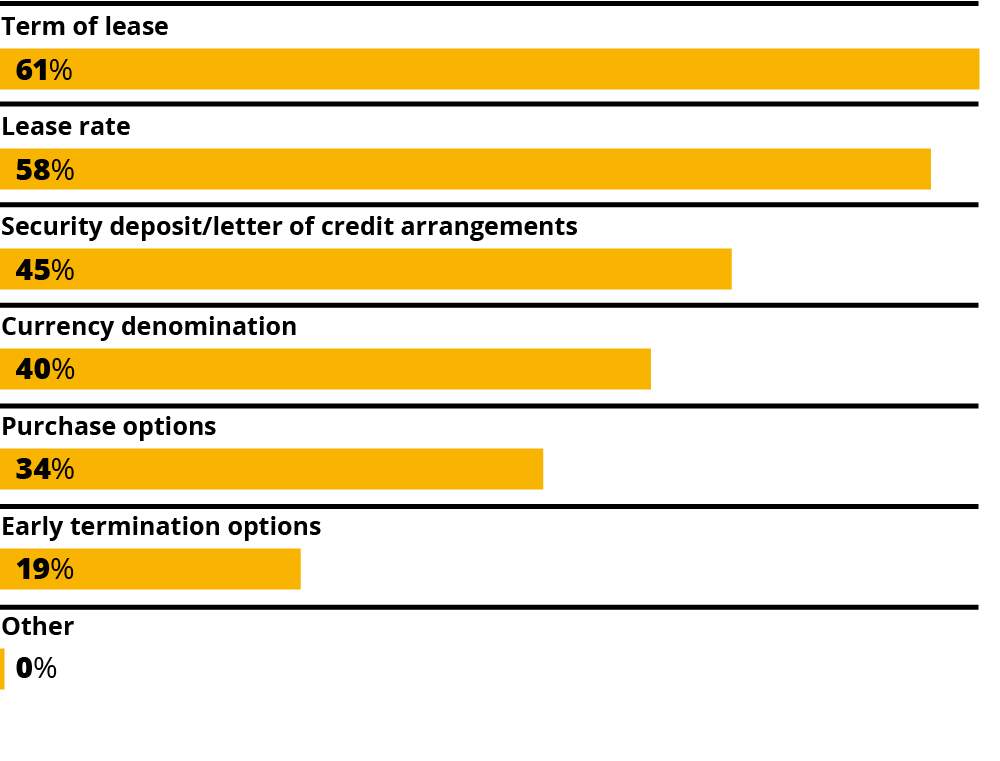

Industry experts interviewed for this report say lease durations could become shorter as airlines seek to reduce liabilities and minimise IFRS 16’s impact on leverage ratios. Respondents agreed, highlighting lease tenors and lease rates above other factors likely to change in lease contracts.

Some lessors interviewed for this report, however, promise to resist any changes to lease contracts – a potential source of tension with airlines in the wake of IFRS 16.

