The Prudential Regulation Authority helped set the stage for the COP26 conference this week by spelling out its approach to the risks posed by climate change.

Responding to a UK government initiative, the PRA said it was looking at how its capital regime could be tweaked to make sure banks are managing climate risks effectively. It will consult on possible changes to the framework throughout the whole of next year.

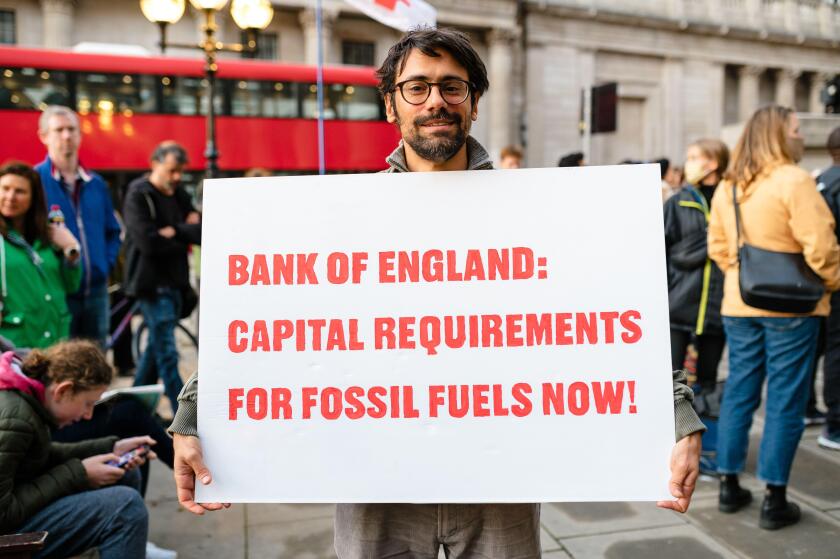

Understandably, there was no sense of jubilation when the report was published. Campaigners want central banks to take far bolder action in the fight against climate change, including by forcing lenders to hold more capital against their dirtiest assets.

But the PRA is taking the right steps, even if it is taking them too slowly.

It has correctly recognised the folly in waving different capital requirements in front of banks — either as a carrot or as a stick — with the hope of influencing their lending decisions.

At best, the experiment would bear little fruit, as with longstanding EU efforts to boost SME lending. At worst, it would introduce an aberration into the risk-based capital framework.

Prudential authorities should instead focus on making sure that banks are able to price their climate risks more accurately.

Through its capital regime, the PRA has suggested it could introduce forward-looking elements into methodologies underpinning microprudential targets — to reflect the fact the past will not be a good guide to the future when it comes to climate change.

It may also issue more detailed guidance on capital modelling, which could include urging firms to consider the default probabilities in their lending portfolios over longer time horizons.

While these aren’t the sorts of measures that will dominate the COP related headlines, they do form part of a good approach for supervisors to be taking.

Capital requirements aren’t the right lever for greening the economy. But there is plenty more that banks can be doing to reduce the risks of climate change.