November 2021

Top Stories

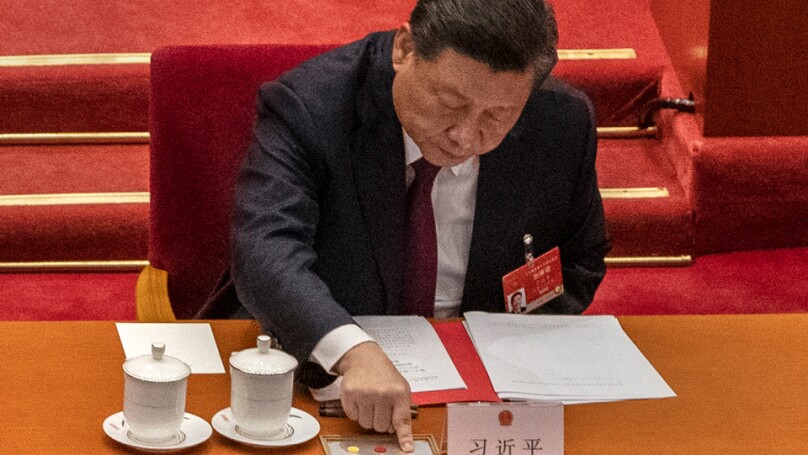

The Xi Factor: Is China uninvestible?

China’s president is a modern-day emperor who rules with an iron fist. His ‘common prosperity’ push promises better jobs and more equality, but it’s causing analysts to ask if the market is no longer investible and investors to fret and pull back – at a time when the country needs foreign capital more than ever.

China’s weak ESG data undermines Xi’s bold pledges

President Xi Jinping has set out ambitious plans to decarbonize China’s economy. But most companies and banks, hampered by a lack of top-down regulation, have little idea what ESG is, let alone how to measure and report it. It is a mess – and one that China needs to clear up fast.

Go to the source: Asian utilities are key to net zero

Investors fear that many Asian governments aren’t doing enough to transition to net zero. They are therefore engaging with the region’s largest utilities hoping for better results. CLP may be an example for others to follow.

Features

-

Efficiency and sustainability top the post-pandemic cash management agenda

This year’s cash management survey sees banks looking beyond purely pandemic-related challenges to focus on sustainable finance and investment in technology. -

Third time lucky: How BR Partners followed the BTG playbook to get its IPO over the line

Ricardo Lacerda launched a boutique investment bank in the aftermath of the 2008 financial crisis. Having finally succeeded in IPOing his firm at the third attempt, he now looks to navigate it through Brazil’s turbulent waters. -

Inside JPMorgan’s bid to build a global retail bank

JPMorgan Chase can be a winner in global digital retail banking according to Sanoke Viswanathan, the bank’s head of international consumer growth. With European expansion starting in the UK under the Chase brand and growth in Latin America through a stake in Brazil’s C6, Viswanathan insists his firm is in this for the long haul. -

Malaysia brings Islamic finance and ESG together

There has always been great overlap between Shariah-compliant finance and ESG principles. Malaysia is trying to harness the potential that arises from this confluence. -

IIF: Regulators try to reassure banks on climate stress tests

Supervisors attending this year’s meeting of the Institute of International Finance were at pains to show they would not be rushing to impose capital penalties on banks based on climate stress tests. But the issue is at the heart of a debate over what the limits to regulatory scope should be. -

Evergrande ripples through Asian high yield

Asian high yield has always been dominated by Chinese real estate, so the Evergrande crisis has shut down the market for new issuance. Is this the chance for non-Chinese issuers to step up? -

A vision for nature-based financial disclosures

Bank of America’s Abyd Karmali is on the Taskforce on Nature-related Financial Disclosures. He spoke to Euromoney ahead of the nature-based COP15 and climate-based COP26 conferences about what is at stake. -

Marisa Drew: ‘Covid served as a call to action on climate’

Credit Suisse’s chief sustainability officer is no ESG ideologue. She is at heart a hard-nosed investment banker who sees a once-in-a-lifetime opportunity to guide clients to a more sustainable future.