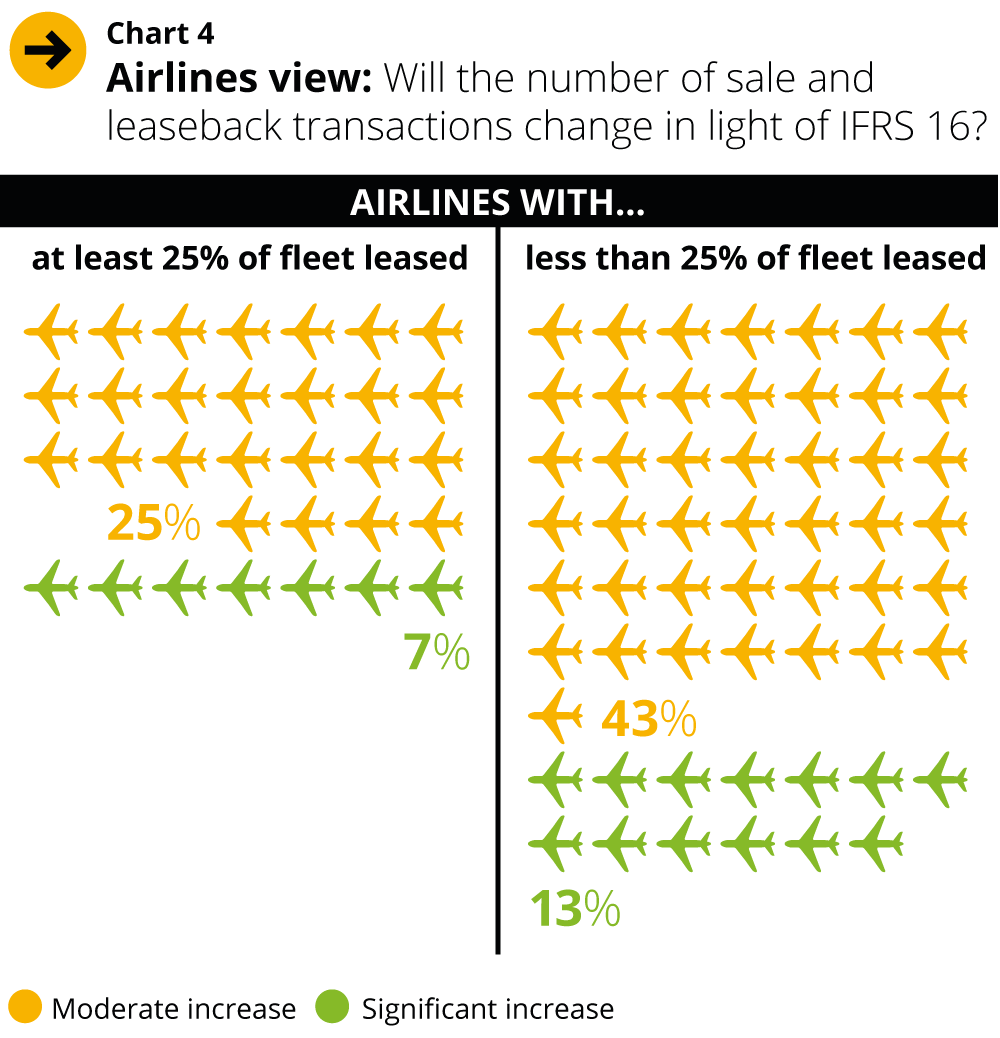

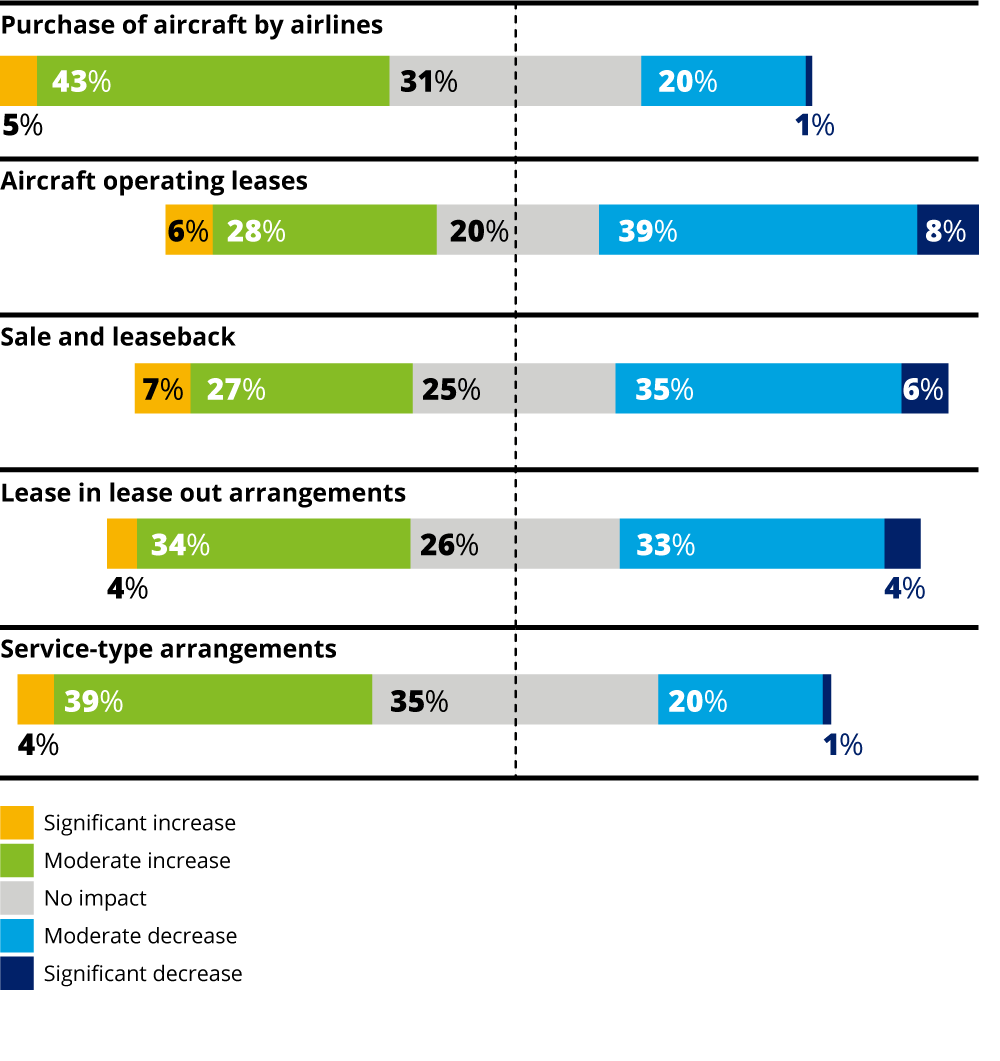

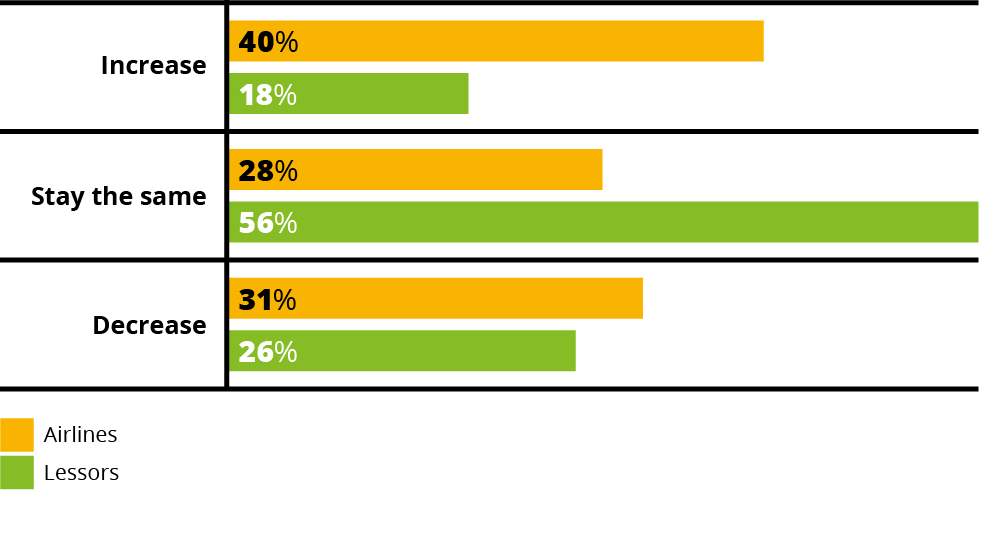

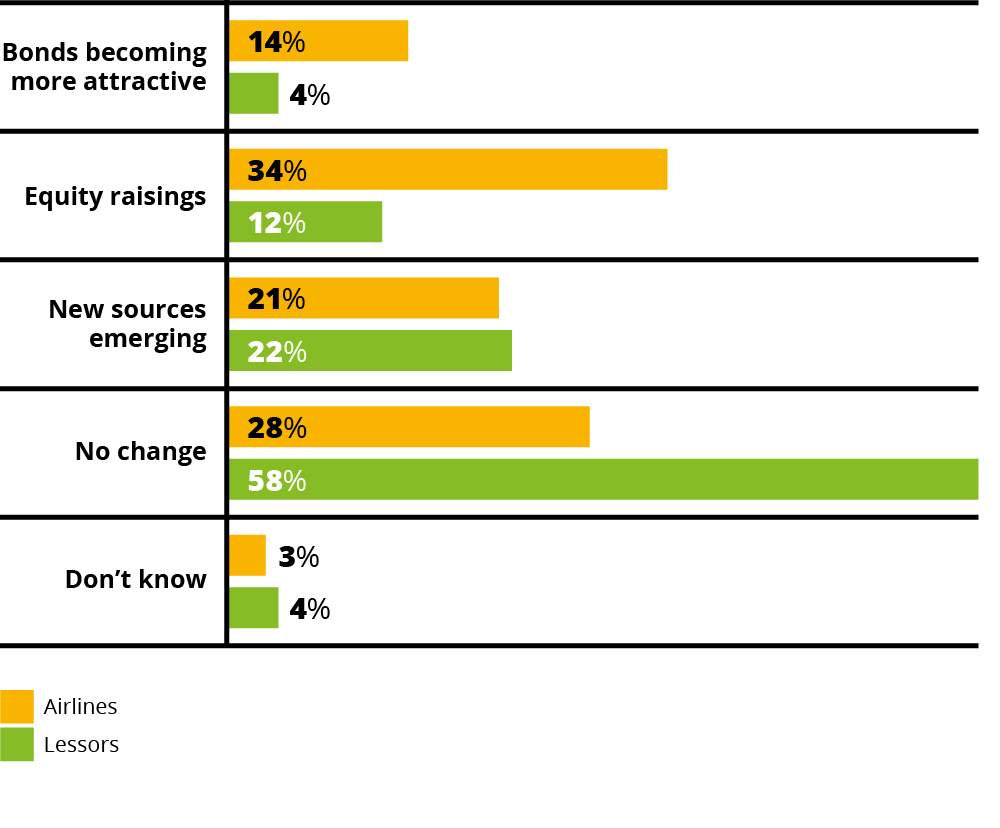

There are mixed views on the impact of IFRS 16 on leasing volumes. While a significant number of survey respondents predict that operating lease and sale-leaseback volumes will fall in light of the new accounting standard, most expect no change or even an increase in leasing activity.

However, opinion is weakly held and varies according to stakeholder. Airlines are as likely to predict a rise as a fall in operating leasing after IFRS 16, while lessors veer more towards a fall. Lessor interviewees, in contrast, appear sure that the advantages of leasing will override any concerns about its accounting treatment.

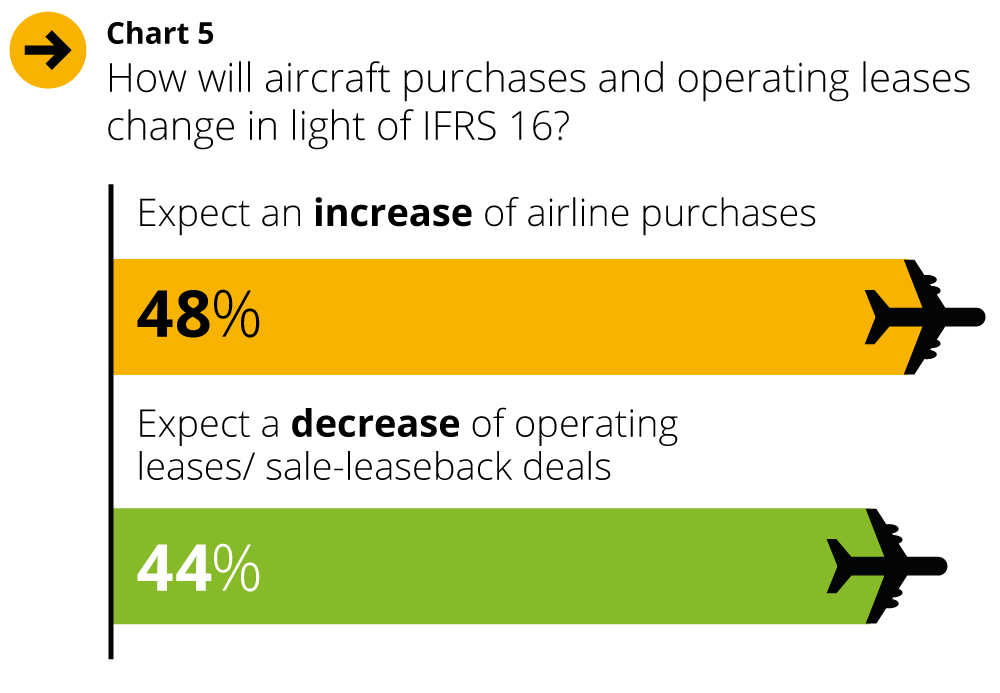

Taken together, 44% of respondents think that IFRS 16 will herald a decline in sale-leaseback or operating lease deals.

