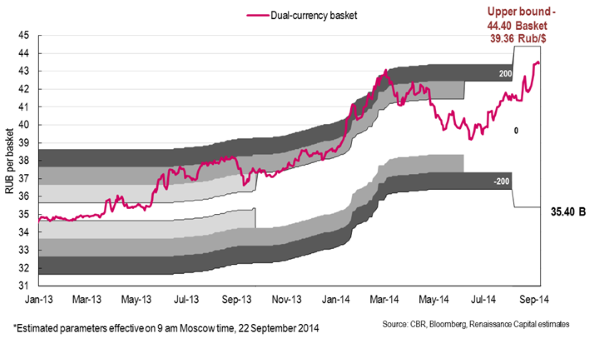

The rouble has tumbled by around 2.8% against the dollar in September, leaving it at a little over 38 roubles to the dollar – close to the 39.40 upper end of the band within which the Central Bank of Russia (CBR) permits it to float.

|

The currency’s malaise is principally driven by the conflict with Ukraine, while high levels of debt redemptions have also contributed to the slump, with around $20 billion of debt coming due in September alone. A lack of dollar liquidity in Russia, resulting from US sanctions, has also undermined the rouble.

The volatile nature of the Ukraine conflict presents a formidable and immediate challenge to traders, seeking to test the CBR’s defence of the currency band, rendering more measurable fundamentals useless.

“There appears to be very little consensus about the rouble among the macro-hedge-fund community – few managers feel they have an edge or can predict what Putin is going to do,” says Sam Diedrich, a portfolio manager at Pacific Alternative Asset Management Company, a fund of hedge funds.

“They could hang their hat on the fundamentals – the path of oil prices or how sanctions are going to affect the economy – but the near-term price action will likely continue to be driven by the ongoing conflict, which is inherently unpredictable.”

Exploiting trends

Some opportunities have presented themselves to those able to exploit short-term trends.

“A recent shortage of dollars caused a run on the currency until the CBR stepped in to provide liquidity, which triggered a mini rally and some support to the currency,” says Diedrich. “There was some trading around that, but it is near-term catalyst driven and it needs tight stop-losses because the situation is very fluid.”

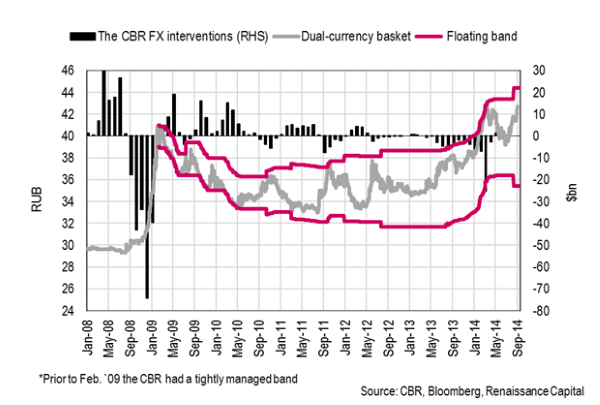

Pre-Ukraine conflict, there was optimism regarding Russia’s plans to implement monetary reforms in 2015. These include relaxing restrictions on the currency’s ability to float and the introduction of inflation targeting. The CBR will continue to intervene if it fears any sudden correction threatens to destabilize its economy, but the change should still allow traders to take a longer-term view without having to trade against the CBR once it reaches a certain trigger, say Russia bulls.

Although the pressure on the rouble is building, there is little prospect of markets breaking the CBR’s resolve in the months before it abandons its band against the dollar.

“There is always a limit to a central bank’s ability to defend a falling currency – if there was an oil rout or a full-scale invasion it might not make sense to maintain the band,” says Marcus Svedberg, chief economist at East Capital. “But with the third-largest FX reserves in the world [$470 billion of international currency reserves], a balanced budget and a current-account surplus, there is little prospect of the CBR abandoning its support for the rouble.”

| Based on the macro fundamentals, such as GDP, inflation and the current account, the rouble looks very cheap Oleg Kouzmin |

Much depends on the Ukraine crisis having been resolved by next year, though the CBR has not offered a specific date for the planned changes. However, the fact Russia has continued to broaden the band within which the rouble can move, despite relentless pressure on the currency, demonstrates its commitment to seeing these reforms through, say analysts.