This aligns roughly with the 48% of respondents who say that IFRS 16 will prompt airlines to purchase more aircraft themselves.

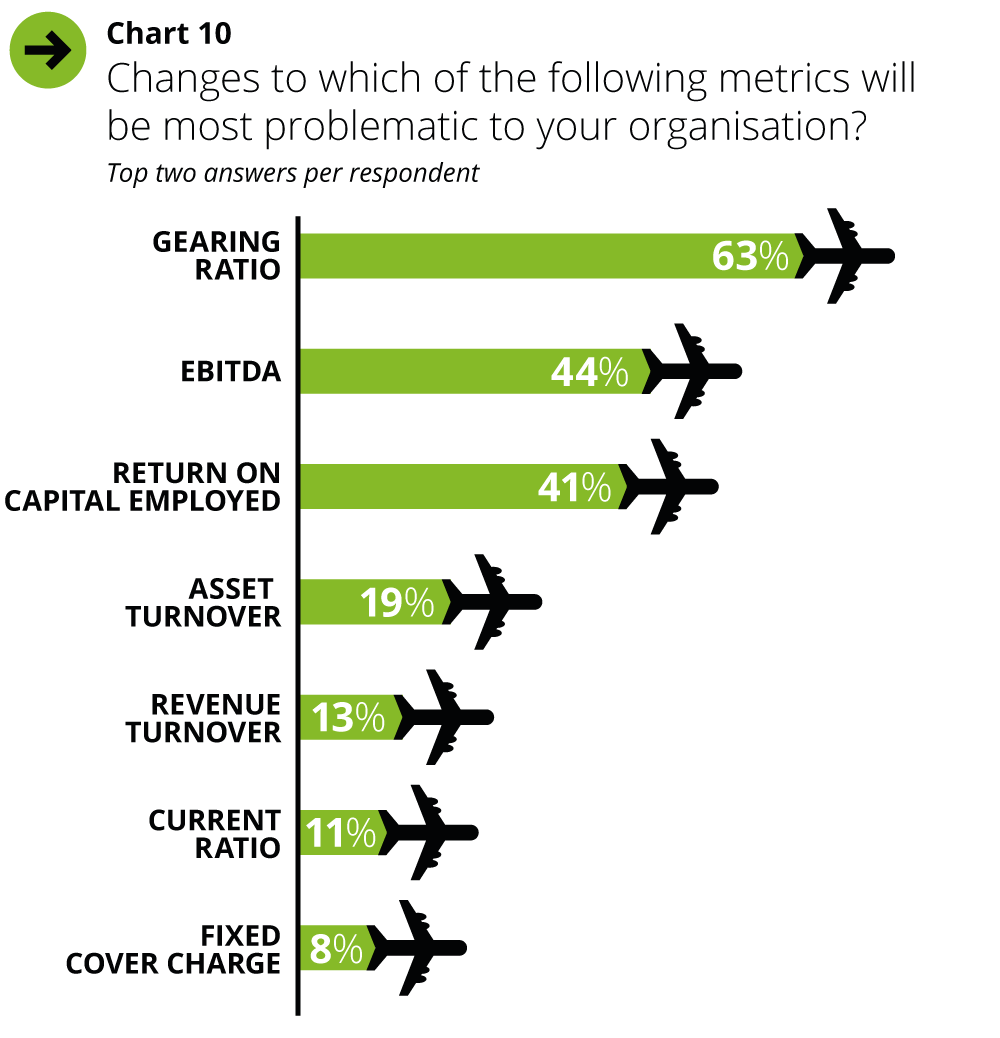

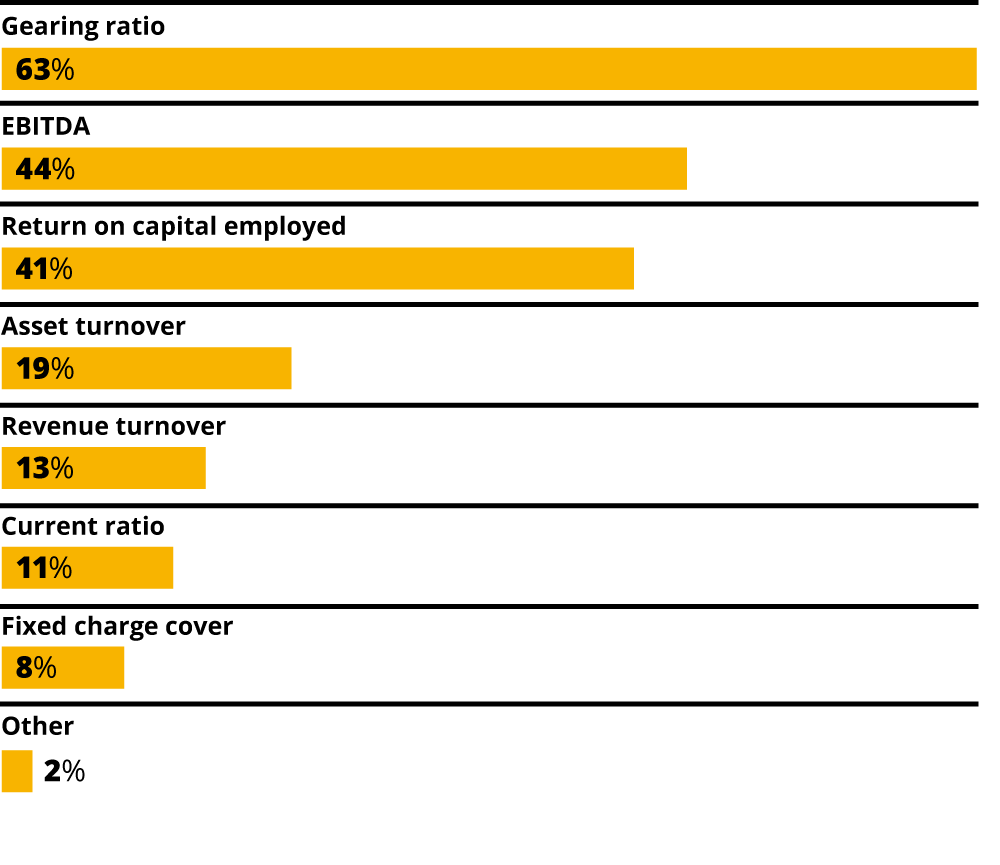

IFRS 16’s impact on gearing ratios could be particularly problematic. While the new accounting will alter a host of key performance metrics, 63% of the wider aviation finance industry and, in particular, 69% of airlines are most concerned by changes to leverage ratios.

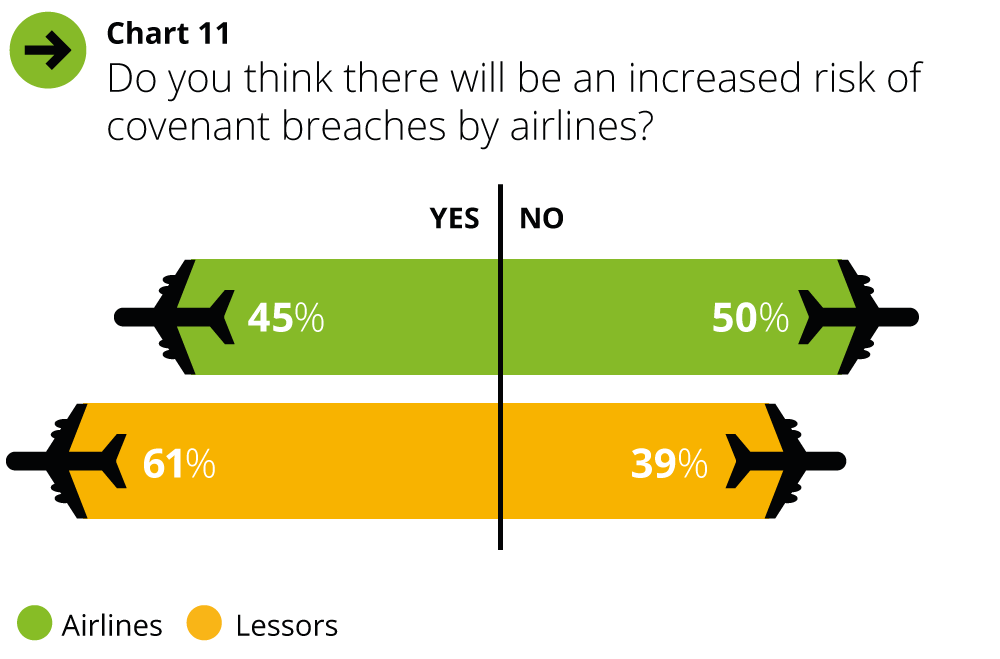

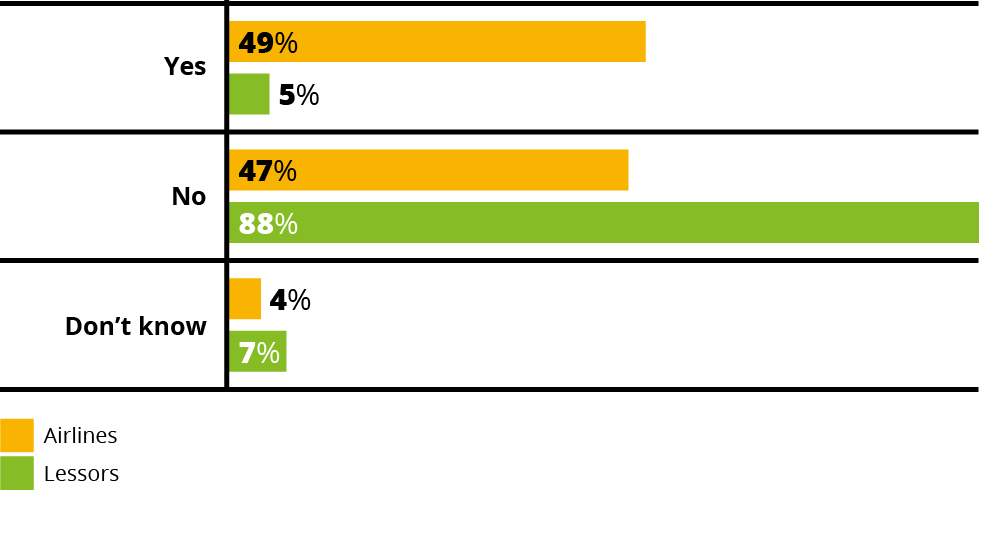

Airlines worry this might breach debt covenants, or increase borrowing costs. Almost half of survey respondents, including 61% of lessors, think that IFRS 16 raises the risk of covenant violations by airlines.

Financiers interviewed for this report counter that most covenants already account for the impact of operating leases on debt, although they concede it will be time-consuming to ensure this is the case.

Whatever the impact, there is broad agreement about the complexity of re-negotiating finance and lease contracts. A third of airlines and 23% of lessors say this will be very challenging, while most of the rest predict some difficulties in doing so.

Currency volatility under IFRS 16 accounting is a concern for airlines, particularly those that lease more heavily. Most leases are paid in dollars, but these payments – recognised as liabilities under the new standard – must be converted to the local currency of an airline, pushing additional foreign exchange volatility through its profit and loss statement.

Managing this extra volatility is the most significant challenge of IFRS 16, say a fifth of airlines. Furthermore, currency denomination is among the lease terms most susceptible to change due to IFRS 16, according to those carriers that rely more heavily on leasing.

The extent to which airlines alter aircraft procurement due to IFRS 16 also depends on their motivation to lease. For while it’s cheaper to buy than rent in the long run, operating leasing provides flexibility and a route to rapid expansion – advantages that many airlines are unlikely to forego.

It’s also the case that most industry observers already adjust airline debt to include operating lease liabilities, so there is less incentive for airlines to rent fewer aircraft after IFRS 16.

On the other hand, certain airlines value balance sheets with lower debt. One reason for this preference might be the location of the airline or its financier, Marc Bourgade, Chief Executive Officer of Stellwagen Finance, points out: “In some countries local banks are not aviation professionals and do not re-integrate operating leases into the debt.”

To find out how IFRS 16 changes lease accounting, the burden these changes impose and how different stakeholders are likely to respond, Euromoney Institutional Investor Thought Leadership has worked with Deloitte to produce this report. Special attention is reserved for the impact on lease structures and aircraft finance, as well as the contrasting views of airlines and lessors on all of the above issues.

Perhaps the key question surrounding IFRS 16 is whether its reporting impact could influence commercial decisions. In particular, might it dissuade airlines from leasing aircraft, or make them seek different lease terms?

It’s worth noting that while the industry appears confident in its understanding of IFRS 16’s accounting implications, there is much less consensus about the standard’s operational impact.

Lease or buy?

Almost half of survey respondents believe IFRS 16 will lead to some fall in operating lease deals, but more predict no change or even an increase in activity (chart 3).

Despite such uncertainty, IFRS 16’s impact on operating leasing is “not something we are overly concerned about,” says David Breen, Head of Finance for Dublin-based lessor Avolon.

“Commercial decisions will still be made by airlines in terms of buying or leasing and this change in the accounting treatment should not be a significant component of an airline’s decision,” he adds.

Colm Barrington, CEO, Fly Leasing

Colm Barrington, CEO of Fly Leasing, agrees. By leasing “you are reducing your residual exposure and getting another source of financing as a way to get aircraft quickly – those factors will be more important to airlines than anything IFRS 16 will do to them,” he says.

While more expensive in the long run, operating leasing provides several advantages to finance leases or outright purchases, including flexibility, quicker access to popular aircraft types and lower initial capital outlay. Rapidly expanding operator Norwegian leases almost half its aircraft, and CFO Østby says the airline is “committed to how we finance our fleet”.

Air France-KLM has about 40% of its fleet under operating lease, a ratio it wants to decrease, although that is “not directly linked to IFRS 16,” says Marie-Agnès de Peslouan, Head of Investor Relations for Air France-KLM.

“We do not decide to have aircraft in operating lease because of the accounting treatment,” she says.

“We have noted from our discussions with airlines the cost and effort of implementing and complying with IFRS 16,” says Natixis' aviation finance expert Woon.

Since IFRS 16 makes only minor changes to lessor accounting, airlines bear most of the burden of implementing the new standard. Investors and lessors must ensure their staff can understand changes to lessees’ books, of course, but only a small minority find this a serious challenge.

Most airlines must implement IFRS 16 from 1 January 2019, and even though the implementation date has been known for almost two years, one in every five airlines is uncomfortable about meeting the deadline.

It is also worth noting that 20% of airlines don’t plan any changes to their reporting, a reflection of the fact that IFRS 16 – despite its intention to harmonise lease accounting – is not universally applicable.

Séverine Guffroy, VP Accounting, Air France-KLM and Chairwoman, IATA Accounting Working Group

The US, for instance, will not adopt IFRS 16. Its related standard – ASC 842 – also puts operating leases onto the balance sheet, but doesn’t significantly change P&L reporting.

“Presentation of the income and cash-flow statement will not be the same at all,” says Air France-KLM VP Guffroy.

“If we want to compare Air France-KLM with Delta – one of our biggest partners – it will not be possible without a restatement of the accounts of Delta or of Air France-KLM,” she adds.

Adoption methodology

Although IFRS 16 contains measures for early adoption, only a handful of airlines are taking that path. Air France-KLM is one, and plans to report in accordance with IFRS 16 from January 2018.