Any resolution in the coming months is likely to be limited in scope, so the mood of rouble traders will depend on the details.

“The most likely scenario to my mind is that some time in the coming weeks or months we will get a diplomatic deal that will end the military conflict, even if it does not resolve the underlying economic and trade arrangements for Ukraine,” says East Capital’s Svedberg.

Dark cloud

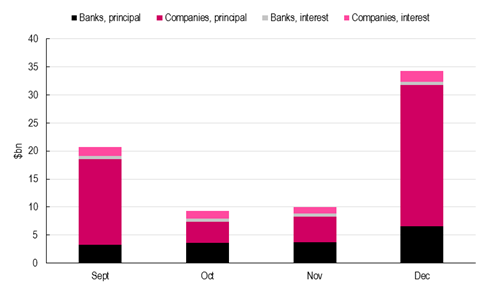

Another dark cloud on the horizon is a second bumper-month for debt redemptions in December, which will see nearly double the value of debt coming due as September. In all, Russia had $74 billion of external financing coming due between September and December, but the last month of the year will see $34 billion of debt expiring.

Things might not be as bad as they seem at first glance. Renaissance Capital estimates that up to half of the $74 billion might involve Russian companies refinancing debt held offshore, or foreign companies refinancing Russia-based subsidiaries, minimizing the risk for the rouble.

Depending on how you calculate it, the full-year print might therefore be closer to $40 billion of onshore rouble assets. The CBR’s international currency war chest also gives it plenty of scope to assist domestic businesses running into trouble refinancing their debt.

On the other hand, if a satisfactory resolution can be found to the Ukraine conflict soon, the rouble should experience an initial relief-rally.

“Based on the macro fundamentals, such as GDP, inflation and the current account, the rouble looks very cheap,” says Oleg Kouzmin, economist for Russia and the CIS at RenCap in Moscow. Russia has a current-account surplus of $56 billion and while GDP growth of around 1% has been weak, RenCap predicts this should rise by around 0.5% in 2015.

“According to our estimates, fair value is around 36 roubles to the dollar,” says Kouzmin. “We therefore see upside for the rouble and forecast 35.5 by year-end, as long we see a resolution to the crisis in Ukraine, new dollar liquidity coming into Russia and support from the central bank or government. If we don’t see that, it is more likely to be around 37.5.” This compares to an average of just under 32 in 2013.

Svedberg agrees, saying: “A rebound following the resolution of the Ukraine crisis should see the rouble regain some of the ground it has lost in 2014 to around 36 or a bit lower, depending on the specifics of the deal. An easing of inflation should boost consumption and lead to growth of 1% to 2% in 2015, again depending on the deal. But there is no real prospect for growth this year.”

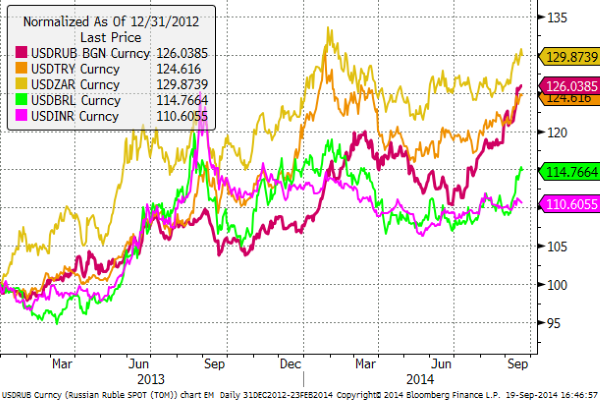

However, few hold long-term appreciation bets on the currency, unlike its emerging-market peers, citing reform inertia and structural weakness.

“Before the crisis, investors were focused on Russia’s structural weakness and while attention has been diverted from that by events in Ukraine, once that is resolved Russia will still face the same challenges,” says Svedberg.

“This has been a lost year for Russia, a country that should grow by 4% to 5% per year. Structural weakness detracts around 2.5% growth a year while Ukraine has shaved off another 2%.”

| Figure 1. The CBR FX policy mechanism |

|

| * “+” means FX sales by the CBR, “-“ means FX purchases by the CBR |

| Figure 2. The CBR FX policy mechanism and interventions |

|

| Figure 3. Rouble compared to EM peers |

|

| Figure 4. Payment schedule of Russian private external debt |

|