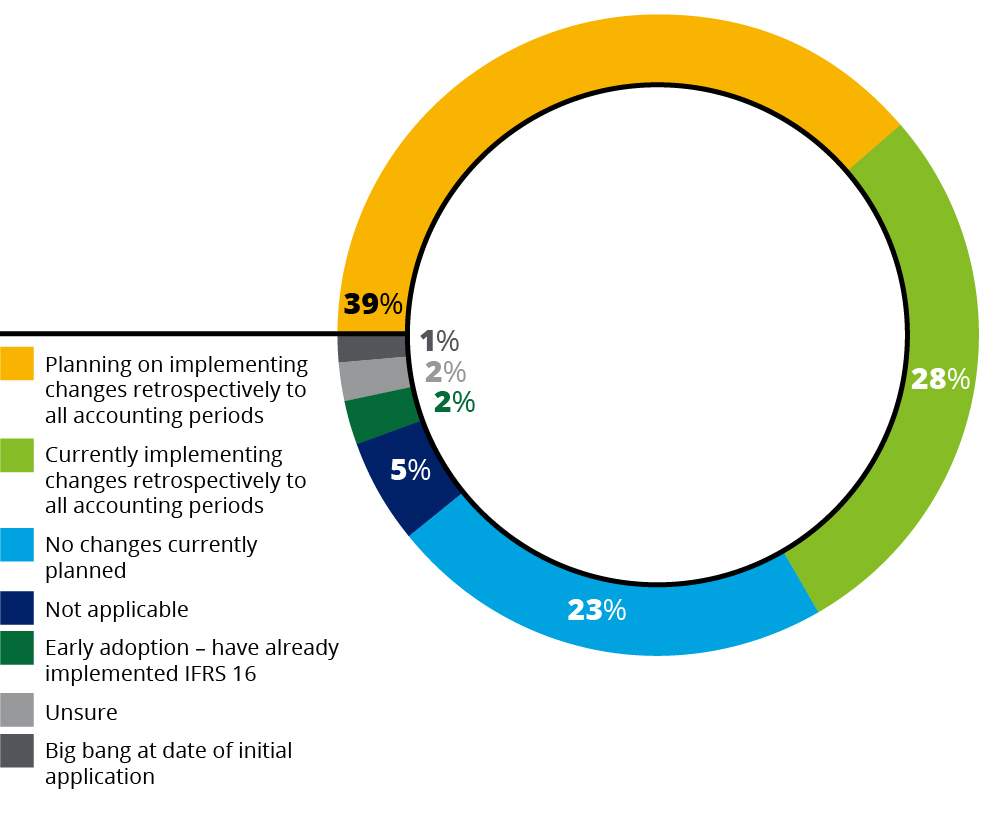

Overall, 75% of airlines in our survey are either planning to, or are currently implementing retrospective changes to past accounting periods (chart 12).

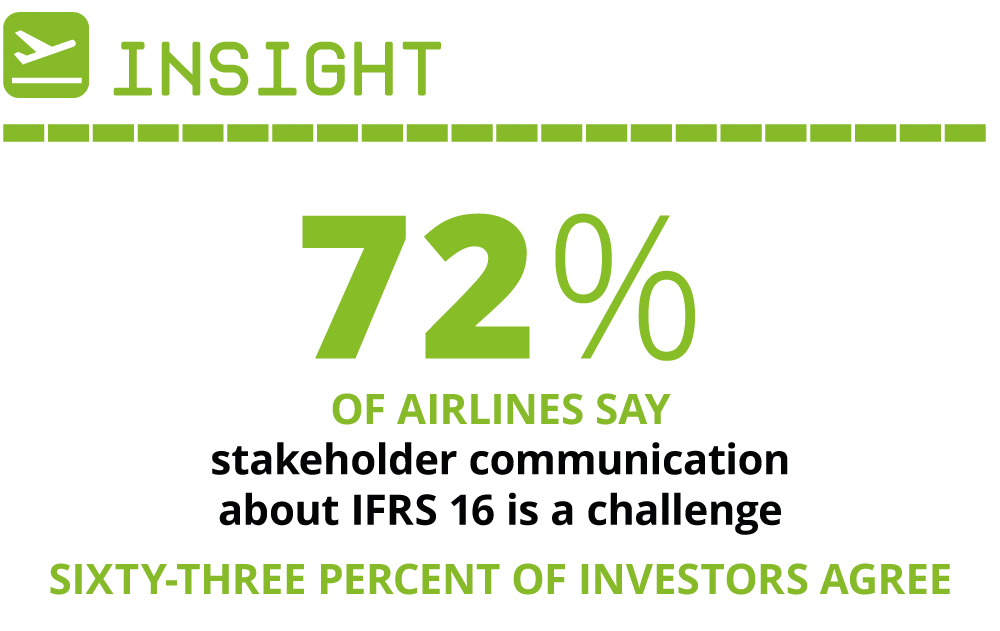

Implementation of IFRS 16 is clearly a huge task for airline accountants. The new standard makes profound changes across balance sheets and income statements, all of which must be carefully applied and explained to investors.

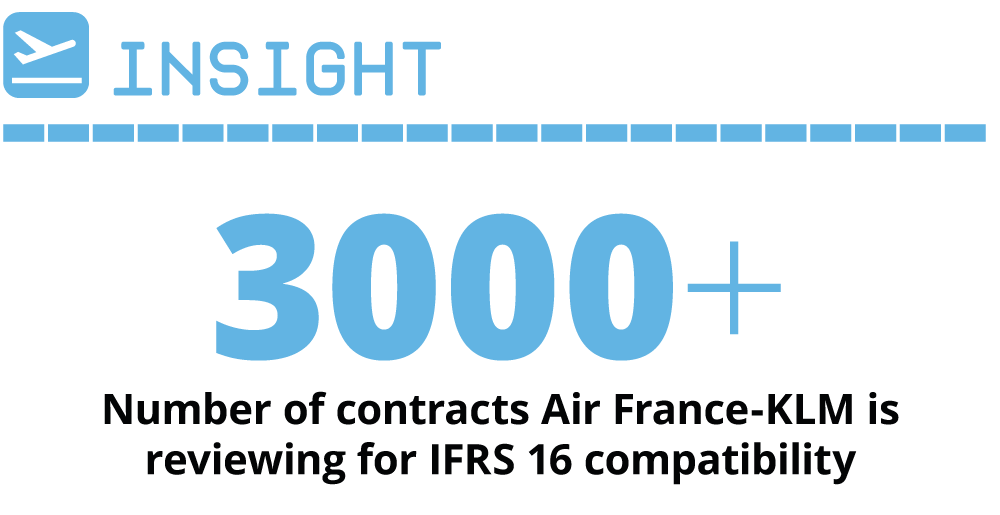

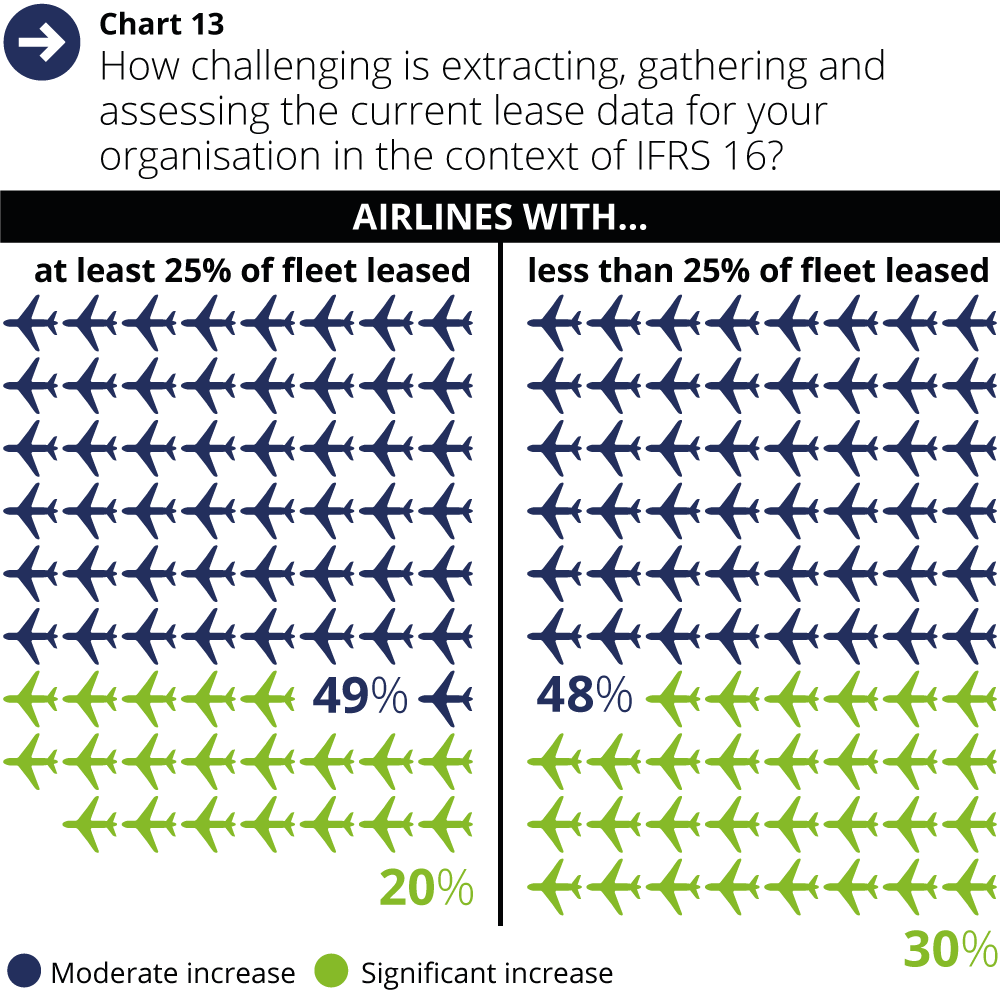

While disclosure and communication requirements are significant, airlines’ preference to apply IFRS 16 retrospectively only heightens the workload. Larger carriers will have to find and analyse thousands of old contracts, a job that may force them to beef up financial departments or recruit outside help.

Airlines in our survey indicate they are ready for the challenge, as do lessors and investors, which must adapt their analysis of airline financials. Less clear is if they know what comes next.

For instance, lessors and airlines interviewed for this report don’t expect IFRS 16 to alter lease contracts, but most of our more than 380 survey respondents think otherwise.

Some uncertainty about future leasing activity remains. In interviews, lessors appear sure that the commercial advantages of operating leasing will override any concerns about its accounting treatment. That anecdotal confidence is reflected by the survey, to the extent that a small majority of respondents expect leasing and sale-leaseback volumes to stay the same or even to increase.

Financiers, meanwhile, say IFRS 16 is unlikely to influence them, since they already capitalise operating leases.

Sometimes, though, their adjustments do not extend across all of an airline’s key metrics. Even where they do, there is potential for IFRS 16 figures to diverge significantly from adjusted estimates.

Only a tiny fraction of survey respondents thinks IFRS 16 is a bad idea. Instead, most applaud the intent to harmonise lease accounting, even though the standard is not universally applicable. Certainly, IFRS 16 will facilitate comparison of airlines in, say, Europe, but it may complicate peer analysis if an airline has not adopted IFRS, as will be the case in the US.

Airlines, lessors and investors must tackle the nuances of IFRS 16 to negotiate this new accounting landscape. By doing so they can better appreciate any commercial consequences of the new standard, and adjust their operations accordingly.

For this report, Euromoney Institutional Investor Thought Leadership surveyed 381 senior executives from the aviation finance industry. 41% or respondents hold C-level positions in their companies, a further 30% are vice presidents and senior directors. The others are senior managers in a variety of roles including regulatory, finance, legal and compliance.

54% of respondents work for airlines and lessors. 20% are working for investors or the financial services industry to aviation finance. The remainder includes predominantly non-financial advisers, for instance from the legal community.

37% of respondents are based in Europe, Middle East and Africa, 32% in Asia-Pacific, and 31% in the Americas.

In addition to the survey, in-depth interviews were conducted with nine senior industry executives and financiers.

The survey was conducted during the period 10 October to 3 November 2017. In-depth interviews took place throughout October and November 2017.

Balancing the Books: IFRS 16 and Aviation Finance is a Euromoney Institutional Investor Thought Leadership report, prepared in conjunction with Deloitte. The research was conducted by Euromoney Institutional Investor Thought Leadership.

This content is made available for your general information and is not intended to address your particular requirements and may include inaccuracies or typographical errors. The content does not constitute any form of advice, recommendation or arrangement by us and is not intended to be relied upon by users in making (or refraining from making) any specific investment or other decisions. Neither Deloitte nor any member firm of Deloitte Touche Tohmatsu Limited, Euromoney Institutional Investor PLC or their related entities make any representations or warranties and, to the fullest extent allowed by law, exclude all implied warranties regarding the suitability of the information; or the accuracy, availability, reliability, completeness of the content.

What level of impact will the adoption of IFRS 16 have on your business?

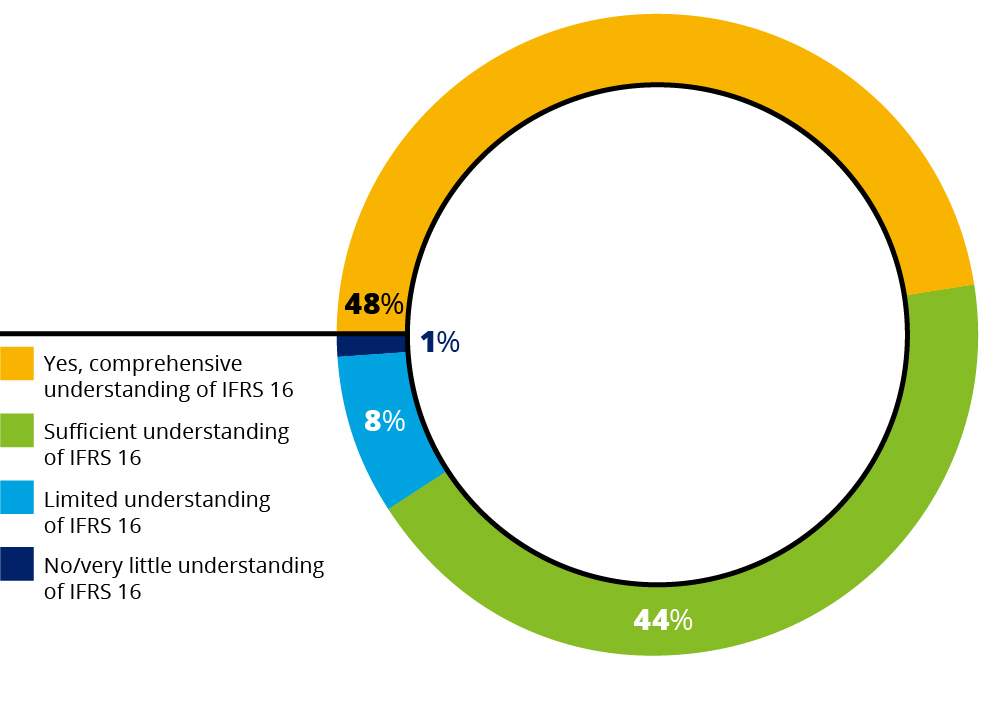

Do you feel you have a comprehensive understanding of the incoming IFRS 16 standard and how it differs from current accounting standards?

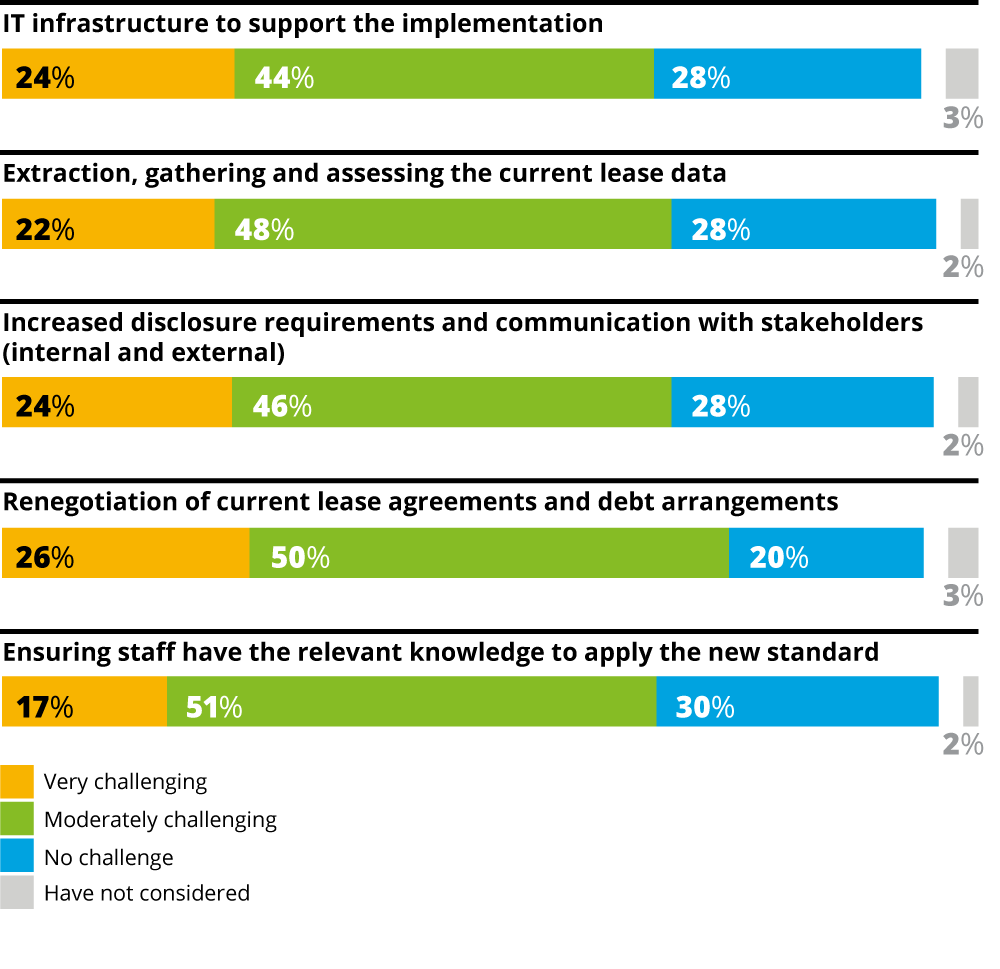

How challenging are the following issues for your organisation in the context of IFRS 16?

IFRS 16 eliminates nearly all off balance sheet accounting for lessees and will impact many companies’ financial metrics. Changes to which of the following metrics will be most problematic to your organisation? (select two)

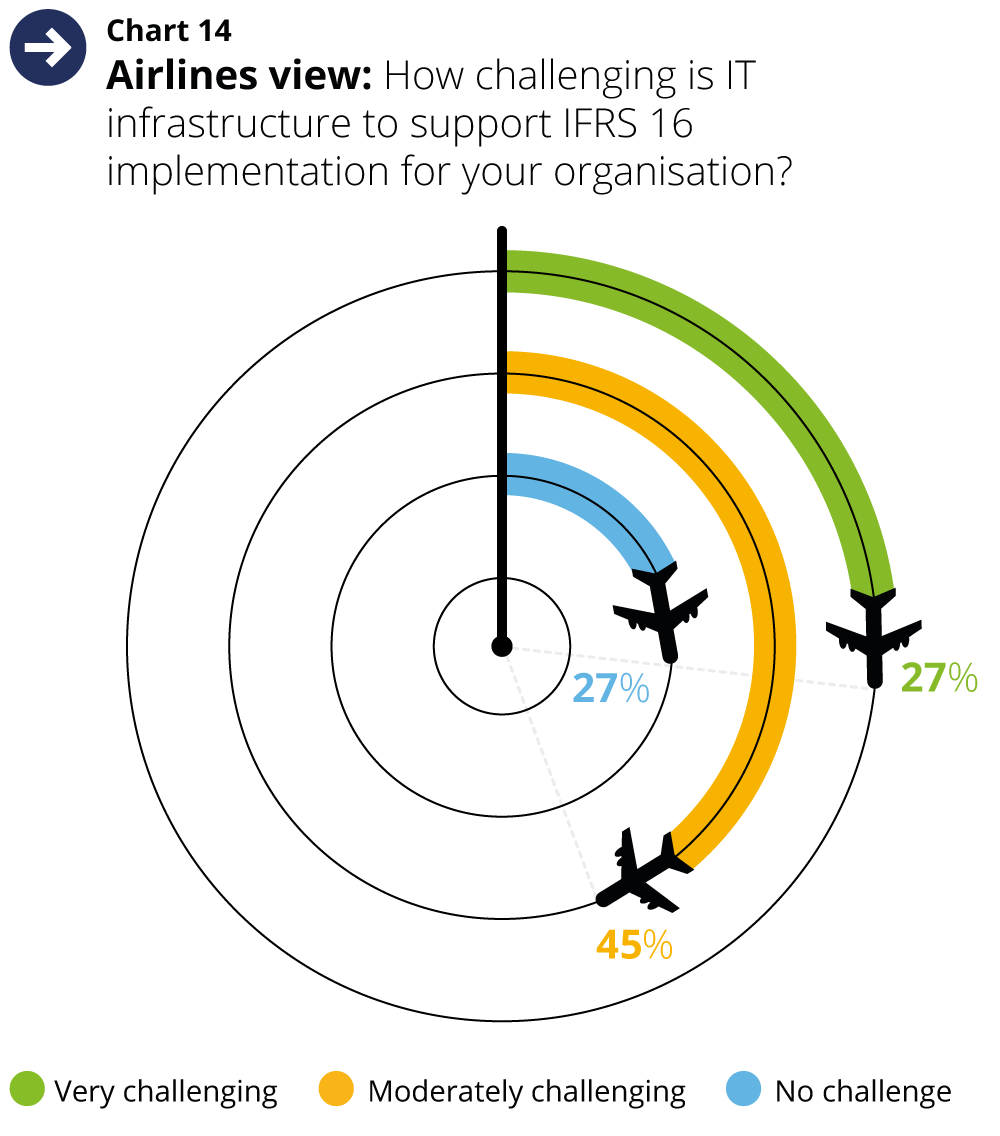

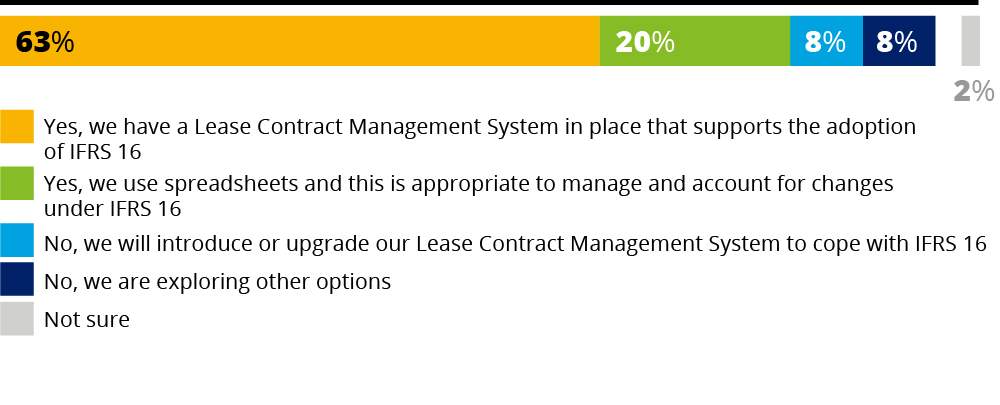

Do you have the required IT infrastructure in place to deal with the adoption of IFRS 16?***

* Respondents working for airlines only

Will the number of the following types of aircraft transactions across markets change in light of IFRS 16?

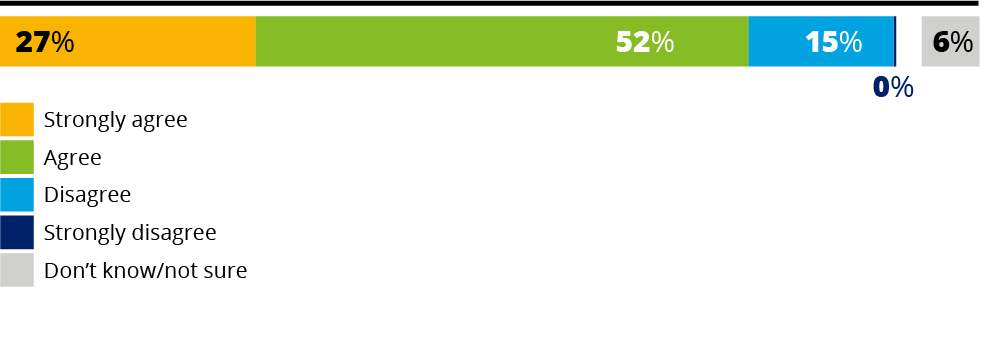

To minimise the impact of IFRS 16 existing leases will be renegotiated and standard terms for new leases will change.

What aspects of existing leases/new standard leases do you expect to change in light of IFRS 16? (select all that apply)*

* Respondents “strongly agreeing” or “agreeing” with question 7 only

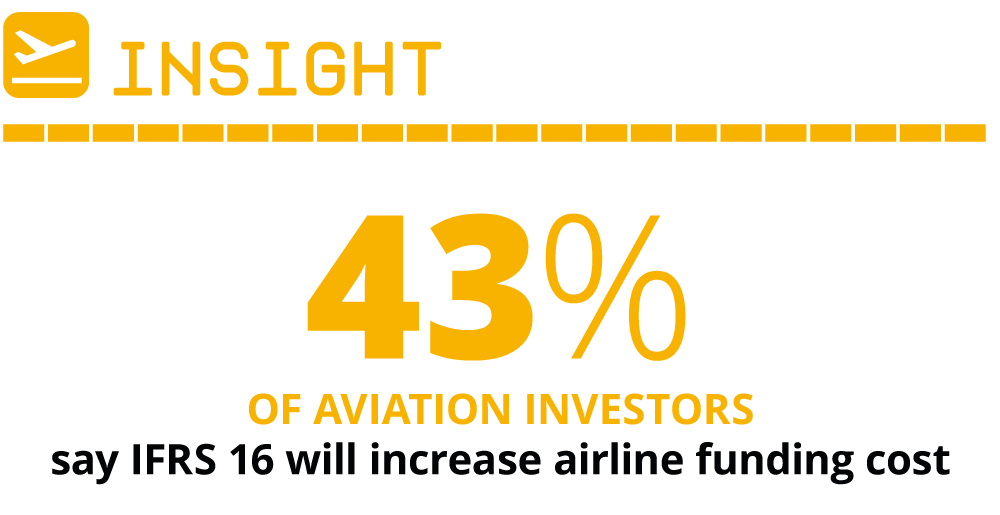

How will IFRS 16 impact the cost of financing/funding of airlines/lessors?

How will IFRS 16 impact the sources of financing/funding of airlines/lessors?

Do you think there will be an increased risk of covenant breaches by airlines/lessors?

IFRS 16 will become effective as of 1 January 2019. Do you consider this timeframe sufficient for your company to make the necessary arrangements?

What stage is your company at in respect of implementing IFRS 16?

For which stakeholders will IFRS 16 be most positive/most negative?

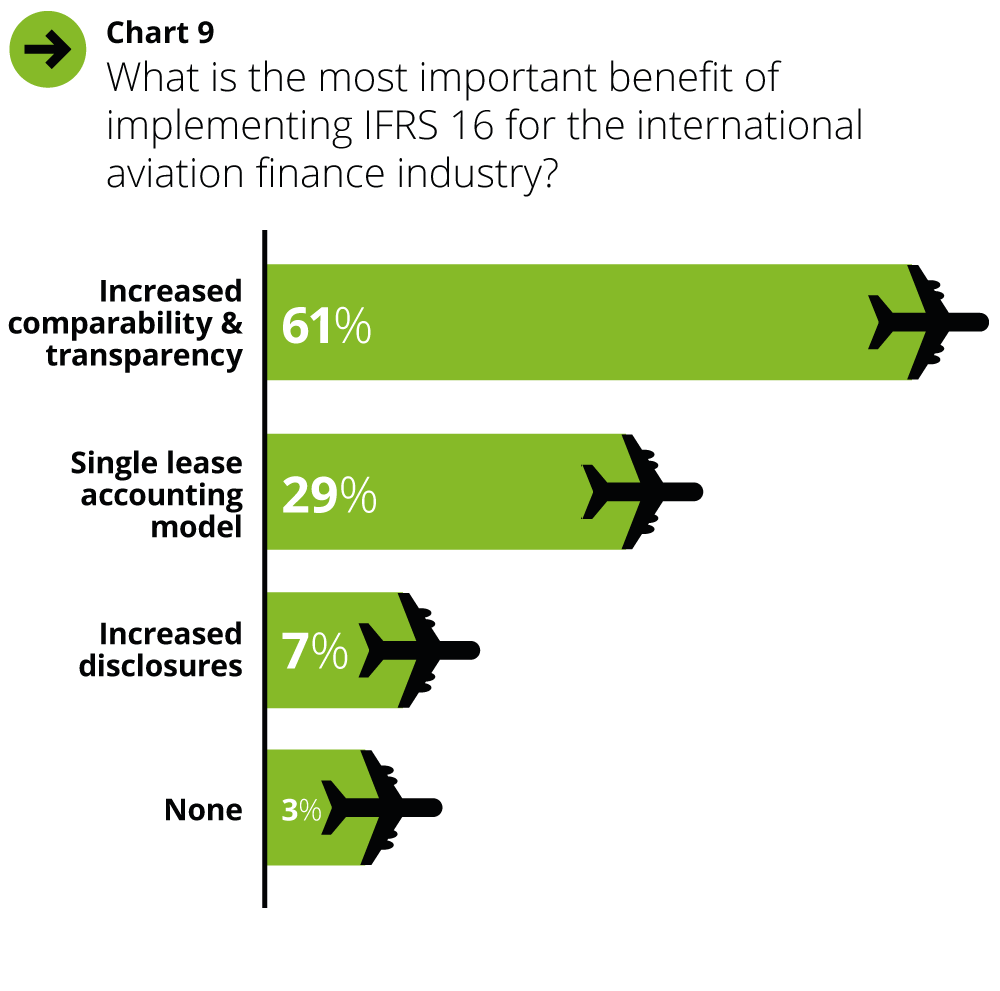

What is the most important benefit of implementing IFRS 16 for the international aviation finance industry?

From a financial reporting perspective, what will be the most challenging aspect for your business?

Note: Due to rounding, some totals do not equal 100%.

Click the button to download this report as a PDF to take away and share.

Balancing the Books

IFRS 16 and Aviation Finance

Advisory Panel:

Brian O’Callaghan, Lead Audit & Assurance Partner, Aircraft Leasing & Finance, Deloitte

Martina McDevitt, Audit & Assurance Director, Aircraft Leasing & Finance, Deloitte

Mike Duff, Head of Data Products, Airfinance Journal

Managing Editor: Ben Bschor

Writer: Alex Derber

Designer: Claire Boston

About Deloitte

Deloitte is the largest global professional services and consulting network, with approximately 263,900 professionals in more than 150 countries. Deloitte’s dedicated Aircraft Leasing & Finance advisory team delivers first-class advice to some of the largest aircraft lessors in the world and are ready to assist in the fields of tax, audit, corporate finance and consulting. Our people have the leadership capabilities, experience and insight to collaborate with clients so they can move forward with confidence.

About Euromoney Institutional Investor Thought Leadership

Euromoney Institutional Investor Thought Leadership creates thought-provoking content for global business leaders. EIITL's editorial team is hugely experienced in devising memorable, long-lasting and effective content programmes. With a team of independent journalists, experienced editors and professional marketers, we create reports, surveys, blogs, articles, videos, infographics and animations. All of our content is unbiased, original, research driven and audience-led.

About Airfinance Journal

Airfinance Journal is a market leading financial publication of the global aircraft and aviation business. Published since 1979, it has been at the forefront of supporting and informing aviation professionals. The Journal includes the latest news, analysis and data relating to the financing of airlines, aircraft leasing companies and manufacturers.